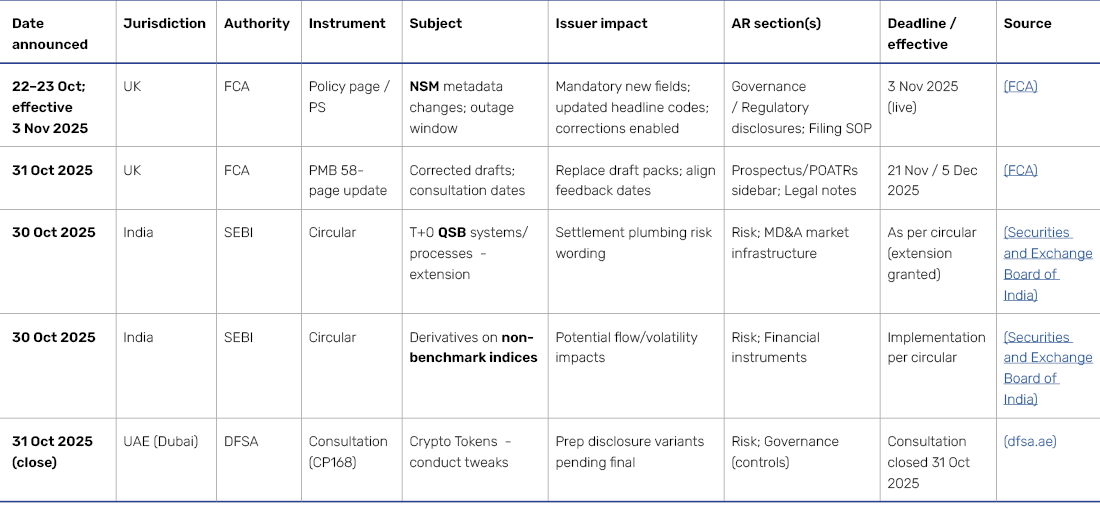

Weekly IRO and Annual Report Intelligence

Regions: United Kingdom · India · United Arab Emirates (Dubai) · Qatar · Saudi Arabia

Date: Monday, 3 November 2025

Coverage window: 27 October 2025 to 3 November 2025

United Kingdom Headlines

-

FCA implements NSM metadata changes; cutover outage completed (rules effective 3 November 2025).

Issuers must add the name and LEI of any related issuer to each disclosure; headline codes/categories are updated; “classification” is removed; and corrections to filings will be possible (prior versions retained but hidden from default view). The FCA flagged ESS/NSM unavailability from 18:30 UTC 31 Oct to 04:00 UTC 3 Nov for the transition. (FCA) -

FCA PMB 58 – clerical corrections posted on 31 October (Update to prior coverage).

blackline errors in certain draft Procedural and Technical Notes and re-posted TN 602.5; consultation deadlines remain 21 November 2025 (most notes) and 5 December 2025 (specific notes). If you saved drafts before 31 Oct, re-download. (FCA)

Analysis (what changes for issuers)

-

NSM changes affect every UK regulatory filing you make via ESS/NSM from today: metadata completeness checks will now block submissions if related-issuer LEIs are missing; headline mapping in your internal trackers must be refreshed; and your disclosure manual should add a post-filing “correction” pathway. (FCA)

-

PMB 58 fixes do not change the policy direction but do change consultation pack references you might cite internally and in adviser instructions. (FCA)

IR actions this week

-

Update the Regulatory Disclosures SOP: insert fields for “Related Issuer Name” and LEI; refresh headline code picklists. (FCA)

-

Amend your NSM submission checklists to include a “correction” decision-tree and record-keeping for superseded versions. (FCA)

-

Circulate a cutover note to Legal/Comms noting the completed outage window and the live date. (FCA)

-

If you responded to PMB 58, replace any pre-31 Oct downloads with the corrected versions; align your internal citations to the 21 Nov / 5 Dec feedback dates. (FCA)

India Headlines

-

SEBI extends timeline for QSB systems/processes for optional T+0 settlement (circular dated 30 October 2025). Exchanges/NSDL have also circulated the extension reference. (Securities and Exchange Board of India)

-

SEBI: Implementation of eligibility criteria for derivatives on existing Non-Benchmark Indices (circular dated 30 October 2025). Aligns index-derivative eligibility on existing non-benchmark indices. (Securities and Exchange Board of India)

Analysis

-

The T+0 extension is broker-side but material for liquidity, settlement-risk and operational-dependency wording in MD&A/Risk. T+0 refers to optional same-day settlement in the cash equity segment – trades executed on the “T” day are paid for and delivered that same day (vs. T+1 next-day settlement) – which can tighten cut-offs, require pre-funding/early securities availability, and split liquidity between cycles. If your shareholder base is retail-heavy, disclose monitoring of settlement-cycle transitions and potential frictions during phased adoption. (Securities and Exchange Board of India). (Securities and Exchange Board of India)

-

Non-benchmark index derivatives eligibility may broaden hedging/volatility dynamics around constituent companies; “non-benchmark indices” are sectoral/thematic or custom indices outside the flagship benchmarks (e.g., not Nifty 50 or Sensex). SEBI’s framework sets quantitative tests – on constituent count and weights, liquidity/turnover thresholds, concentration caps, and market-cap coverage – that, once met, allow futures/options to be listed on those indices. This can expand hedging access, influence derivative-linked flows and basis/dispersion, so keep your Market Risk and Financial Instruments notes neutral but current. (Securities and Exchange Board of India)

IR actions this week

-

Insert a sentence in Risk → Market infrastructure/Settlement noting SEBI’s 30 Oct extension for T+0 optional cycle implementation by QSBs; add a cross-reference to Treasury’s liquidity management policy. (Securities and Exchange Board of India)

-

Ask your brokers’ corporate desk for a T+0 readiness statement and planned timeline; retain in your disclosure backfile. (NSE India)

-

For companies sitting in custom/non-benchmark indices, request an internal note on derivative-linked flows and whether any sensitivity tables need refresh. (Securities and Exchange Board of India)

United Arab Emirates (Dubai) Headline

-

DFSA CP168 (Crypto Tokens) – consultation closed on 31 October 2025; proposals include minor conduct requirement amendments reflecting market feedback. (dfsa.ae)

Analysis

-

If you have DIFC-regulated entities or crypto-adjacent activities (treasury pilots, tokenised instruments, wallet partnerships), start a gap-check on conduct, risk and disclosure language pending final DFSA text. (dfsa.ae)

IR actions this week

-

Flag an internal policy watch: assign Legal/Compliance to summarise CP168 implications and prepare draft risk/controls text variants for rapid insertion once finalised. (dfsa.ae)

-

Map any crypto-token exposure in cash management or innovation sandboxes to board-approved limits and disclosure thresholds. (dfsa.ae)

Qatar (Update)

No new issuer-wide rules/circulars posted within the window on QSE Market Notices; maintain existing governance and disclosure baselines. (qe.com.qa)

Saudi Arabia (Update / Watch)

CMA consultation on simplified investment funds remains in the pipeline (original call 06 Oct 2025). Keep on watch approaching November policy cadence. (cma.org.sa)

India reporters

-

Risk → Market infrastructure & liquidity: Add: ~“SEBI extended the implementation timeline for optional T+0 settlement systems/processes for Qualified Stock Brokers on 30 October 2025; we continue to monitor settlement-cycle changes and potential impacts on liquidity and trade confirmations.” (SEBI). (Securities and Exchange Board of India)

-

Financial instruments note (if relevant): If your equity features in non-benchmark indices with active derivatives, acknowledge the 30 Oct SEBI criteria implementation and the team’s monitoring of derivative-linked flows. (SEBI). (Securities and Exchange Board of India)

UK reporters

-

Governance / Regulatory Disclosures page: Insert one line that, from 3 November 2025, NSM submissions include related issuer name and LEI and use updated headline codes; reflect that issuers can submit corrections (prior versions preserved on NSM). (FCA NSM). (FCA)

-

Project timetable footnotes: Note completed NSM cutover outage (31 Oct–3 Nov UTC) to explain any submission clustering or timestamp drift around the weekend. (FCA PMB 59). (FCA)

-

Prospectus/POATRs side-bar (if included): If you cite PMB 58 materials, refresh links and dates to the 31 Oct corrected drafts and 21 Nov / 5 Dec feedback deadlines. (FCA PMB 58). (FCA)

Dubai reporters (DFSA nexus)

-

Risk → Regulatory change: Pre-draft a neutral sentence on DFSA CP168 closure and pending outcomes that could tighten conduct controls for crypto-token activities. (DFSA). (dfsa.ae)

Sources (primary/official)

-

FCA: National Storage Mechanism changes page (ESS/NSM metadata & requirements) – (FCA)

-

FCA: PMB 59 (NSM outage timing and actions) – (FCA)

-

FCA: PS24/19 (NSM enhancements; in-force date) – (FCA)

-

FCA: PMB 58 (updated 31 Oct; consultation deadlines) – (FCA)

-

SEBI: Further extension for QSB systems/processes re T+0 (30 Oct 2025) – (Securities and Exchange Board of India)

-

NSE/NSDL circulars referencing SEBI’s T+0 extension – (NSE India)

-

SEBI: Implementation of eligibility criteria for derivatives on existing Non-Benchmark Indices (30 Oct 2025) – (Securities and Exchange Board of India)

-

DFSA: CP168 “Balancing Innovation and Investor Protection” (consultation closes 31 Oct 2025) – (dfsa.ae)

-

QSE: Market Notices (no new market-wide notices in window) – (qe.com.qa)

-

CMA Saudi: Announcements / public consultation index (context for funds track) – (cma.org.sa)

Triage grid

IR & AR WEEKLY ALERTS

To download and save this article.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

Leave A Comment