The TPT Framework:

Your Blueprint for a Net-Zero Future

Discover how this gold-standard approach is reshaping corporate transition planning globally.

The intensifying climate crisis has spurred the development of frameworks to guide businesses toward a sustainable future. The Transition Plan Taskforce (TPT) framework is a critical tool for developing and disclosing climate-related transition plans, aiming to establish a “gold standard” and ensure financial flows align with a net-zero economy. This framework is not merely about compliance, it is a strategic imperative for businesses navigating the complexities of a low-carbon world. This article offers a bird’s eye view for issuers in the UK, India, and Dubai, explaining the framework’s key aspects, implications, and benefits.

Understanding the TPT Framework

While developed in the UK, the TPT framework is designed for global application. It supports international consensus on what constitutes a robust transition plan and aligns with the International Sustainability Standards Board (ISSB) standards, particularly IFRS S1 and IFRS S2, which aim to create a global baseline for sustainability-related financial disclosures. The framework is intended for both voluntary and mandatory use internationally, providing flexibility while promoting adoption. The framework was developed through a collaborative effort, with input from over 100 organizations and tested by over 500, ensuring its robustness. Transition plans are a strategic imperative, fundamental to a company’s business model, not just a matter of compliance.

Key Components of a TPT-Aligned Transition Plan

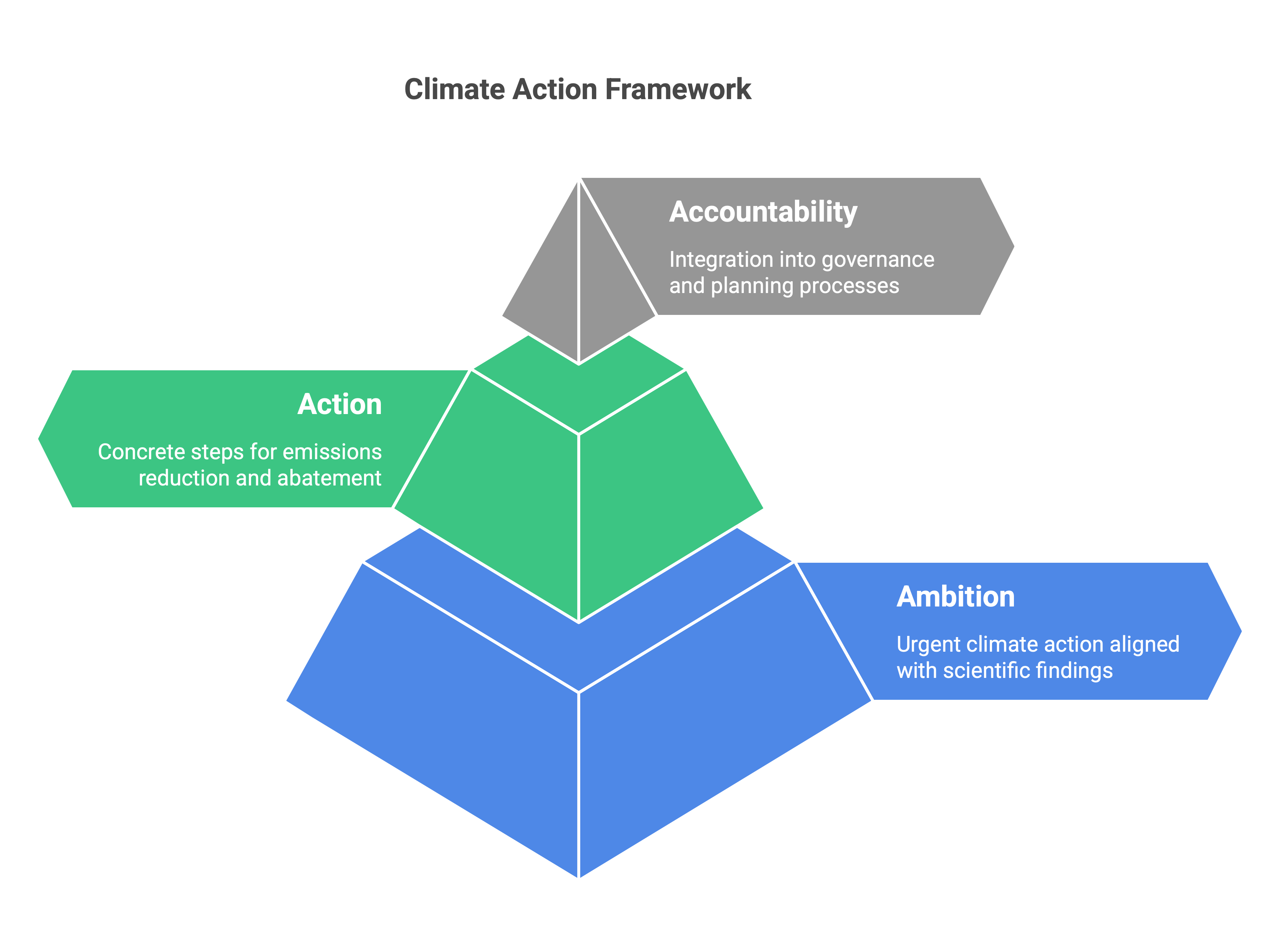

The TPT framework is built on three guiding principles: Ambition, Action, and Accountability.

- Ambition: Plans should reflect the urgency of climate action, incorporating scientific findings and responding to national and international commitments. This includes decarbonizing, addressing climate-related risks, and contributing to an economy-wide transition. A strategic approach should be adopted, considering impacts on stakeholders, society, the economy, and the natural environment, to avoid unintended consequences.

- Action : Plans should translate objectives into concrete, short, medium, and long-term steps, including a roadmap of planned actions. This involves considering Scope 1, 2, and 3 emissions, prioritizing direct abatement over purchasing carbon credits, and ensuring actions are supported by appropriate resourcing plans.

- Accountability : Plans should be integrated into organizational processes for business, financial planning, and governance. This involves defining clear roles and responsibilities, aligning culture and incentives, reporting material information, and ensuring plans are flexible, dynamic, and regularly reviewed and updated.

A good transition plan has five core elements, broken down into 19 sub-elements, each with specific disclosure recommendations:

- Foundations: This involves disclosing the Strategic Ambition, including objectives, priorities, and the implications for the business model and value chain, along with key assumptions and external factors.

- Entities should disclose objectives for reducing Scope 1, 2 and 3 GHG emissions, enhancing resilience to climate change, and accelerating a transition to a low-GHG emissions economy.

- They should disclose the current and anticipated strategic changes to the business model and value chain as well as the timeframe over which those changes are expected to occur.

- Key assumptions made, and external factors depended upon, should be disclosed including their implications for achieving strategic ambitions.

- Implementation Strategy: This includes disclosing actions to achieve the Strategic Ambition within business operations, products, services, and financial planning.

- Entities should disclose information about short, medium, and long-term actions relating to production processes, workforce adjustments, supply chain and procurement and changes to facilities and other physical assets.

- They should disclose information about actions to change the portfolio of products and services, as well as any underlying taxonomies used to classify them.

- A description of any policy or condition used to achieve strategic ambitions should be disclosed.

- Entities should disclose the qualitative and quantitative effects of the plan on financial position, performance, and cash flow, including how the plan is resourced.

- Engagement Strategy : This details how the entity engages with its value chain, industry peers, government, and civil society.

- Entities should disclose engagement activities with their value chain and how these are prioritised.

- They should disclose engagement activities with industry counterparts, including memberships in trade organizations.

- Entities should disclose engagement activities with government, regulators, and civil society.

- Metrics and Targets : This includes disclosing metrics and targets used to monitor progress, including governance, business, operational, financial, and GHG metrics.

- Entities should disclose any targets set, and how these reflect the strategic ambitions, and how these relate to other actions in the plan.

- They should disclose their approach to setting and reviewing targets and how progress is monitored, including any third-party validation and reviews.

- Annual progress should be reported against all targets, with an analysis of trends or changes in performance.

- Information on GHG emissions should be disclosed, including Scope 1, 2 and 3 emissions, and the approach used to measure emissions.

- Entities should disclose information about how carbon credits are used.

- Governance : This explains how the transition plan is embedded within the entity’s governance structures.

- Entities should identify those responsible for oversight of the plan including the board, committees, or individuals.

- They should identify management bodies or individuals responsible for the executive oversight and delivery of the transition plan.

- Entities should disclose how culture is aligned with the strategic ambitions of the plan.

- They should disclose information about how incentive and remuneration structures are aligned.

- Entities should disclose information about actions to build skills and competencies across the organization to achieve strategic ambitions.

TPT Framework in Your Region

The TPT Framework offers a globally applicable structure for transition plan disclosures, aligning with ISSB standards and supporting businesses across regions. In the UK, the government is spearheading efforts to mandate transition plans, with the Financial Conduct Authority (FCA) aiming to strengthen disclosure requirements in alignment with the framework. For Indian companies, the framework provides a consistent approach to transition planning, enabling compliance with ISSB standards and enhancing international competitiveness even in the absence of mandates. Similarly, companies in Dubai can leverage the framework for voluntary adoption, using it to showcase sustainability efforts and align business strategies with global goals, positioning themselves ahead of potential regulations.

TPT Framework and Integrated Annual Reporting

The TPT Framework seamlessly integrates into broader sustainability-related disclosures within general-purpose financial reports, aligning with the requirements of IFRS S2. It offers comprehensive guidance on effectively reporting transition plan elements, ensuring that material information is both transparent and consistent with established reporting norms. By embedding these details within financial disclosures, the framework enables organizations to demonstrate their commitment to sustainability while maintaining compliance with global standards. To enhance clarity and accessibility, it is recommended that organizations periodically publish transition plans as standalone documents, offering a deeper dive into strategies, metrics, and progress. This approach underscores the importance of strategic alignment and meticulous reporting in the journey toward a net-zero future.

Benefits of Adopting the TPT Framework

Adopting the TPT framework offers several benefits:

- Improved Investor Confidence: Credible transition plans increase investor confidence and support capital allocation decisions.

- Enhanced Risk Management : The framework aids in managing climate-related risks and opportunities.

- Strategic Advantage : It provides a strategic blueprint, promoting a whole-of-organization transformation.

- Global Recognition : The framework helps in demonstrating sustainability efforts on a global scale.

- Preparation for Future Regulation : Voluntary adoption helps companies stay ahead of potential regulatory requirements.

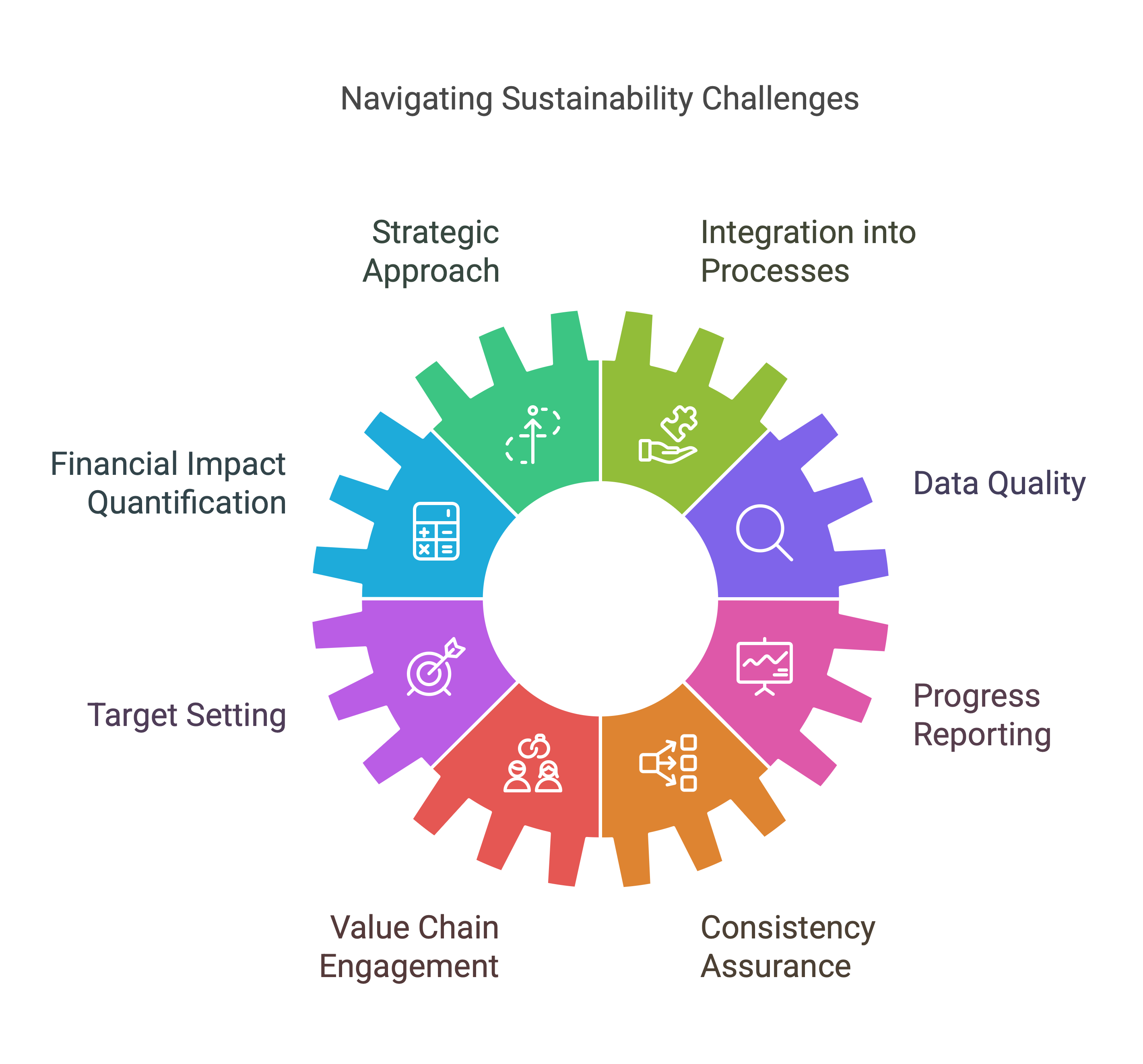

Challenges in Adopting the TPT Framework

Adopting the TPT framework is not without challenges:

- Developing a Strategic and Rounded Approach: Moving beyond a narrow focus on emissions to consider wider systemic implications and interdependencies can be difficult. Avoiding unintended consequences like “paper decarbonization” or maladaptation is crucial.

- Integrating Transition Plans into Existing Processes : Incorporating sustainability into core operations and planning cycles can be challenging and may require significant organizational changes.

- Quantifying Financial Effects : Accurately projecting the financial impacts of transition plans over the short, medium, and long term is complex due to uncertainties in climate impacts and policy developments.

- Data Availability and Quality : Gathering and verifying data, particularly for Scope 3 emissions, supply chain mapping, and the financial impacts of climate adaptation, can be difficult.

- Setting and Validating Targets : Selecting appropriate targets, aligning them with strategic ambitions, and demonstrating alignment with national and international commitments can be challenging. Setting credible, science-based targets and validating them with third parties may also pose difficulties.

- Reporting on Progress : Detailed sustainability reporting may be challenging for entities with less experience.

- Engaging with the Value Chain : Working with complex supply chains and multiple stakeholders to gather data, set targets, and implement actions can be difficult.

- Ensuring Consistency : Ensuring consistent reporting with corporate norms and other standards like IFRS S1 and S2 requires additional effort.

- Balancing Ambition with Practicality : Balancing high ambition with practical implementation may pose difficulties.

Closing Remarks

The TPT framework is more than a tool—it is a compass for businesses navigating the inevitable transition to a low-carbon economy. As the climate crisis reshapes the global business landscape, adopting this framework signals not just compliance but foresight, resilience, and strategic leadership. It empowers organizations to align ambition with actionable plans, manage risks, and seize opportunities within a rapidly evolving regulatory and market environment.

For issuers in the UK, India, Dubai, and beyond, the TPT framework provides a structured pathway to integrate sustainability into their core strategies, enhancing credibility and investor confidence while preparing for future regulations. Challenges in adoption, from data quality to financial impact projections, are opportunities to embed sustainability as a defining element of long-term growth.

The time for action is now. By adopting the TPT framework, businesses can position themselves at the forefront of this critical economic transformation, turning ambition into progress and securing their place in a sustainable and resilient global economy. For more information, consult the detailed resources offered by the TPT. You can always connect with me at Dickenson also to help you explore your TPT opportunity.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Kinneri is an Economics Major graduate, with minors in Liberal Arts and Business Study from NY University (NYU). She joined Dickenson full-time in May 2016 as an Associate Consultant within the firm’s Investor Relations practice, and as an Editor for the Corporate Reporting practice. Since then, she has successfully developed strong skills in developing investor presentations, in Bloomberg/ FactSet data mining, News Release preparation, IR Analytics, Investor Targeting reports and curating the content’s team work for the Corporate Reporting and Financial PR practices of Dickenson. In February 2017, she took up the responsibility of seeding the company’s UK presence and based herself permanently in London. As a Director of the company’s UK arm, she is currently responsible for developing the firm’s business in the North Atlantic markets.

The TPT Framework

To download and save this article.

Authored by:

Kinneri Saha

CEO & Director – IAR and ESG,

Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment