The AI Revolution in Buy-Side Investing

A Strategic Imperative for Investor Relations

Artificial Intelligence (AI) has emerged not as a technological supplement but as the engine driving a paradigm shift in buy-side investing. For asset managers, hedge funds, and institutional investors, AI is not merely a tool; it is the foundation upon which decision-making processes are being reconstructed. In this world of unprecedented speed, precision, and depth of analysis, Investor Relations (IR) teams must urgently recalibrate their strategies. The stakes are simple: adapt and thrive, or risk irrelevance in a market where data rules and machines define the pace.

For CXOs overseeing IR functions, this is not merely an operational challenge; it is a strategic imperative. Buy-side firms are leveraging AI to fundamentally alter how they evaluate companies, allocate capital, and engage with corporate disclosures. This transformation is creating a landscape in which the rules of investor engagement are no longer set by humans alone. Instead, they are shaped by algorithms that process terabytes of data, identify patterns with surgical accuracy, and execute decisions at lightning speed. To understand what is at stake and how to respond, we must delve into the specific ways in which AI is reshaping buy-side operations and the implications for corporate communications.

How AI is Transforming Buy-Side Investing

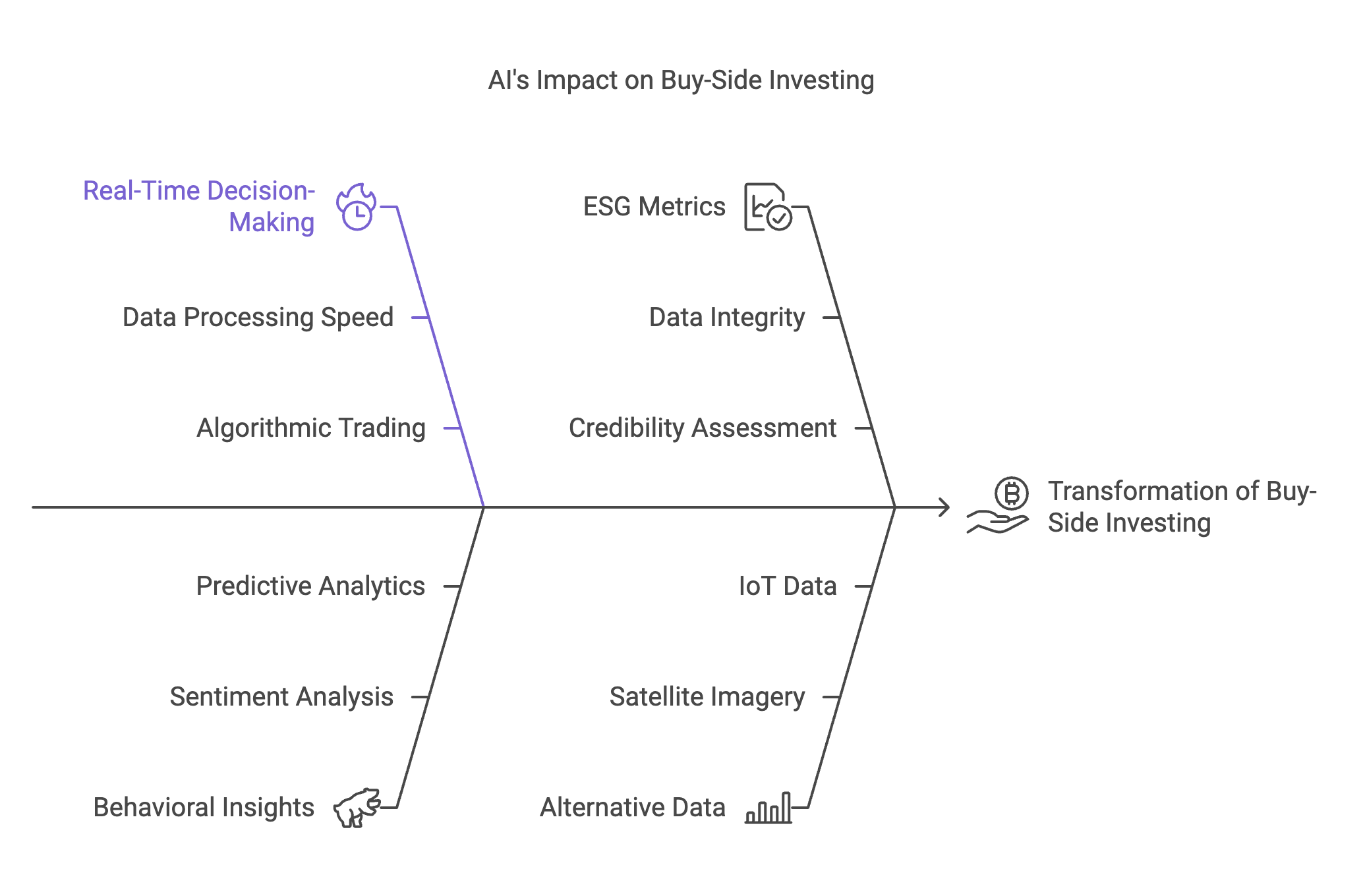

AI’s application in buy-side investing is profound, operating at the intersection of real-time data processing, predictive analytics, and behavioural modelling. These capabilities are enabling buy-side firms to not only refine their investment strategies but also to redefine the metrics by which they evaluate companies.

-

Real-Time Decision-Making:

At the core of this transformation is AI’s ability to analyze and act on vast quantities of data in real time. Hedge funds like Citadel and Renaissance Technologies have built proprietary AI systems that process millions of data points-earnings reports, geopolitical developments, market trends, and even social media chatter-within seconds. These algorithms are not merely reactive; they are anticipatory, identifying opportunities and risks long before they become apparent to human analysts.Consider that over 60% of all stock trades in the U.S. are now executed using algorithms, many powered by AI. High-frequency trading has become the norm, enabling buy-side firms to exploit micro-arbitrage opportunities invisible to the human eye. This level of speed and precision demands a parallel response from IR teams. Traditional quarterly updates and static disclosures are no longer sufficient. For a firm whose data is inconsistent or outdated, AI systems will detect the discrepancies and act decisively, often to the company’s detriment.

-

Behavioral Insights and Sentiment Analysis:

AI is also transforming how investor behaviour is predicted. Predictive analytics, which incorporates historical data, market sentiment, and economic trends, allows firms like Bridgewater Associates to model market responses to various scenarios. On a more granular level, AI systems are dissecting corporate communications for tone, pacing, and even omissions. A single word from an executive during an earnings call, if perceived as hesitant or contradictory, can trigger AI-driven sell-offs or adjustments.Tesla’s 2018 earnings call is a case in point. When Elon Musk dismissed analysts’ questions as “boring” and “boneheaded,” AI-powered sentiment analysis flagged his tone as a confidence risk. The result was a $2 billion drop in Tesla’s market capitalization within hours, driven largely by automated trading systems acting on the perceived sentiment.

-

ESG Metrics as a Strategic Data Source:

Environmental, Social, and Governance (ESG) factors have transitioned from being supplementary considerations to becoming central to buy-side evaluations. AI plays a critical role here, enabling firms like BlackRock and State Street to go beyond superficial ESG claims. These systems cross-reference corporate disclosures with external datasets, including regulatory filings, satellite imagery, and third-party audits, to assess the credibility and consistency of ESG commitments.For instance, an energy company that proclaimed its carbon neutrality was flagged by AI when emissions data revealed a year-over-year increase in its supply chain’s carbon footprint. The firm’s failure to provide granular, independently verified metrics led to its exclusion from BlackRock’s ESG portfolios. This underscores a critical shift: ESG is no longer about narrative; it’s about data integrity.

-

Alternative Data for Competitive Advantage:

AI has unlocked the potential of alternative datasets, such as satellite imagery, IoT data, and even consumer sentiment trends from social media. Two Sigma, for example, integrates these sources into its investment strategies, detecting patterns in consumer behavior that traditional analysis often overlooks. The result is a level of granularity that can influence buy-side decisions even before a company’s formal disclosures are made public.For IR teams, the implication is stark: your company is being measured in ways that are often outside your control. Aligning corporate messaging with external realities is no longer optional—it is an existential requirement.

Strategic Implications for Investor Relations

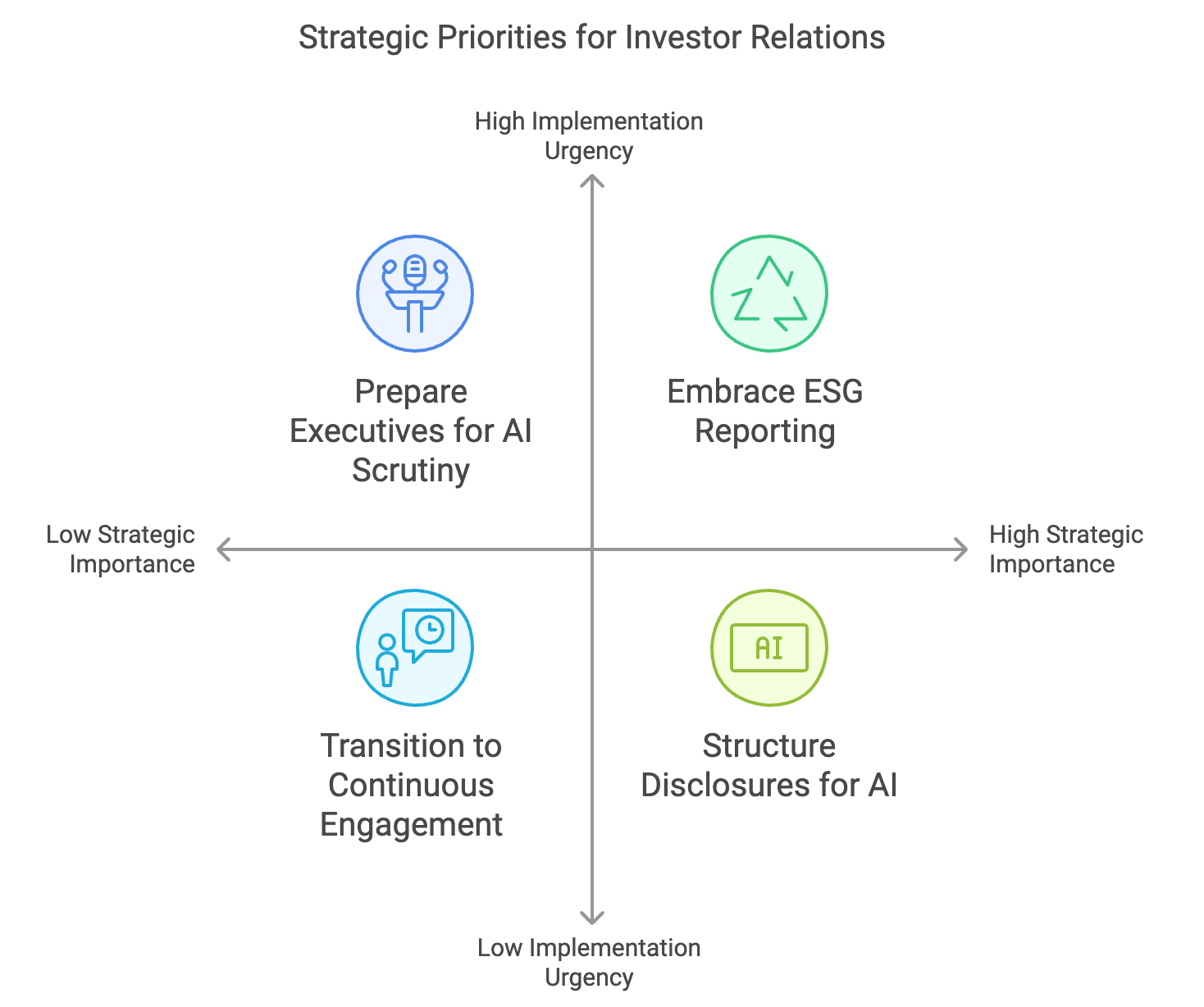

The transformation underway in buy-side investing requires IR teams to rethink their role, not as conduits of periodic information but as strategic enablers of trust and clarity in an environment defined by continuous evaluation. Every disclosure must be designed with AI systems in mind. Unstructured narratives and vague language are liabilities. Structured formats-clear tables, bullet points, and consistent metrics-are critical to ensuring data is interpreted accurately by algorithms.

Embrace ESG as a Strategic Imperative:

ESG reporting must move beyond compliance to become a core component of corporate strategy. This includes providing independently verified data, aligning ESG goals with operational performance, and delivering transparency across all levels of reporting. Companies like Unilever, which published a Climate Transition Action Plan complete with measurable milestones and third-party validation, exemplify this approach. Their credibility boosted investor confidence and increased institutional ownership.

Prepare Executives for AI Scrutiny:

AI evaluates not only what is said but how it is said. IR teams must prepare executives for a level of scrutiny that extends beyond human perception. This includes tone calibration, consistency across platforms, and a focus on delivering clear, precise messaging during high-stakes interactions.

Adopt Continuous Engagement:

Quarterly updates are relics of a slower era. IR teams must leverage digital platforms to provide real-time updates that align with the pace of AI-driven decision-making. This ensures that investors—both human and machine—have access to the data they need, when they need it.

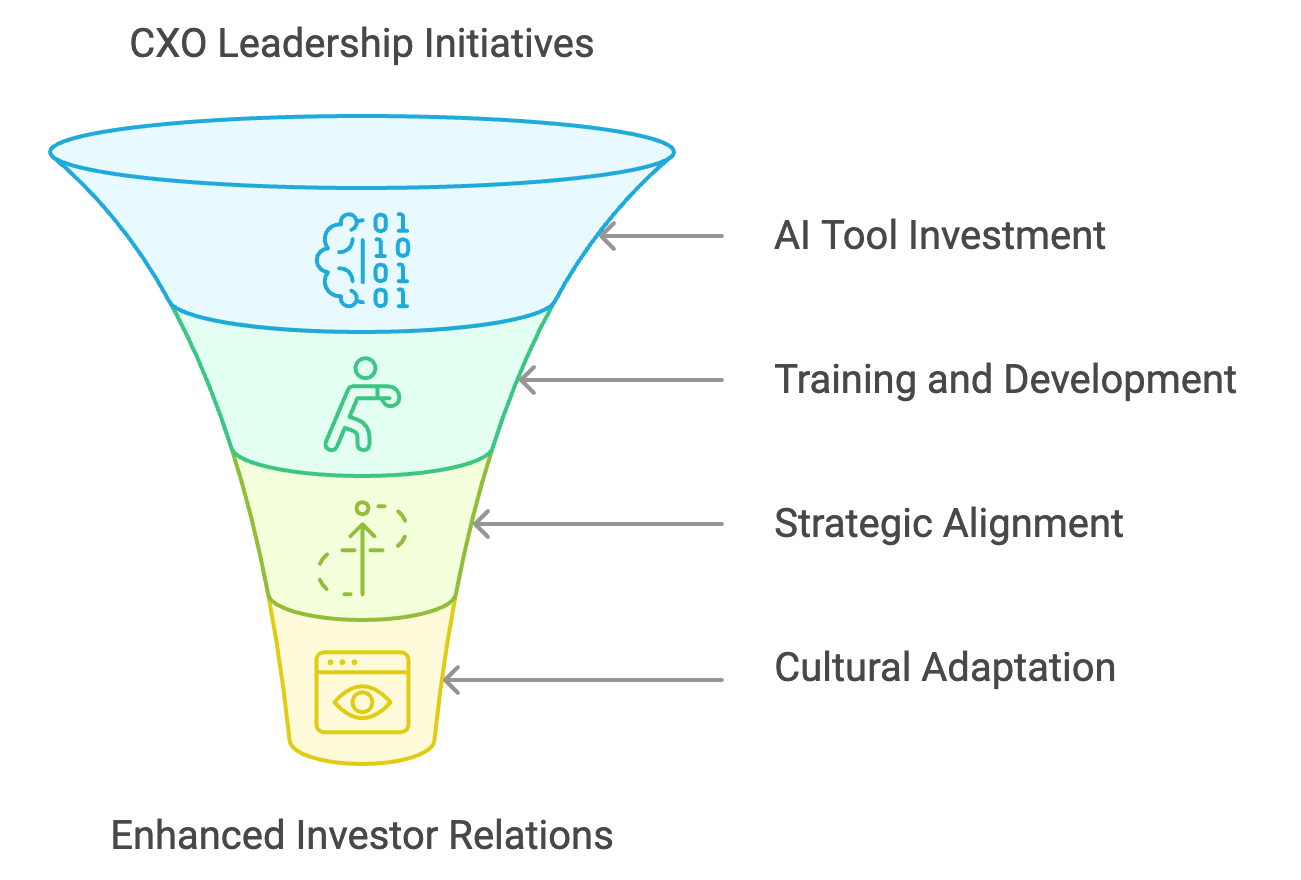

The CXO’s Role in Leading the Transformation:

For CXOs, the task is not just to oversee this transformation but to drive it. IR teams require investments in AI-enhanced tools, training in data analysis and sentiment interpretation, and alignment with broader corporate strategies. This is a leadership challenge as much as it is an operational one. Transparency, consistency, and adaptability must be embedded into the organisational culture.

The integration of AI into buy-side investing has irrevocably changed the dynamics of investor engagement. For IR teams, the challenge is not just to keep pace but to redefine their role in this new landscape. The rewards for those who succeed are profound: deeper trust, stronger market positioning, and a competitive edge that resonates in an era defined by precision and data.

The time to act is now. For CXOs ready to lead this transformation, the opportunities are immense-but only if approached with clarity, urgency, and strategic foresight. Let’s connect to ensure your IR function is not only equipped to navigate this new reality but to thrive within it. Together, we can position your organisation at the forefront of this AI-driven revolution in buy side investing.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Shankhini Saha, the Director of Investor Relations at Dickenson, holds an MPhil with distinction from the University of Cambridge, UK, and a BA magna cum laude from The New School, USA. Specializing in stakeholder engagement across diverse sectors, Shankhini is dedicated to transparent communication and providing strategic insights into clients’ financial performance and growth initiatives. With a proven track record of managing complex investor relations for a diverse portfolio of global clients, she excels in crafting impactful narratives that resonate with investors, analysts, and stakeholders. Shankhini’s leadership in high-profile quarterly results hosting and comprehensive IR campaigns showcases her commitment to creating lasting value for issuers in the global capital market.

The AI Revolution in Buy-Side Investing

To download and save this article.

Authored by:

Shankhini Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment