For Public & Private Sector Companies: Beyond Compliance: Achieving IFC’s Blueprint for Stakeholder Engagement Success – Part 1

Join us as we embark on this enlightening journey, offering insights, strategies, and practical tips to not only comply with but also excel in implementing IFC’s recommendations for stakeholder engagement and integrated reporting. This series promises to be an invaluable resource for those committed to shaping the future of corporate governance and ESG excellence.

Introduction

Welcome to our two-part blog series designed to illuminate the path toward enhanced corporate governance and stakeholder engagement, inspired by the International Finance Corporation’s (IFC) recommendations. This series is crafted for ESG professionals, company secretaries, and all stakeholders invested in the strategic evolution of integrated reporting and corporate transparency.

Part 1: Beyond Compliance: Achieving IFC’s Blueprint for Stakeholder Engagement Success

In our first instalment, we delve deep into the IFC’s mindset on fostering better disclosures in governance. The IFC’s framework is not just about meeting existing standards but about setting new benchmarks for transparency, accountability, and sustainable growth. This section aims to unravel the complexities of the IFC’s recommendations, offering a clear understanding of how companies can elevate their governance structures beyond mere compliance. We explore the essence of effective stakeholder engagement, highlighting the critical aspects often overlooked by publicly listed companies. Our goal is to provide a comprehensive guide that elucidates the IFC’s vision for corporate governance, paving the way for enterprises to not only meet their financial objectives but also positively impact society and the environment.

Part 2: Beyond Compliance: Translating Stakeholder Engagement through Integrated Reports

The journey continues in our second part, where we focus on the practical application of these principles through the lens of a company secretary. This segment is dedicated to navigating the complexities of mobilizing success through an Integrated Annual Report. We dissect the integral role of company secretaries in orchestrating stakeholder engagement and how it can be effectively translated into integrated reporting. This part is a hands-on guide for company secretaries and ESG professionals looking to harness the power of IFC’s stakeholder engagement framework to craft reports that resonate with integrity, transparency, and a deep-seated commitment to sustainable development.

Our Elevating Corporate Governance Through Stakeholder Engagement

In the dynamic realm of corporate governance, the International Finance Corporation (IFC) stands at the forefront, establishing a gold standard with its “Corporate Governance Progression Matrix for State- Owned Enterprises.”1 This framework, published in 2019, brings stakeholder engagement into the spotlight—a facet often unknowingly omitted by some publicly listed entities. The essence of the IFC’s guidelines is to nurture an environment of transparency, accountability, and enduring growth, encouraging corporations to surpass mere financial goals and to make a meaningful impact on society and the environment.

Decoding the IFC’s Recommendations

The IFC’s framework serves as an exhaustive manual to refine the governance quality of state-owned enterprises via robust stakeholder engagement. It delineates a spectrum of practices, from foundational to globally acknowledged best practices, encompassing stakeholder identification, engagement policies, governance frameworks, and mechanisms for addressing grievances. At its heart, the framework is designed to foster a systematic interaction between companies and their stakeholders—be they employees, clients, regulatory bodies, local communities, or entities within the NGO and civil society sectors.

This initiative by the IFC is not just about adhering to a set of guidelines; it’s a call to action for companies to engage more deeply and meaningfully with the various groups and individuals vested in their operations. It champions a corporate culture where stakeholder voices are not just heard but are integral to shaping business strategies and outcomes. Through this enhanced lens of governance, companies are positioned not only to thrive financially but also to contribute constructively to the broader tapestry of society and the natural environment.

IFC Corporate Governance Progression Matrix for State-Owned Enterprises (Integrating Environmental, Social, and Governance Issues) © 2019 International Finance Corporation. All rights reserved. 2121 Pennsylvania Avenue, NW Washington, DC 20433 USA Internet: www.ifc.org

Key Components of the IFC Recommendations:

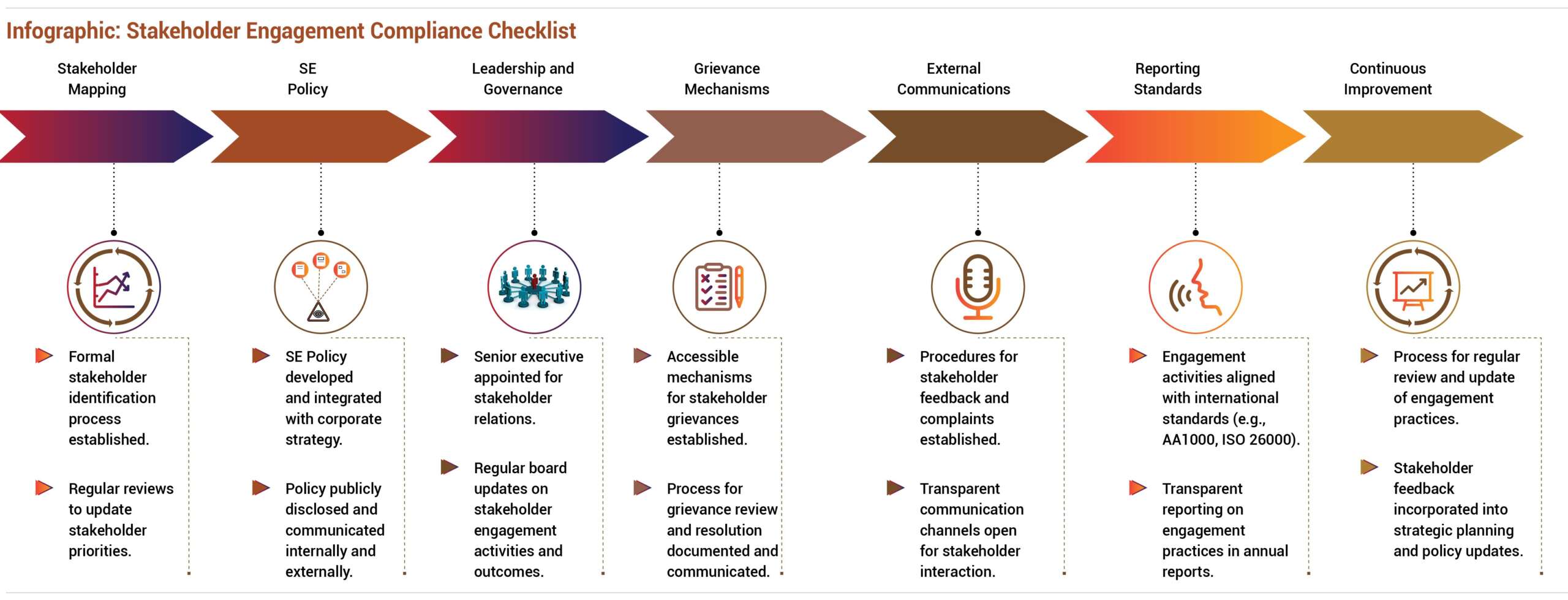

1. Stakeholder Mapping

Identifying and understanding the needs and expectations of all stakeholders, including indirect and secondary ones, to ensure their concerns are addressed in the company’s strategic planning.

2. Stakeholder Engagement Policy (SE Policy)

Developing and implementing a clear policy that outlines the company’s approach to stakeholder engagement, ensuring it is integrated with its overall strategy and operational goals.

3. Governance and Leadership

Establishing clear responsibilities within the organization for stakeholder engagement, including appointing a senior executive to oversee these activities and ensuring board oversight.

4. Grievance Mechanisms

Creating accessible and transparent channels for stakeholders to voice their concerns and grievances and ensuring these inputs are considered in decision-making processes.

5. External Communications and Redress

Implementing procedures for effective communication with stakeholders and providing means for redress where stakeholders’ rights might be impacted.

6. Reporting and International Standards

Aligning stakeholder engagement practices with international standards and best practices and reporting on these activities transparently in the company’s annual reports

7. Continuous Improvement

Regularly reviewing and updating stakeholder engagement policies and practices to reflect stakeholder feedback and evolving international standards.

Implementing the Recommendations: A Checklist for Compliance

To assist publicly listed companies in aligning with the IFC’s stakeholder engagement framework, we’ve distilled the recommendations into an easy-to-follow checklist. This visual guide is designed to serve as a ready reckoner for companies to assess their current practices and identify areas for improvement.

Conclusion

The IFC’s stakeholder engagement recommendations offer a roadmap for state-owned enterprises and publicly listed companies to enhance their corporate governance frameworks. By embracing these guidelines, companies can build stronger, more transparent relationships with their stakeholders, leading to improved trust, better risk management, and, ultimately, enhanced corporate performance. As companies worldwide strive to meet these standards, the role of comprehensive strategies, clear policies, and continuous improvement in stakeholder engagement has never been more critical.

For Public & Private Sector Companies: Beyond Compliance: Translating Stakeholder Engagement through Integrated Reports – Part 2:

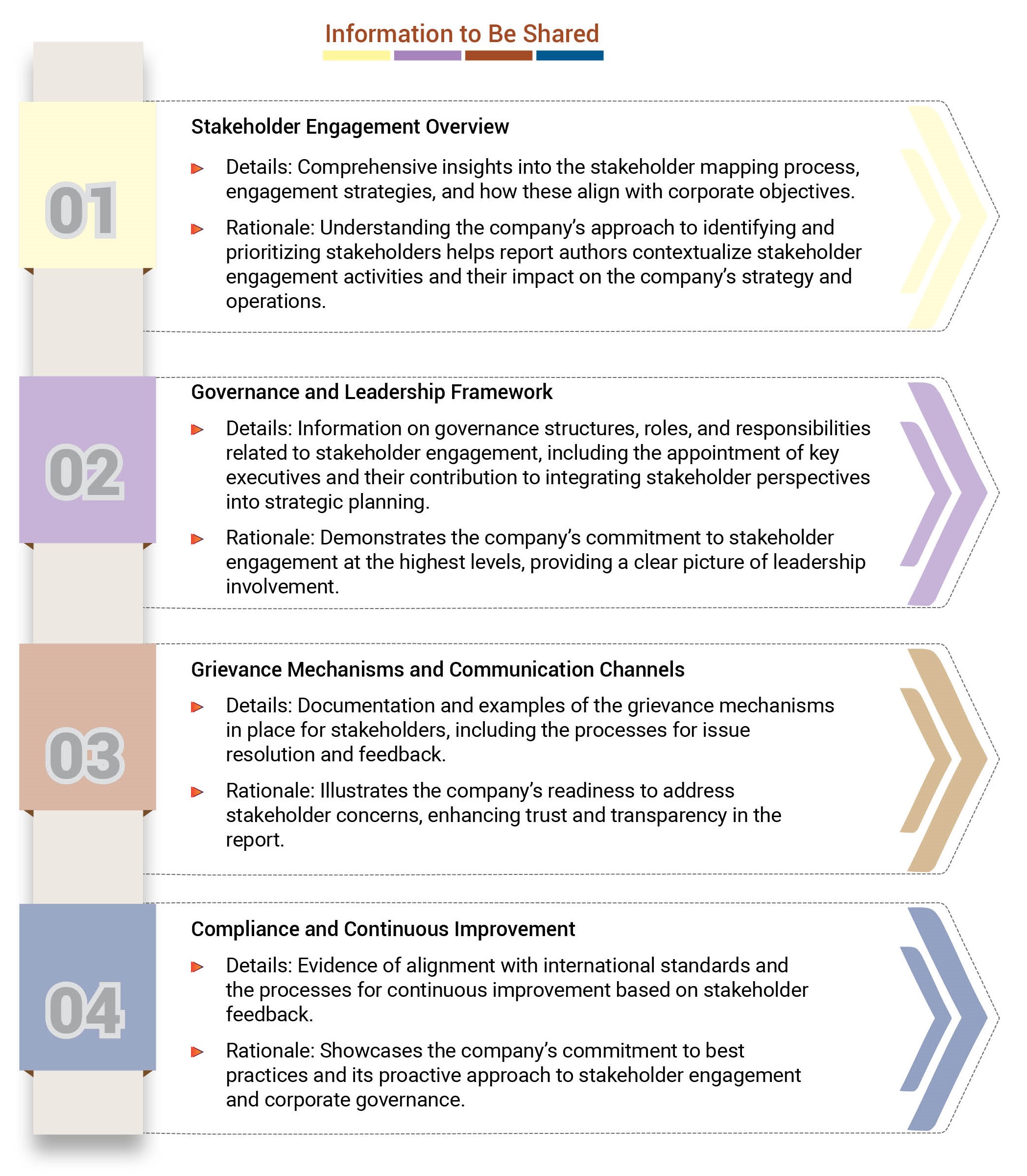

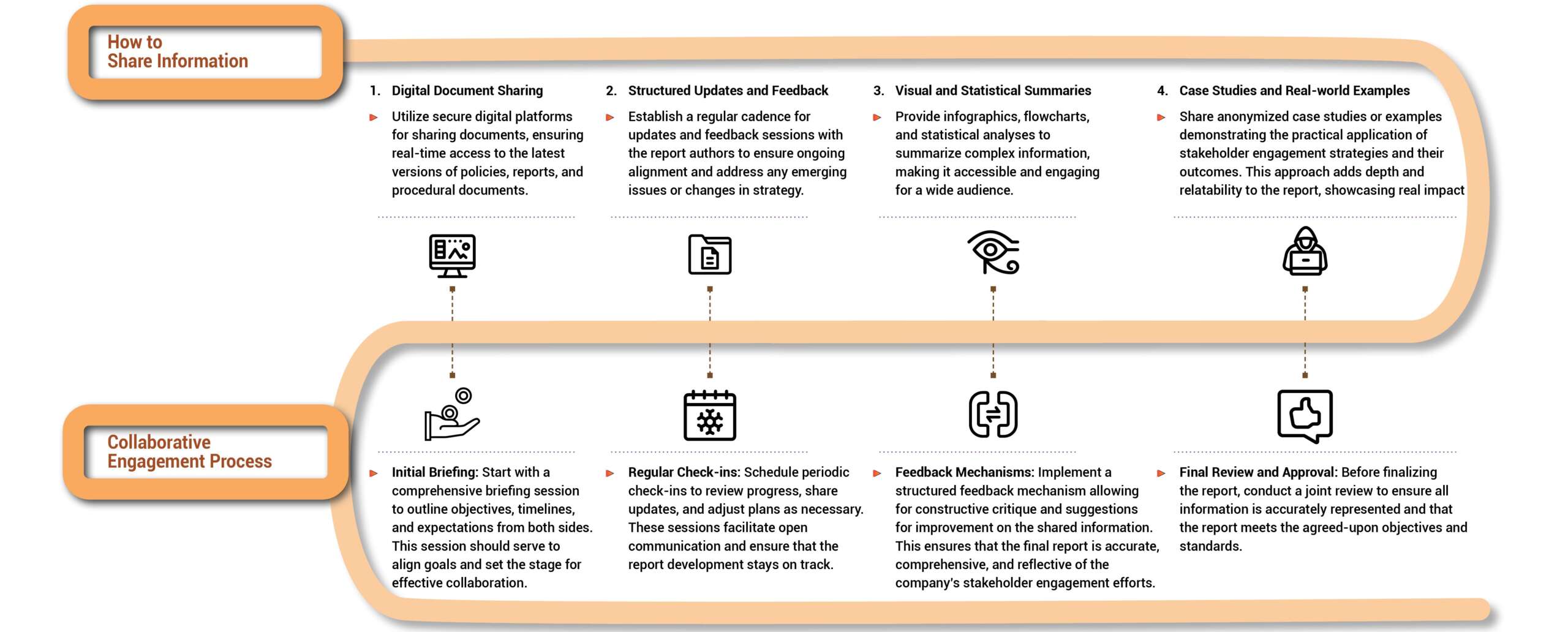

Enhancing Integrated Reporting: A Guide to Collaboration

To truly capture a company’s adherence to the IFC’s stakeholder engagement framework, forging a strong partnership and open lines of communication with the creators of the Integrated Report, such as Dickenson, is crucial. This guidance lays out a universal strategy for the type and manner of information exchange necessary to elevate the calibre of Integrated Reports. It’s designed to be universally applicable, cutting across client specifics to provide a blueprint that any company can follow.

The essence here is straightforward: If you aim for your Integrated Report to accurately mirror your commitment to stakeholder engagement and corporate governance, prioritizing effective collaboration and strategic information sharing is non-negotiable. This approach is not just about compliance for its own sake. It’s about ensuring that the process of creating the report is as strategic and impactful as the content itself. By adopting a clear, methodical approach to sharing insights and data with your reporting team, you set the stage for an Integrated Report that goes beyond mere documentation to become a testament to your company’s dedication to sustainable and responsible business practices.

In essence, this is about making every piece of shared information count towards crafting a report that not only meets international standards but vividly demonstrates your company’s genuine commitment to making a positive impact. It’s about ensuring that your Integrated Report stands as a clear reflection of your values and actions, making it a powerful tool for communication and change.

Conclusion

Let’s get straight to the point: Collaboration is more than a trendy term; it’s the cornerstone of exceptional Integrated Reports. The success of these reports relies heavily on two critical elements: effective teamwork and the intelligent exchange of information. This goes beyond merely checking off requirements to comply with frameworks like the IFC’s. It’s about authentically demonstrating a company’s thorough engagement with stakeholder interests and corporate governance principles.

When there’s a seamless partnership between companies and report authors, something remarkable occurs. We’re not just producing standard documents; we’re creating reports that vividly reflect our commitment to sustainability and ethical business practices. This effort transcends the basics. It’s about exceeding expectations and setting new standards.

So, what’s our strategy? It’s straightforward. Make every interaction meaningful, ensure that every piece of information shared is impactful, and aim for reports that not only meet but exceed standards. Through this approach, we showcase not only our compliance but also our profound dedication to conducting business responsibly.

As we venture into enhancing Integrated Reports with a spirit of cooperation and deliberate information sharing, the path we choose is evident. We aim to lead, setting an example that underscores our commitment to excellence and integrity in our reporting efforts. Let’s embark on this journey with the determination to achieve reports that not only inform but also inspire.

The IFC’s stakeholder engagement recommendations offer a roadmap for state-owned enterprises and publicly listed companies to enhance their corporate governance frameworks. By embracing these guidelines, companies can build stronger, more transparent relationships with their stakeholders, leading to improved trust, better risk management, and, ultimately, enhanced corporate performance. As companies worldwide strive to meet these standards, the role of comprehensive strategies, clear policies, and continuous improvement in stakeholder engagement has never been more critical.

Beyond Compliance: Translating Stakeholder Engagement through Integrated Reports

To download and save this article.

Authored by:

Manoj Saha

Managing Director

Manoj Saha is the Managing Director of Dickenson World, a leading Capital Markets Communication solutions company. He leads Dickenson World in Investor Relations, Corporate Reporting and ESG Advisory.

To know more on how Dickenson can assist you at this critical juncture, email to enquiry@dickensonworld.com

Leave A Comment