The IR talent crunch is real. Here is the playbook for CFOs & Aspirants.

Picture this. Results week is two days away. Draft numbers are moving, the audit committee wants tighter guidance language, and your website still needs last quarter’s transcript uploaded. You turn to your Investor Relations team. It is one person. Maybe two. They are smart, but stretched.

This is not unusual. In the UK, IR keeps getting more professional and more accountable, yet most teams are still one to three people. In India, the market adds issuers faster than it adds trained IROs. Across the Gulf, listings have fired up demand for people who can work across disclosure, storytelling, and investor engagement. The outcome is the same in each market. Expectations are rising faster than the supply of job-ready talent.

Good news. There is a practical fix that helps both sides of the table. Train to publisher standards, then place people into live roles with supervision through the first couple of cycles. That is the idea behind CapEdge.

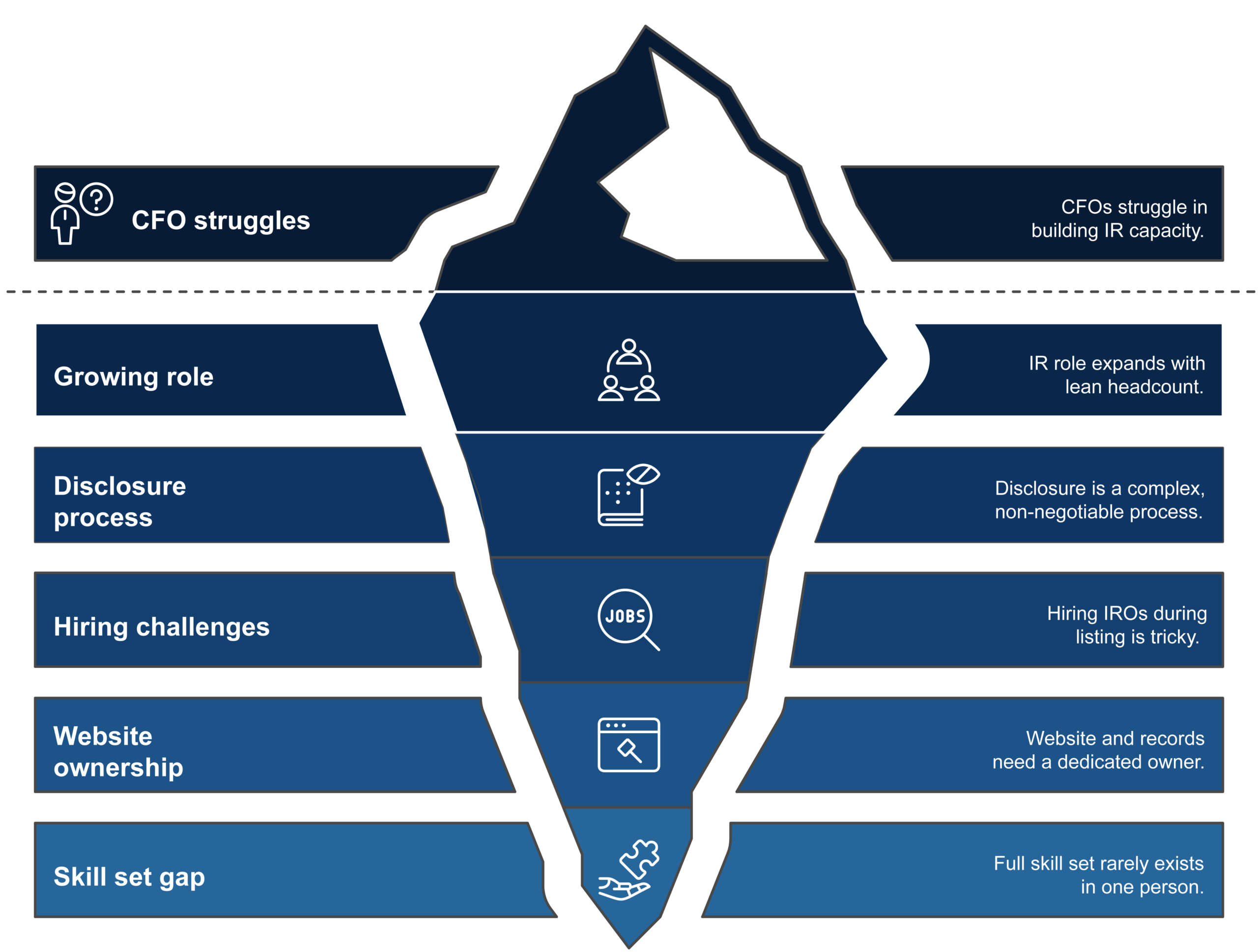

Why do CFOs struggle in building IR capacity?

- The role keeps growing while headcount stays lean.

IR has to cover market conduct, governance, ESG alignment, investor feedback, and leadership narrative. That is a lot to pack into a small team. If roles are not defined clearly, peak periods become a scramble. - Disclosure is a process, not just a paragraph.

Handling inside information, documenting delay decisions, and getting website and archival obligations right are all non-negotiable. It takes practice to do this calmly when pressure rises. - Hiring during a listing cycle is tricky.

In the UAE and Saudi Arabia, demand for experienced IROs spikes when markets are issuing. You either pay a premium for a finished hire, or you onboard promising talent and accept a learning curve. Both options can work, but the second is faster if training and supervision are planned, not left to chance. - Website and records need a real owner.

India’s rules specify what must appear on an issuer website and for how long. Someone has to run that cadence and keep an audit trail. That someone is usually IR. - The full skill set rarely sits in one person on day one.

You can find great communicators without capital-markets fluency and vice versa. The hybrid profile that you need can be built if the first year is structured.

Why is IR a smart career-move for finance and communications professionals?

-

- You sit at the strategy–markets interface.

IR is where the investment case is shaped and delivered. You learn how numbers, narrative, and governance fit together, and you see how investors actually react. - Demand is visible in the right places.

The Gulf exchanges keep listing. India has a vast issuer base. The UK market expects strong process discipline. Those conditions reward people who can step in and deliver reliably. - Governance fluency sets you apart.

You do not have to be a lawyer, but you do need to be comfortable with how disclosure rules operate in practice. That confidence is learnable, and it signals job-readiness immediately. - The work creates a portable portfolio.

An earnings release, an investor presentation, a Q&A script, and a clean website archive are proof of practice you can show your next employer.

- You sit at the strategy–markets interface.

What should great IR training and placement deliver?

-

- Regulatory foundations that you can use.

Teach the mechanics of delayed disclosure, website obligations, and common exchange practices. Apply them to cases. The goal is muscle memory, not trivia. - Results-cycle workflows.

Write an earnings release with management commentary. Build a presentation that fits local style norms. Rehearse an analyst Q&A. Publish the transcript and update the website on time. - Market-facing judgement.

Practice materiality calls, delay logs, guidance language, and buy-side dialogue in simulated conditions. This is where coaching matters most. - Placement as a promised outcome.

Training without a real seat at a real issuer leaves the job half done. The ramp is where skill turns into habit.

- Regulatory foundations that you can use.

