Why MD&A Matters More to Valuation Than We Admit

The quiet influence of MD&A

Within most listed companies, Management Discussion and Analysis is approached primarily as a regulatory obligation. It is prepared once the financial statements are finalised, reviewed for compliance, and aligned carefully with statutory language. Beyond this, it often receives limited strategic attention compared with earnings calls, investor presentations, or roadshows.

From an investor’s perspective, however, MD&A occupies a very different position. It is not read as a summary of results, nor as a promotional narrative. It is treated as a diagnostic document, one that reveals how management understands its business, interprets the industry environment, and evaluates the balance between opportunity and risk. These judgements, formed quietly through MD&A, play a material role in shaping long-term confidence in valuation.

This divergence between internal perception and external use explains why MD&A remains one of the most underestimated documents in the valuation ecosystem.

How investors typically perceive MD&A

Investors rarely begin their analysis with MD&A. Financial statements, key ratios, and cash-flow metrics usually come first. MD&A is read afterwards, selectively but deliberately, to validate what the numbers suggest.

At this stage, investors are no longer asking whether performance has improved or deteriorated. They are asking why. They assess whether management can clearly explain outcomes, distinguish between structural and temporary factors, and articulate the underlying drivers of change. MD&A is therefore evaluated less for completeness and more for coherence.

Global securities regulators have consistently articulated MD&A as a document intended to help investors view the company through management’s own lens. Its purpose is not merely to restate financial results, but to place them in context, explain the drivers of earnings and cash flows, and enable investors to assess whether historical performance provides a reliable foundation for future outcomes. (CRI)

Experienced investors also analyse the MD&A comparatively. They compare it with prior-year disclosures, with earnings call commentary, and with observable outcomes over time. Inconsistencies are noted, as are areas where narrative discipline holds. Through this process, MD&A becomes a tool for assessing management credibility, not just performance.

MD&A is the only controlled window into the future

MD&A holds a unique position among statutory disclosures. It is the only formal document where management can discuss future direction without issuing explicit projections or earnings guidance. Global reporting frameworks consistently describe its purpose as providing forward-looking context rather than forecasts.

This distinction is central to its value. Investors do not expect numeric precision in MD&A. They expect judgment. How management describes industry conditions, demand trends, regulatory developments, and strategic priorities provides insight into its view of uncertainty and allocation of attention.

Expectation-setting within MD&A occurs through framing rather than forecasting. Emphasis on specific themes, caution around others, and consistency in narrative across reporting periods all influence how investors anchor their medium-term assumptions. Over time, this framing contributes to confidence, or the lack of it, in management’s ability to navigate change.

Where MD&A relies excessively on generic optimism or broad macro commentary, investors often infer a lack of strategic depth. Where it demonstrates a measured, company-specific interpretation of the operating environment, it tends to strengthen valuation confidence even in volatile conditions.

“Valuation confidence is built quietly. MD&A reveals how management interprets complexity, frames uncertainty, and communicates discipline in ways investors track far beyond quarterly results.”

Risk disclosure as a signal of leadership quality

Risk discussion is one of the most revealing elements of MD&A. Yet, in many annual reports, it remains static year on year, with little evolution, irrespective of changes in the business model or operating environment. Investors do not judge the quality of risk disclosure by the length of the list alone; instead, they look for relevant disclosure that is evolving and tied to the firm’s underlying economics.

Recent empirical evidence supports this view. A peer-reviewed study published in the International Journal of Financial Studies finds that richer, more informative risk disclosures in MD&A are significantly associated with a lower likelihood of a severe stock price decline in the future. Firms that provide a higher intensity of risk information tend to experience less stock price crash risk, particularly when the narrative contains incremental, clear, and differentiated information rather than repetitive boilerplate disclosure. This effect is more pronounced for firms with weaker information environments, weaker external monitoring, and greater investor attention, suggesting that high-quality risk disclosure helps mitigate information asymmetry and supports market confidence in uncertain contexts. (MDPI)

Investors interpret these empirical patterns as evidence of leadership quality. When MD&A risk sections introduce new, context-specific risks as strategy and conditions change, refine previously stated risks with greater nuance, and describe the company’s preparedness with clarity rather than generic language, they signal active oversight and thoughtful judgement. In contrast, risk narratives that remain unchanged over time or that rely on broad, undifferentiated descriptions often raise questions about whether management truly understands the company’s risk profile and is sufficiently attuned to emerging uncertainties.

MD&A provides management with an opportunity to demonstrate not only awareness of uncertainty but also readiness to address it. This readiness matters to investors because markets tend to price known risks; unrecognised, understated, or poorly articulated risks contribute to information asymmetry and abrupt corrections. Empirical evidence suggests that when MD&A risk disclosures are more informative and incremental, they can help reduce severe price disruptions by enhancing transparency and lowering information asymmetry.

In this context, a thoughtful risk narrative functions not merely as a compliance exercise but as a leadership signal. It communicates awareness, strategic discipline, and realism. These attributes build investor trust over time and contribute to more stable valuation perceptions, especially in environments with high uncertainty, where monitoring mechanisms alone may not be sufficient to reassure markets.

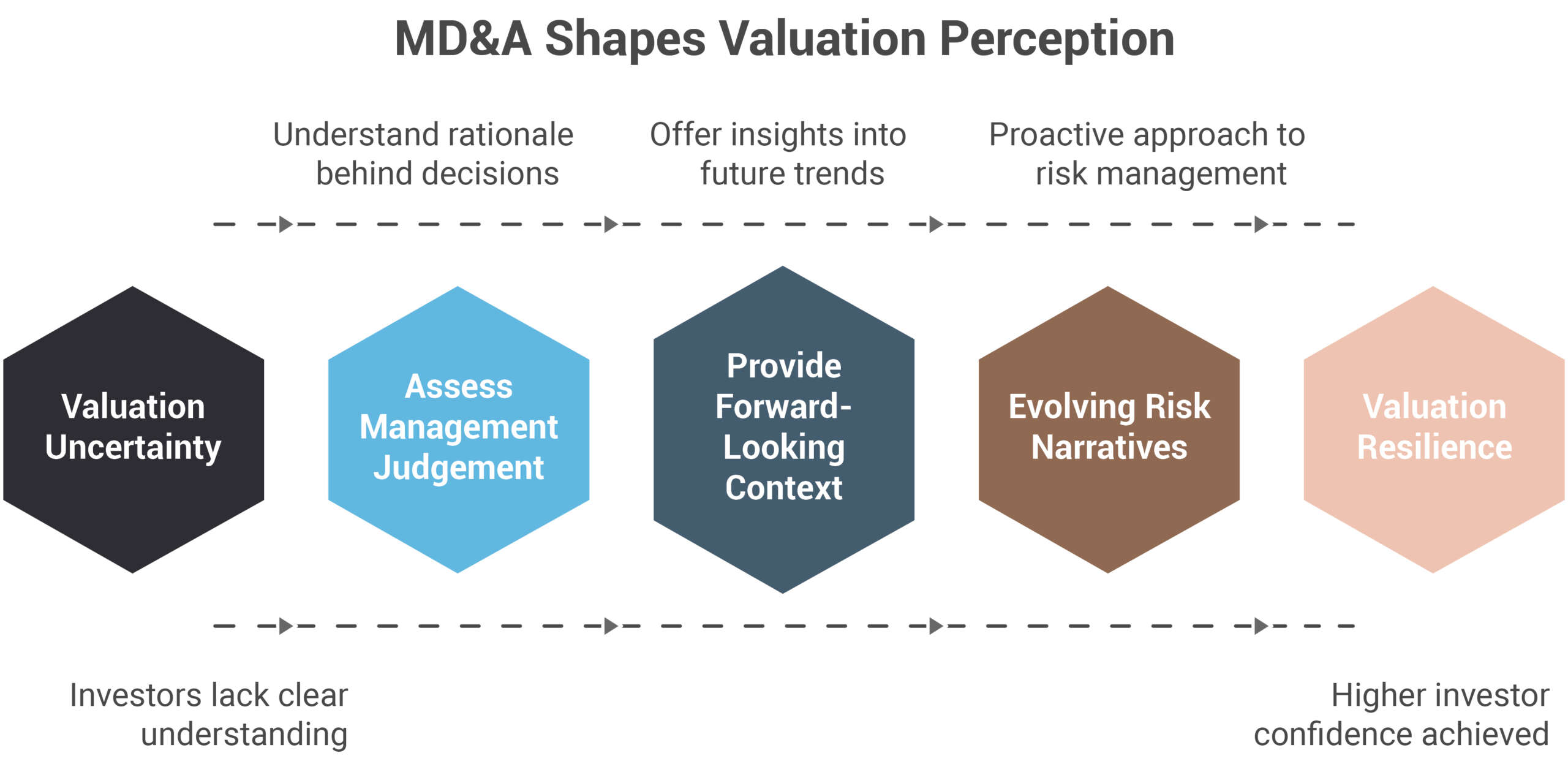

How MD&A quietly influences valuation

MD&A does not affect valuation through explicit formulas or metrics. Its influence is indirect but persistent.

Clear articulation of business drivers reduces uncertainty around future cash flows. Disciplined discussion of capital allocation supports confidence in return generation. A balanced treatment of opportunity and risk lowers the probability that investors assign to negative surprises. Collectively, these factors influence the discount rates and multiples investors are willing to apply, even when not stated explicitly.

Patterns in MD&A disclosures are fundamental. Consistency in strategic priorities, alignment between stated risks and subsequent outcomes, and coherence between narrative and action all contribute to perceptions of reliability. This reliability often manifests in more stable ownership and greater valuation resilience during periods of stress.

Conversely, MD&A narratives that shift tone frequently, avoid complex topics, or conflict with observable behaviour tend to erode trust. Even strong financial performance can struggle to sustain valuation when this trust weakens.

Patterns Investors Identify Quickly in MD&A Disclosures

In practice, many companies approach MD&A incrementally, using the prior-period disclosure as a base and updating figures with limited reconsideration of the narrative structure. Investors increasingly find this approach ineffective. MD&A is most valuable when it is built around the themes that matter most to financial statement users, rather than as a sequential commentary on period-over-period movements that are already visible in the numbers.

Experienced investors look for early identification of issues likely to influence future performance. This includes emerging trends, evolving uncertainties, and external factors such as interest rates, regulatory shifts, or changes in economic policy that are material to the business. When such factors are introduced, investors also expect continuity in subsequent disclosures, with narratives evolving as conditions change rather than disappearing once attention fades. (Riveron)

Consistency across public disclosures is equally essential. MD&A that conflicts in tone or emphasis with earnings calls, press releases, or investor presentations can undermine confidence, even when the underlying data is accurate. At the same time, investors recognise that MD&A is not a marketing document. They expect a level of depth and context that may go beyond other communication channels, particularly where matters are material to long-term performance.

Ultimately, MD&A is management’s opportunity to place financial results in context. clear language, focused discussion of what matters most, and selective use of tables or charts to support complex explanations all contribute to a disclosure that enhances understanding rather than merely restating information already available elsewhere.

“When treated as a year round process rather than a last minute task, MD&A becomes one of the most credible and controllable tools for shaping long term investor perception.”

Repositioning MD&A within the investor relations toolkit

For boards, CFOs, and investor relations leaders, the implication is clear. MD&A should not be treated as an appendix to financial statements that gets finalised at the end of the reporting cycle. It is a strategic communication instrument that consistently conveys how management interprets performance, assesses risk, and positions the company for the future.

In practice, MD&A carries both legal and informational responsibilities that go beyond compliance. In specific reporting regimes, management must identify and discuss material trends, events, and uncertainties known at the time of filing, even if they have not yet fully affected results. This underscores the document’s forward-looking nature and its role in shaping investors’ understanding under both challenging and stable conditions. (IR Impact)

The most effective MD&As do not attempt to persuade investors with broad optimism. They help investors form judgment by demonstrating how management interprets complexity, balances ambition with realism and prepares for uncertainty. When MD&A explains not just what happened, but why it matters going forward, it becomes a key signal of thoughtful leadership and disciplined oversight.

Companies that recognise and leverage this role tend to benefit from more substantial investor confidence over time. Those who underestimate it often miss one of the most credible and controllable ways to influence long-term perceptions of value, particularly during periods of heightened uncertainty or structural change.

From Year-End Exercise to Year-Round Discipline

The implication for boards, CFOs, and investor relations leaders is straightforward. MD&A should not be treated as an eleventh-hour drafting exercise once the numbers are finalised. It is most effective when curated progressively, informed by decisions, trade-offs, and risks as they emerge throughout the year.

The strongest MD&As are rarely assembled in a single sprint at year-end. They are shaped over time, drawing on management discussions, capital-allocation decisions, evolving risk assessments, and recurring investor questions. When MD&A is approached this way, it becomes a record of management judgment rather than a retrospective explanation of outcomes.

This shift requires discipline rather than additional disclosure. It involves identifying, early in the year, the themes likely to matter most to investors, tracking how those themes evolve, and ensuring narrative consistency across earnings calls, investor interactions, and formal disclosures. By the time the annual report is finalised, the MD&A should reflect a considered point of view that investors have already begun to recognise.

Companies that adopt this year-round approach tend to produce MD&As that feel coherent, credible, and grounded. Those who leave the exercise to the end of the reporting cycle often rely on familiar language and generic framing, unintentionally weakening one of the most controllable elements of their valuation narrative.

Viewed this way, MD&A is not a compliance deliverable. It is a management discipline. When treated as such, it quietly but consistently reinforces investor confidence over time.

Footnotes:

-

Carr, Riggs & Ingram (CRI), “Understanding the Management’s Discussion and Analysis (MD&A) Disclosure”, Dec 2018. Available at: https://www.criadv.com/insight/understanding-mda-disclosure/

-

Fei Su, Lili Zhai and Jianmei Liu, “Do MD&A Risk Disclosures Reduce Stock Price Crash Risk? Evidence from China”, Dec 2023. Available at: https://www.mdpi.com/2227-7072/11/4/147

-

Drew Niehaus and Emily Schwabenland, “How MD&A Can Yield Better Investing Decisions”, Sep 2019. Available at: https://riveron.com/posts/mda-can-yield-better-investing-decisions/

-

IR Impact, “MD&A in troubled times”, Mar 2021. Available at: https://www.ir-impact.com/2001/03/mda-troubled-times/

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Bhushan Wankhede is a finance professional with over a decade of experience across investor relations, financial advisory, and academia. He holds postgraduate degrees in Commerce and Finance and is currently pursuing a Ph.D. in Commerce, bringing a research-oriented perspective to capital markets communication. He is the CEO of CapEdge, a specialised training initiative focused on building practical capabilities in investor relations and capital markets communication. At Dickenson, Bhushan works closely on the analytical and disclosure aspects of investor relations, including interpreting quarterly performance, anticipating investor queries and shaping management responses, benchmarking peer commentary, and supporting structured IR communication Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process. frameworks. His academic experience strengthens CapEdge’s focus on structured learning and applied financial insight.

Why MD&A Matters More to Valuation Than We Admit

To download and save this article.

Authored by:

Bhushan Wankhede

CEO – CapEdge, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment