Financial Models: Everyone likes a happy ending!

A must-have tool in an IR kit.

By Manoj Saha, Managing Director at Dickenson World

enquiry@dickensonworld.com

An effective product offering, an efficient management, and a well-laid outlook. While these are all facets of a business that are successful in gaining an investor’s attention, often, they aren’t enough to garner “investor commitment”.

Even a star-studded film with a brilliant script, direction, and narration, seems inconsistent without a happy ending. And when it comes to a business’ IR kit, this happy ending can be compared to a well defined and explained FINANCIAL MODEL.

So, does this make a financial model a must-have tool in an IR kit?

Today, most businesses are multi-product, multi-service, multi-location, multi-process and truly dynamic. They are well diversified across various streams, and this makes a narration of the company’s story lengthy and sometimes sketchy. If not done intelligently, explaining these complex businesses could potentially create confusion and questions among potential investors, which may fan the feeling of uncertainty when considering investment.

Although a well conceived IR deck aims to cover a majority of these aspects, a Financial Model goes a long way in ironing out the picture, and offers investors a more complete package.

Here’s the STARCAST…

- A Detailed Profit & Loss Statement: A solid financial model will always accurately reflect the expense items of a company, as well as the revenue of its products. Combining multiple products with vastly different aspects could be a major flaw. This is something that is not that hard to get right in the first place. Doing it wrong can cause the financial projections to be significantly inaccurate. An ideal Profit and Loss Statement in the Financial model should consist of adequate break up between its KPA’s. For example, this includes a break up between different products, different geographies, or different segments.

- A short synopsis of the Balance Sheet: one of the most important financial statements is the Balance sheet. A potential investor would always need to understand how the balance sheet could expand or shrink after a two to three year period. A well-detailed Balance sheet majorly focused on the gross block, debt, and working capital, which goes a long way in giving more clarity to potential investors.

- A Dynamic Financial Model: After putting in all the numbers and assumptions in the P&L and Balance sheet, what investors would like to do is prop in their thoughts into a financial model. This means that all assumptions should be appropriately linked. While not every model needs to have multiple pre-set scenarios built-in, it is useful to see, at a minimum, how changing key assumptions could impact the model’s outputs in realtime. It is particularly useful to see this output directly on the assumptions tab so there’s no need to flip between tabs after making an assumption tweak.

If not done intelligently, explaining these complex businesses could potentially create confusion and questions among potential investors, which may fan the feeling of uncertainty when considering investment.

If the script engages the audience, the impact comes from the numbers…

Investors (read here as an analyst) are slaves to numbers. After pitching the narrative of the company’s outlook, it almost always boils down to the numbers. This is where the role of a Financial Model really shines. A company’s Positioning, Management Strategy and Industry Outlook must be summed up by the Financial Model.

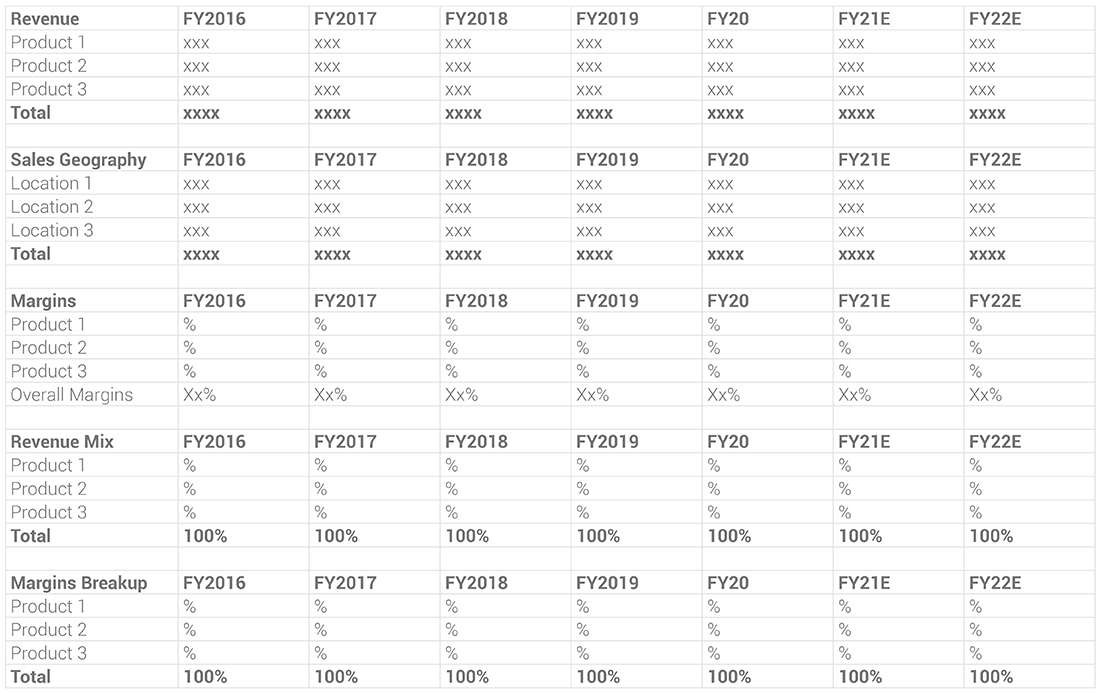

For example, suppose a company has a high-margin value-added product and is also a market leader. Its margin in this value-added product is 5X of its other products. The revenue breakup alone is not enough to adequately illustrate this, and a detailed product-wise revenue and margin analysis is necessary to bring out the complete scenario.

In addition to that, financial models also help Institutions (Fund Managers, Bankers, etc) to value the INTRINSIC value of the business in a more lucid way.

A company’s Positioning, Management Strategy and Industry Outlook must be summed up by the Financial Model.

For example:

Climax… is what Investor Relations (IR) achieves with the financial model

- Speed up your Sellside Coverage & improve management bandwidth: Sell-Side analysts work on a stretched bandwith with multiple companies to cover. To speed up a recommendation note and to aid their working on company projections, the Financial Model becomes handy and crucial, eliminiating the time an analysit would spend extracting data from past financials and creating a skeleton of a financial model.

Moreover, a ready to work Financial model not only gives a gist of numbers, but also channelizes a thought process amongst investors on how one should look at the company. It helps analysts to have a more holistic view of valuation and not restrict their opninons to blanket and generic valuation techniques, which are generally adopted in case of very broad numbers.With past numbers and break-ups readily available, an analyst can focus on the outlook (estimates) and their Valuation Methodology. - Maintain a uniform line of communication: Once all the KPI’s are streamlined and highlighted in the Financial model, future communication between an Analyst and the IRO becomes more focussed, easy, and outlook oriented. A financial model aims to make communication more institutionalized and consistent, if not constant. It also eliminates generic queries from analysts and makes engagement more centred on strategy and outlook.For example:

- Not only investors, but other financial institutions find comfort in Financial Models from the IR team: A financial model prepared for the purpose of IR also comforts various other financial stakeholders, such as bankers, credit rating agencies, and other independent financial institutions. Sometimes, MIS or Annual Reports alone could limit the understanding of financial institutions, while more detailed financial model could help understand the business profile and drivers. This could materially change the positioning of the company for such financial institutions.

- Inter-department synchronisation: If we assume a Financial Model was for a mass audience, then its no surprise that it is a very effective tool from an internal control perspective as well. In a well-diversified organisation with multiple products, multiple locations, and multiple segments, a well-built financial model highlights the performance of each segment or sub-segment categorically. Through this process, every segment becomes accountable from an investors communication perspective. IROs can play a meaningful role in bridging the gaps between various departments while preparing a financial model. The Top Management can also be well serviced thorugh exercises such as peer benchmarking for every segment (in case each business segment has different sets of peers), or a trend analysis for each segment. Thus financial models once prepared can provide a holistic view of the company.

A ready to work Financial Model not only gives a gist of numbers, but also channelizes a thought process amongst investors on how one should look at the company.

THE END.

A financial story skilfully told through ruggedized financial models and sharp investor presentations has the power to transform your investment thesis into compelling one.

Authored by:

Manoj Saha

Managing Director

Manoj Saha is the Managing Director of Dickenson World, a leading Capital Markets Communication solutions company. He leads Dickenson World in Investor Relations, Corporate Reporting and ESG Advisory.

To know more on how Dickenson can assist you at this critical juncture, email to enquiry@dickensonworld.com

Financial Models: Everyone likes a happy ending!

To download and save this article.

Leave A Comment