EMBRACING AI:

A STRATEGIC ADVANTAGE FOR CFOS

A STRATEGIC ADVANTAGE FOR CFOS

As CFOs navigate the complexities of financial management and investor relations, one critical question remains: how can artificial intelligence (AI) transform your role and bring unprecedented value to your organization? AI has become more than a buzzword; it’s a powerful Tool that can drive efficiency, enhance decision-making, and maintain a competitive edge. In this blog, we will explore the integration challenges CFOs face, the benefits of AI, and how our AI Consulting Practice can help you leverage this technology to its full potential.

The Key Pain Point: Seamless Integration

While the potential of AI is vast, many CFOs face a significant challenge in integrating AI technologies into existing financial and operational systems. The fear of disruption, the need for compliance, and the demand for immediate ROI can make AI adoption seem daunting. However, overcoming these challenges can unlock substantial benefits for your organization.

Understanding the Integration Challenges

- Complexity of Existing Systems: Many organizations have complex, legacy financial systems that are not easily compatible with new AI technologies. The integration process can be technically challenging and resource intensive.

- Data Quality and Consistency: AI relies heavily on high-quality, consistent data. Ensuring that your data is clean, well-organized, and up-to-date is crucial for successful AI implementation.

- Regulatory Compliance: Financial data is subject to strict regulatory requirements. Integrating AI must ensure compliance with these regulations to avoid legal and financial repercussions.

- Cultural Resistance: The introduction of AI can be met with resistance from employees who fear job displacement or are sceptical about the technology. Building a culture that embraces AI is essential.

How AI Consulting Can Help

Our AI Consulting Practice is designed to address these integration challenges head-on, ensuring a smooth transition and tangible benefits for your financial operations. Here’s how we can help:

- Customized Solutions: We work closely with your team to develop AI solutions tailored to your specific needs. Our consultants conduct a thorough assessment of your current financial systems and processes to identify the best AI tools and methodologies for your organization.

- Seamless Implementation: Our experienced AI consultants ensure a smooth integration of AI technologies into your existing systems. We provide hands-on support throughout the implementation process, minimizing disruption to your operations.

- Comprehensive Training and Support: We offer extensive training programs to equip your team with the necessary skills to utilize AI effectively. Our ongoing support ensures that your team can confidently manage and optimize AI tools, driving continuous improvement in financial performance.

- Risk Mitigation and Compliance: We prioritize compliance and risk management, ensuring that AI adoption aligns with regulatory standards and mitigates potential risks. Our expertise helps you maintain investor confidence and uphold transparency.

The Transformative Benefits of AI for CFOs

Integrating AI into your financial operations offers numerous benefits that can transform your role and enhance your organization’s performance. Here are some key advantages.

Enhanced Decision-Making

AI-driven analytics provide real-time insights and predictive modeling, enabling CFOs to make more informed decisions that align with investor expectations and market dynamics. By analyzing vast amounts of data quickly and accurately, AI helps identify trends, forecast future performance, and optimize financial strategies.

Improved Financial Reporting and Compliance

Automated systems powered by AI can streamline financial reporting, ensuring accuracy and compliance with regulatory standards. This not only saves time but also enhances transparency and trust with investors. AI can automatically detect anomalies, reduce errors, and ensure that financial statements are precise and reliable.

Operational Efficiency

AI can automate routine tasks such as data entry, reconciliation, and variance analysis, freeing up your team to focus on more strategic activities. This leads to cost savings and improved operational efficiency. For instance, AI-powered tools can handle repetitive tasks that would otherwise consume valuable time and resources.

Strategic Forecasting and Risk Management

AI algorithms can analyze vast datasets to identify trends and potential risks, allowing you to proactively manage financial risks and forecast future performance with greater precision. AI-driven risk models can provide early warnings of potential financial issues, enabling you to take corrective actions promptly.

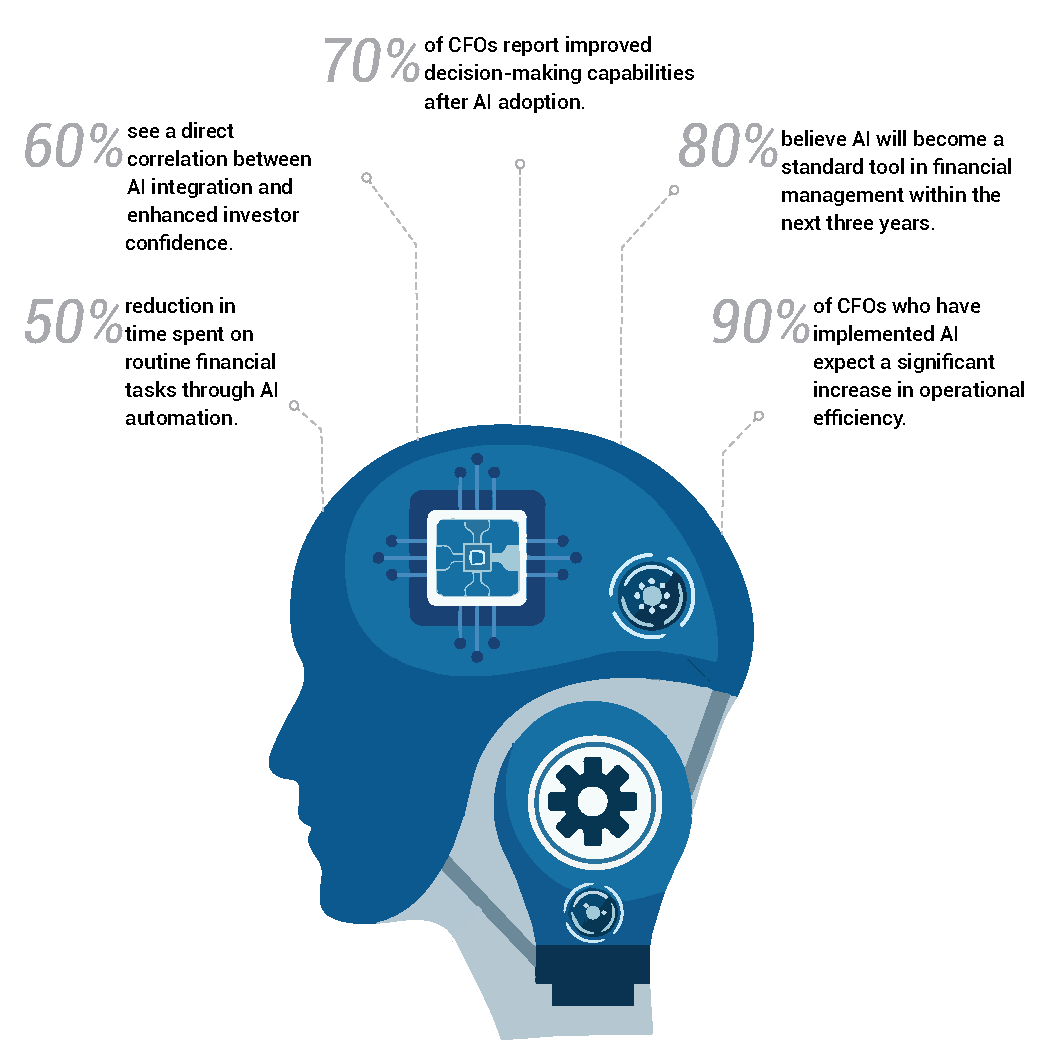

Infographic: The AI Advantage for CFOs

To visualize the transformative power of AI, we have created an infographic that highlights key data points demonstrating the benefits of AI for CFOs.

The Path to Seamless AI Integration

To visualize the transformative power of AI, we have created an infographic that highlights key data points demonstrating the benefits of AI for CFOs.

- Invest in AI Training and Development: Equip your team with the necessary skills and knowledge to understand and utilize AI tools. This will enable a smooth integration of AI into your financial processes. Training programs should cover both technical skills and strategic insights to maximize the benefits of AI.

- Pilot AI Projects: Start with pilot projects in key areas such as financial planning and analysis, auditing, and compliance. Measure the impact and scalability before broader implementation. Pilots allow you to test AI applications in a controlled environment, identify potential issues, and refine the technology before full-scale deployment.

- Collaborate with AI Experts: Partner with AI consultants who can guide you through the complexities of AI adoption. Their expertise will help you identify the most valuable use cases and ensure successful deployment. Expert guidance can help you navigate technical challenges, regulatory requirements, and organizational changes.

- Foster a Data-Driven Culture: Encourage a culture where data-driven decision-making is the norm. Ensure that your team understands the value of data integrity and the role of AI in enhancing business outcomes. A data-driven culture promotes the consistent use of data in decision-making processes, ensuring that AI applications are effective and reliable.

Realize the Full Potential of AI

Integrating AI into your financial operations doesn’t have to be overwhelming. With the right partner, you can achieve seamless integration and unlock AI’s full potential. Enhance decision-making, streamline operations, and boost investor confidence by embracing AI.

By partnering with our AI Consulting Practice, you can overcome the challenges of AI adoption and leverage its transformative potential to enhance financial reporting, improve operational efficiency, and drive strategic decision-making.

Ready to transform your financial IR engagement and management with AI? Contact us to learn how our AI Consulting Practice can guide you every step of the way.

EMBRACING AI:A STRATEGIC ADVANTAGE FOR CFOS

To download and save this article.

For more insights and updates on AI in finance, subscribe to our newsletter and stay ahead of the curve.

Contact Us:

To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com. Our AI Strategy Consultant service is here to help you leverage the power of AI for your business success.

London

UK Bureau

Ms. Kinneri Saha

+44 748 723 4770 (UK)

+91 99877 23160 (India)

Mumbai

India Operations

Ms. Shankhini Saha

+91 73044 81351 (M)

Leave A Comment