The UK Lens: Impairment, Judgement and the New Transparency

As the UK’s regulatory climate sharpens, boards are under growing pressure to ensure their disclosures communicate judgment, rather than just compliance.

Our Issue 101 Newsletter highlighted how the Financial Reporting Council (FRC) and Financial Conduct Authority (FCA) are redefining expectations – from impairment testing to Consumer Duty and tax governance. Each signals a more profound shift: from transparency as data to transparency as stewardship. Nowhere is this more evident than in the debate around impairment of assets – a once-technical area that has become a quiet test of credibility for UK finance leaders.

Impairment: From Accounting Charge to Governance Signal

Under IAS 36 and FRS 102, companies must ensure that assets such as goodwill or property aren’t carried above their recoverable amount. When market conditions, technology or strategy change, an impairment review determines whether book values still reflect economic reality.

Historically, this was a back-office exercise. Today, the FRC’s recent thematic reviews and enforcement cases have made impairment disclosures a public measure of board discipline.

Investors now ask: “Do the assumptions behind this valuation make sense in light of the company’s strategy and market signals?”

Impairment has evolved into a conversation about how management exercises judgment amid uncertainty.

How it affects reporting in the Annual Report

Impairment testing exists to prevent overstatement of assets. High-quality reporting therefore depends on transparent disclosure of the key assumptions that underpin recoverable amounts. The testing requires judgement in forecasting cash flows, selecting discount rates, setting long-term growth rates, defining cash-generating units, and determining whether value in use or fair value less costs of disposal is the appropriate basis. These judgements must be explained in a way that allows investors to evaluate the credibility of the numbers and their alignment to strategy.

What readers should expect to see in the notes is set out in IAS 36. For CGUs containing goodwill or indefinite-life intangibles, disclose: the basis used to determine recoverable amount; if value in use is used, the forecast horizon, the growth assumptions including any justification for rates above long-term averages, and the discount rate or rates; if fair value less costs of disposal is used, the valuation technique and principal inputs. Where a reasonably possible change in a key assumption would cause impairment, provide a sensitivity analysis that identifies the assumption, the magnitude of change required, and headroom. Where the business environment has shifted, boards should update assumptions promptly and explain the link to strategic decisions. In 2025 this is particularly relevant given higher discount rates and regulator emphasis on clear, decision-useful sensitivities and consistency between the front half and the financial statements.

“In a high-scrutiny reporting climate like the UK, transparent assumptions and clear narrative links now define credibility. This piece explores how CFOs can channel impairment reviews into signals of resilience, stewardship, and strategic accountability.”

For investor relations and finance decision-makers in UK-listed companies, impairment remains one of the most scrutinised areas of reporting. The FRC’s 2024–25 Annual Review confirms that impairment was, for the third consecutive year, the issue most frequently raised with companies, reinforcing the expectation for robust assumptions, coherent narrative linkage, and clear sensitivity disclosures.

Looking ahead, the IASB’s 2024 exposure draft proposes targeted amendments to IAS 36 and IFRS 3 on value-in-use inputs and disclosure. While still in proposal stage, the direction indicates continued focus on clarity of assumptions and better linkage between valuation mechanics and business rationale. Companies should monitor these developments and reflect the spirit of enhanced transparency in current reports.

Regulatory Framework

Impairment testing in the UK is governed primarily by IAS 36 (Impairment of Assets) for IFRS reporters and FRS 102 Section 27 under UK GAAP. Both frameworks require that assets are not carried at more than their recoverable amount, defined as the higher of value-in-use and fair value less costs of disposal. Goodwill, indefinite-life intangibles, and assets not yet in use must be tested annually, regardless of indicators.

Emerging 2025 Developments

In 2025, two developments stand out. First, the IASB’s 2024 exposure draft on IAS 36 and IFRS 3 proposed simplifications to allow restructuring assumptions in value-in-use calculations and updated discount rate guidance, with finalisation expected in late 2025. Second, the FRC’s 2024/25 Annual Review emphasised ongoing weaknesses in impairment-related disclosures, particularly in smaller listed firms. The regulator continues to urge greater transparency in key assumptions, sensitivity analysis, and alignment between the narrative and financial sections of annual reports.

“Impairment testing reveals how strategy, risk, and realism intersect. This article shows how companies can use disclosure as a storytelling tool, building investor trust through clarity, challenge, and consistent, decision-useful reporting.”

Market Context and Indicators

The UK’s high-interest-rate environment has become a critical impairment driver, increasing discount rates and lowering recoverable values, particularly in consumer, tech, and property sectors. IAS 36 lists both external indicators (economic decline, interest rate spikes, falling market capitalisation) and internal indicators (asset obsolescence, underperformance, or restructuring) that must trigger reassessment.

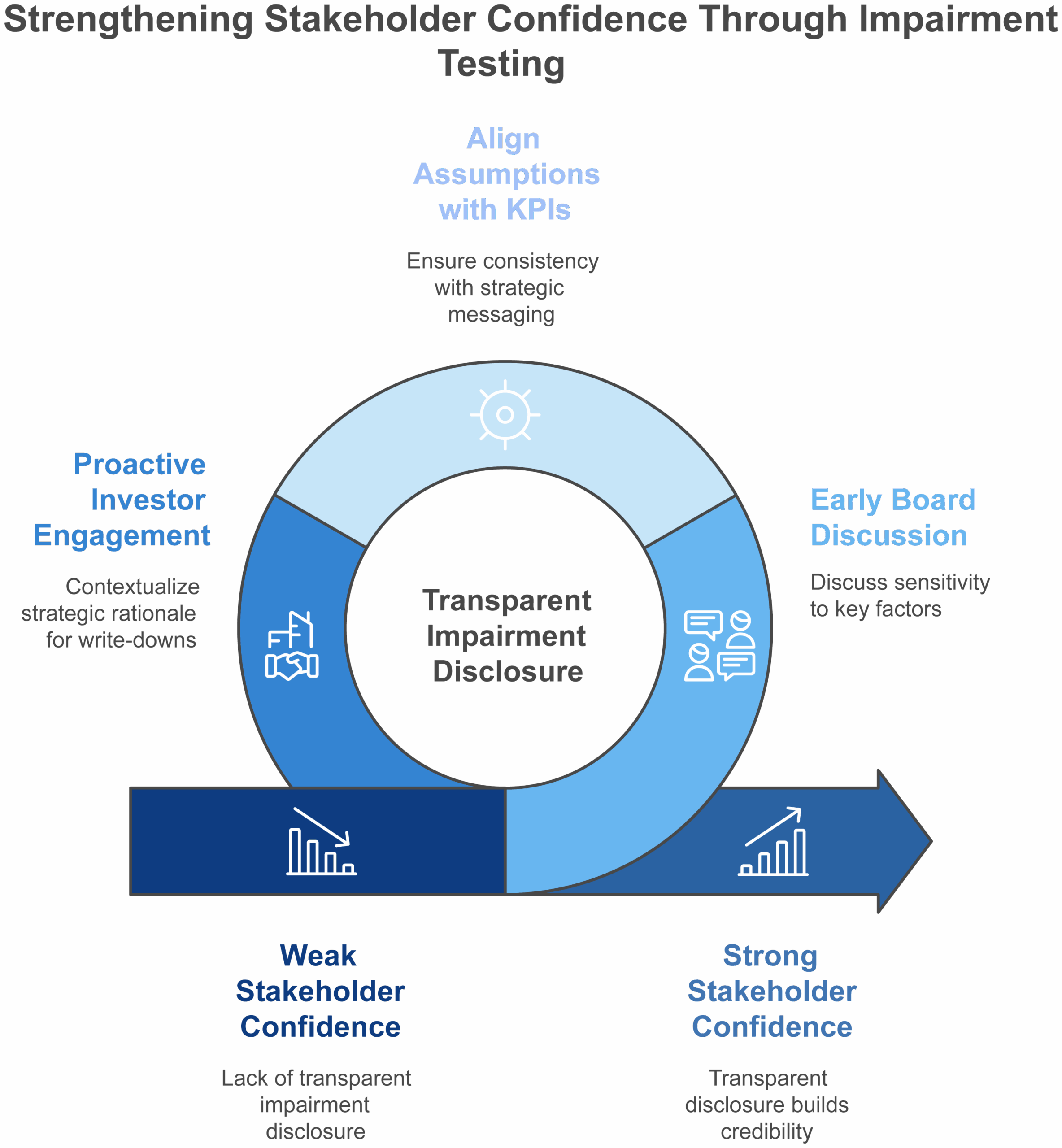

Investor Relations Perspective

From an IR communications standpoint, impairment testing is a credibility signal to the market. Transparent disclosure of impairment assumptions, especially how macroeconomic uncertainty is modelled, strengthens stakeholder confidence. Best practice involves early board-level discussion of:

- Sensitivity to discount rates and cash flow projections.

- Alignment of impairment assumptions with published KPIs and strategic messaging.

- Proactive investor engagement around major write-downs to contextualise strategic rationale.

FRC Commentary on Common Weaknesses

The 2025 FRC review reiterated five recurring disclosure issues:

- Insufficient justification for key inputs (growth, discount rates).

- Missing or vague sensitivity disclosures.

- Inconsistent messaging between the financial and strategic reports.

- Poor judgement disclosure for cash-generating unit (CGU) boundaries.

- Failures to reassess prior-year assumptions.

By addressing these, companies show not only technical compliance but also governance maturity – critical in maintaining confidence among institutional investors.

Practical Takeaway

For boardrooms, audit committees, and IR officers, 2025 impairment reviews are a test of resilience and transparency. With higher interest rates and sustained investor scrutiny, impairment processes must be robustly justified, clearly disclosed, and closely aligned with the company’s broader narrative on performance and outlook.

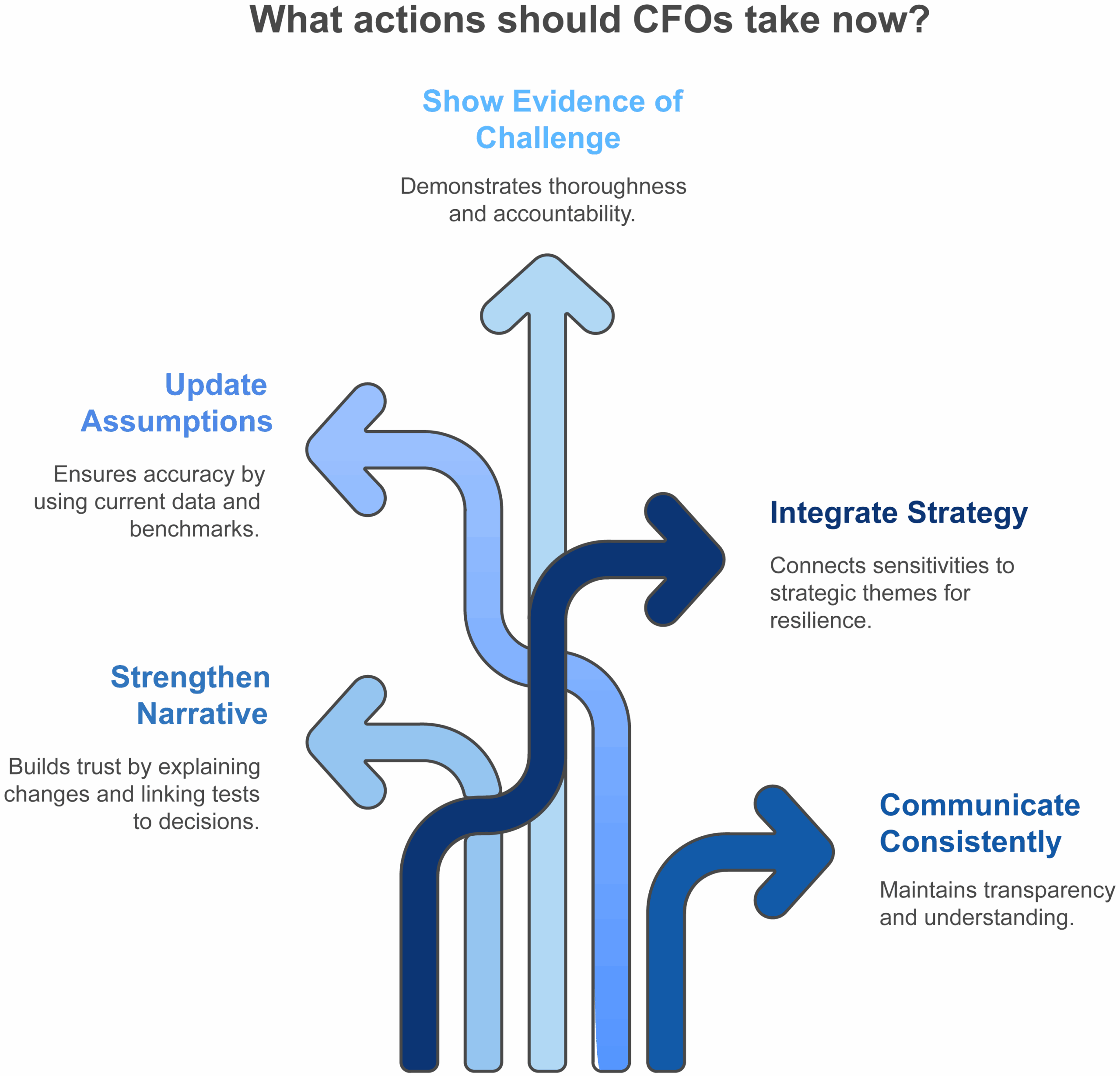

What CFOs Should Do Now

- Strengthen the narrative: Explain not only what changed but why. Link impairment tests to real business decisions—such as market exits, technology shifts, or margin pressures. This is key to building trust.

- Update key assumptions : Re-evaluate discount rates, growth forecasts and terminal values using current gilt yields and sector benchmarks. Out-of-date inputs are among the FRC’s most common criticisms.

- Show evidence of challenge : Demonstrate that the audit committee interrogated management’s assumptions. Well-documented challenge processes now feature in enforcement reviews.

- Integrate strategy and sensitivity : Use scenario analysis to connect impairment sensitivities to broader strategic themes—cost inflation, demand cycles, and capital allocation. This turns compliance data into a resilience narrative.

- Communicate consistently : Ensure the tone and data in your Strategic Report mirror those in the financial statements. Investors quickly detect gaps between the story and the numbers.

Closing Remarks

Impairment has become a visible test of stewardship, not only a technical calculation. As you prepare the next cycle, the priority is to connect assumptions, sensitivities, and governance challenge to a clear strategic narrative. Dickenson partners with investor relations teams to deliver that connection. We align valuation inputs with disclosed strategy, document committee challenges, and present decision-useful sensitivities, then translate the outcome into investor-grade communication collaterals. The result is a report that communicates judgement with clarity and earns confidence across capital markets.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Kinneri is an Economics Major graduate, with minors in Liberal Arts and Business Study from NY University (NYU). She joined Dickenson full-time in May 2016 as an Associate Consultant within the firm’s Investor Relations practice, and as an Editor for the Corporate Reporting practice. Since then, she has successfully developed strong skills in developing investor presentations, in Bloomberg/ FactSet data mining, News Release preparation, IR Analytics, Investor Targeting reports and curating the content’s team work for the Corporate Reporting and Financial PR practices of Dickenson. In February 2017, she took up the responsibility of seeding the company’s UK presence and based herself permanently in London. As a Director of the company’s UK arm, she is currently responsible for developing the firm’s business in the North Atlantic markets.

The UK Lens on Impairment

To download and save this article.

Authored by:

Kinneri Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment