Global IR outsourcing

The emergence of Global IR Outsourcing for Investor Relations services

In a fast-moving global economy, you can find several companies that are collaborating with offshore service providers, rather than establishing their own in-house capabilities. Over the years, the global service delivery model has proven to be a flexible and efficient option of having resources offshore. This model is now becoming a common and significant practice for delivering high-quality services from global locations with round-the-clock resource availability. The information technology and business processing outsourcing businesses are strong testimony to the effective use of global delivery centres, yielding undeniable benefits and well-established high-performance levels. At Dickenson, we believe that several line-item Investor Relations related services are particularly well-suited to benefit from global delivery business models, while some may not be.

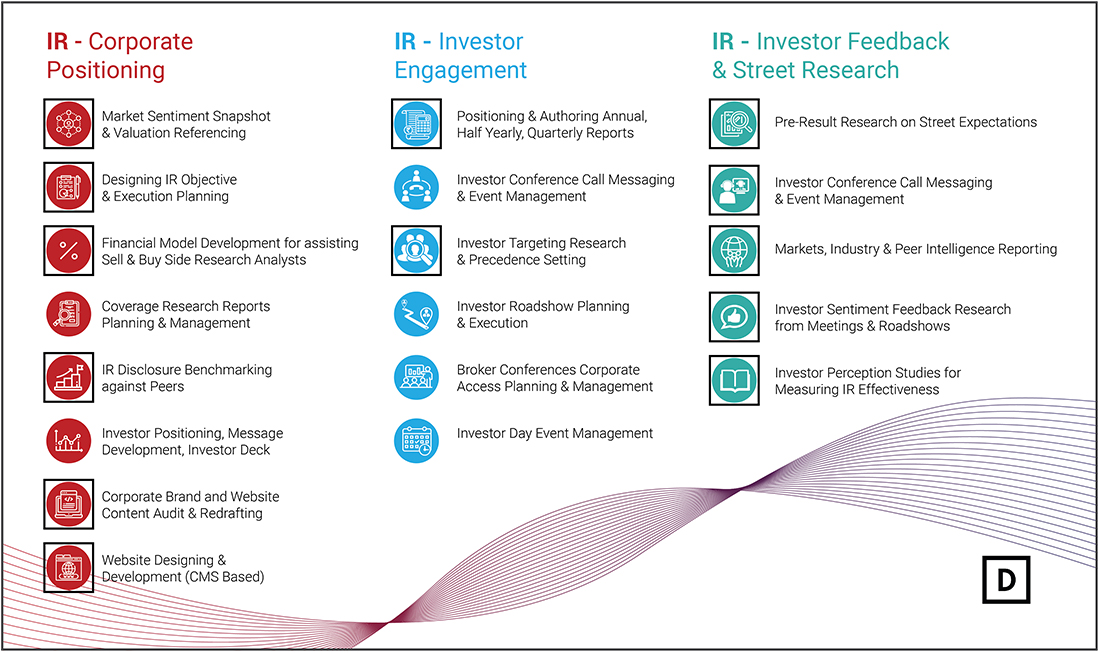

Broadly speaking, there are three basic functions that work in tandem with each other for delivering value to IR officers (IROs):

- IR Corporate Positioning

- IR Investor Engagement

- IR Investor Feedback and Street Research

Of the various sub-services that exist under the three main IR functions, several specific services tend to be more research and analytics based, which can straightforwardly be carried out by highly qualified analysts located anywhere on the planet. Clients’ requirements can easily be scoped by local account managers, which can be executed by a global delivery centre without requiring significant client engagement or advisory interactions. These are marked by black square boxes.

The ones that are not marked in square boxes tend to be more engagement centric, and require frequent face-to-face advisory interactions with clients. For these services, agencies that have an on-shore delivery model are much better suited to meet IRO requirements. Being closer to clients and investors within global financial centres, such as in the City of London, or downtown Manhattan, NY, or central-south Mumbai – are distinct advantages.

Advantages of engaging an onshore-offshore service partner:

- Access to investors: With an onshore model of delivering IR services, an agency is more capable of keeping up to date with the evolving IR objectives of the client by frequently interacting with the management. At the same time, the agency should also be able to arrange meetings with investors easily on behalf of their clients. Being located in Global Financial Centres such as London, New York, Hong Kong or Mumbai is distinctly advantageous.

- Analytical bandwidth: The global service delivery model provides avenues to take benefit of low-cost structures and explore highly skilled markets. An increasing number of companies are attracted to the effectiveness of offshoring in order to capitalise on comparative cost advantages, economies of scale and global presence. A fundamental reason why an IRO could consider offshoring some specific functions would be to reduce its permanent costs and drive up the ROI of his or her IR budget by leveraging actionable intelligence. For a company based in the EU or the Mena region, for example, paying an offshore agency, that has a relatively lower payroll brackets for highly qualified skilled specialists, can be more cost effective when compared to creating in-house resources within one’s own country.

- Specialisms: Offshoring amplifies the efficiency of operations and bolsters business productivity. What companies look for, while selecting an offshoring partner, is its specialised professional expertise. India is one of the largest global markets with a talent pool of professional and technical skills that makes it an instinctive choice for many multinational corporations. Supported by best-in-class research infrastructure and capabilities, the country is consistently delivering premium quality services. At Dickenson, our teams of professionals include sell-side analysts, investor relations professionals, investment bankers, financial PR experts, business journalists and brand specialists. We aim to deliver the right team, with the right experience and expertise, to every client.

- The commonality of language: As per a McKinsey report, offshoring is primarily conducted in countries where English qualifies to be the main business language. The focus on the commonality of the language explains why English-speaking countries resort to offshoring to a great extent. Therefore, countries with high English language proficiency, such as Australia, South Africa, Philippines and India, have become potentially desirable choices for offshoring.

- Quick time-to-market: With globalisation connecting countries with one another, offshoring offers a company the gateway to premium services with timely project delivery. One of the reasons why companies opt for an offshore service partner is to receive expeditious service deliveries. The global delivery centres located in India offer fastest turnaround time due to vast time zone differences. With our Global Delivery Centre located in Mumbai, all our key onshore service hubs west of India benefit from the time difference of the global clock. This factor facilitates prompt and timely project completion.

Dickenson’s Global Delivery model

A Case Study

Dickenson World has a distinguished global delivery model that is successfully generating business value for its clients through reliable, cost-effective and high-quality services. It is one of the first companies to establish knowledge process outsourcing in the India for servicing investor relations professionals (IROs) globally. Dickenson World operates out of its main global delivery centre based in Mumbai, and its satellite global onshore centres based in London, UAE, Doha and NY.

Dickenson World is a global capital markets communication firm serving a broad range of public and private institutions across UK, EU, India and the MENA region. With over 20 years of experience, we have built a uniquely capable ecosystem to execute investor engagement strategies for companies, globally.

The global delivery centres of Dickenson World make the company a dynamic capital markets communication services outsourcing company. The clients of Dickenson World have direct access to the company’s deep knowledge, top talent, and multiple capabilities. The delivery centres are a part of the company’s global delivery network and offer cross-industry capital markets communication outsourcing services in industries spanning realty, media, technology, financial services, health and public service, infrastructure, consumer products and resources. With approximately 50 people serving clients in several countries, Dickenson World drives innovation to improve the way the world’s IROs work and deliver.

Global IR outsourcing

To download and save this article.

Authored by:

Manoj Saha

manoj.saha@dickensonworld.com

To know more on how Dickenson can assist you at this critical juncture, email to enquiry@dickensonworld.com

Leave A Comment