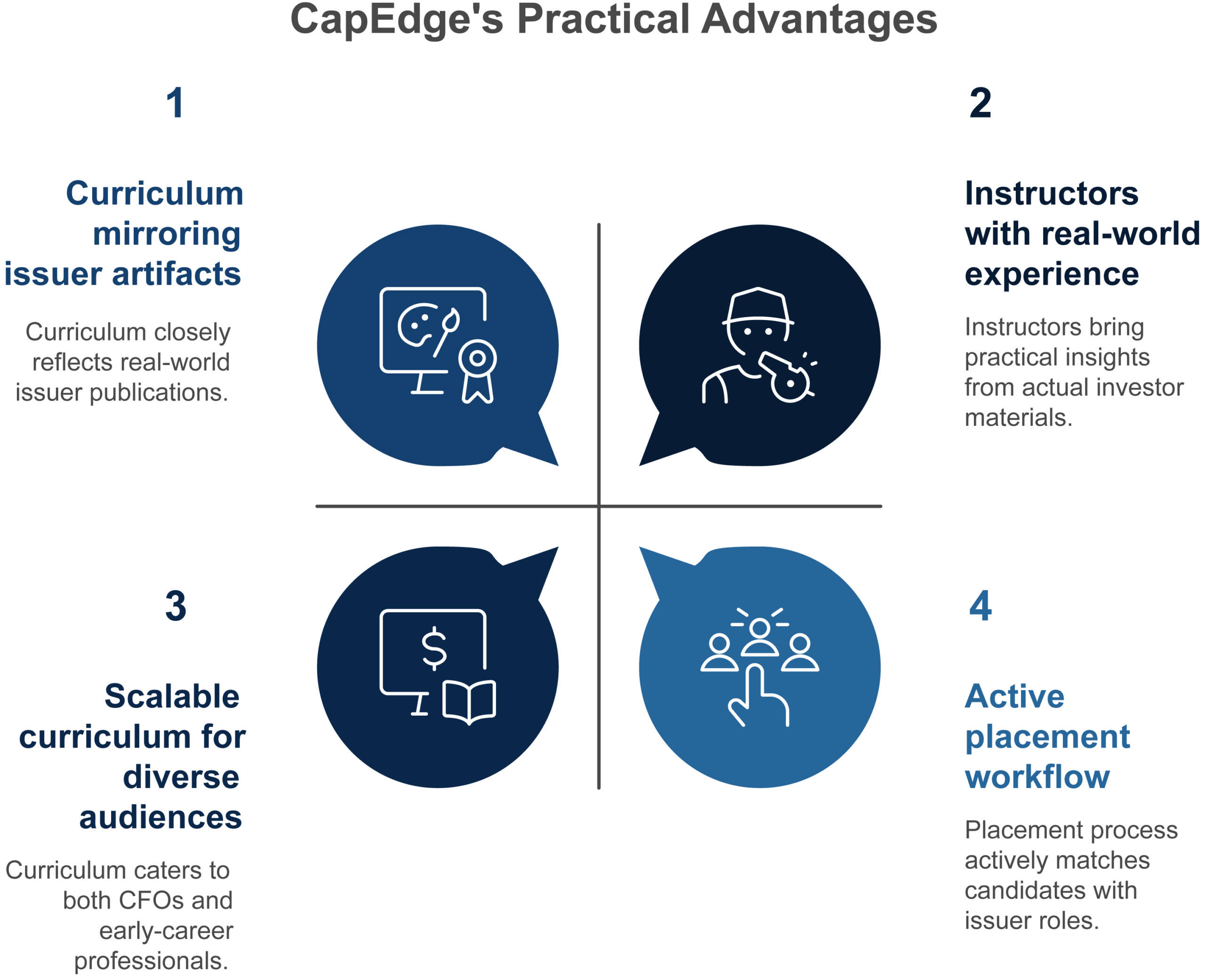

Why is CapEdge the practical answer?

CapEdge lives inside Dickenson World, a capital markets communications house. That means three things for you.

-

- The curriculum is built by people who actually ship investor materials.

Your instructors write earnings releases, prepare investor decks, and advise boards on disclosure discipline for a living. The exercises mirror the artefacts issuers publish. - Placement is a workflow, not a wish.

We match people into roles through active issuer relationships across India, the UK, the UAE, Saudi Arabia, and Qatar. The ramp continues through two results cycles with supervision. - It scales to both audiences.

CFOs get a de-risked path to team formation. Early-career professionals get a credible on-ramp and an employer who knows what they can do because they have already done it during training.

- The curriculum is built by people who actually ship investor materials.

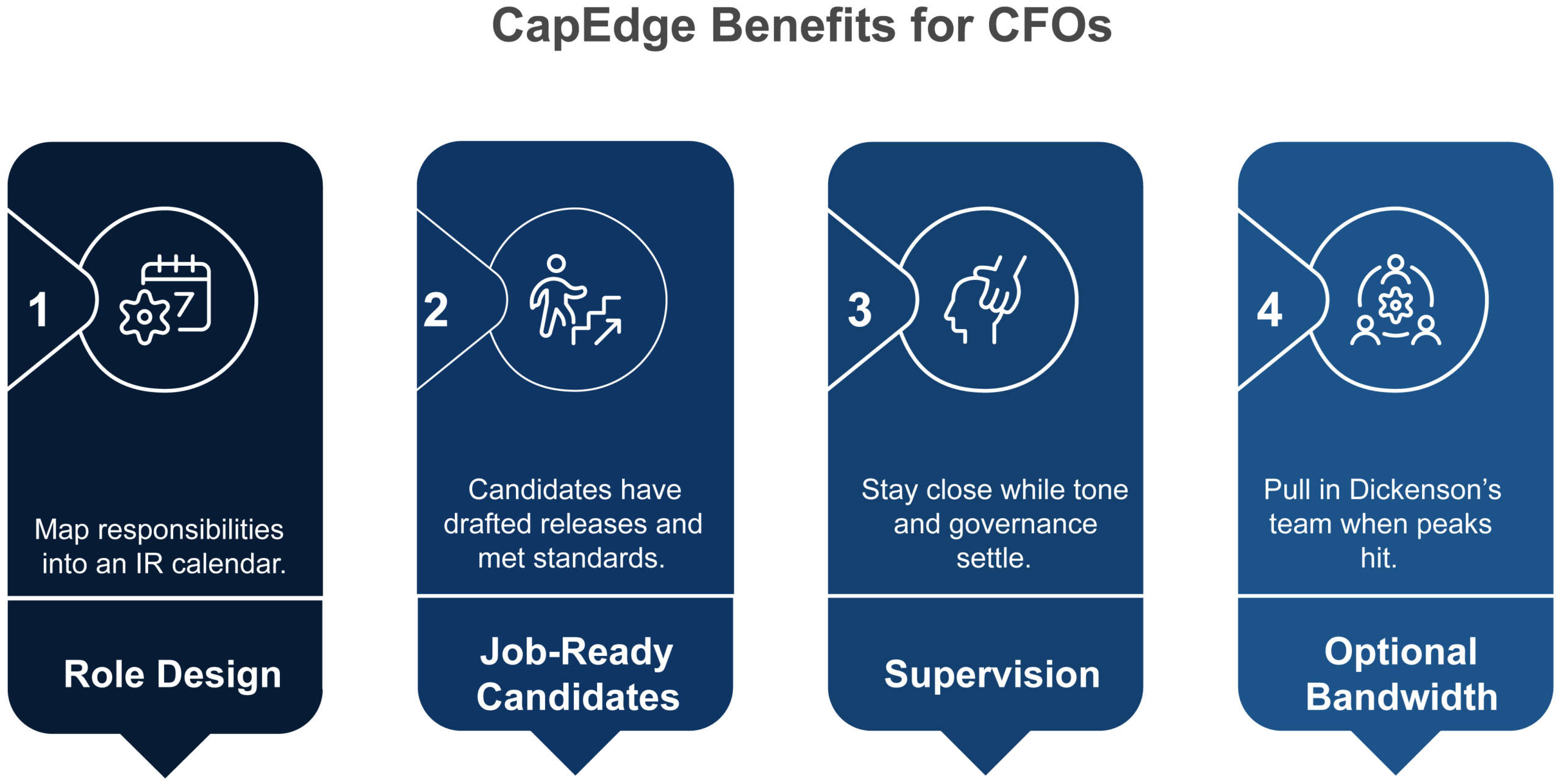

What CFOs get with CapEdge

-

- Role design in one day.

We map Board, Audit Committee, legal, and website responsibilities into an IR calendar fitted to your listing venue and investor base. - Shortlists that are genuinely job-ready.

Candidates have drafted releases, built presentations, logged hypothetical delay decisions, and met website and transcript standards in practice sessions. - Supervision through the first two cycles.

We stay close while tone, cadence, and governance settle into a rhythm. - Optional bandwidth from the studio.

When peaks hit, you can pull in Dickenson’s corporate reporting and transaction communications team without starting from zero.

- Role design in one day.

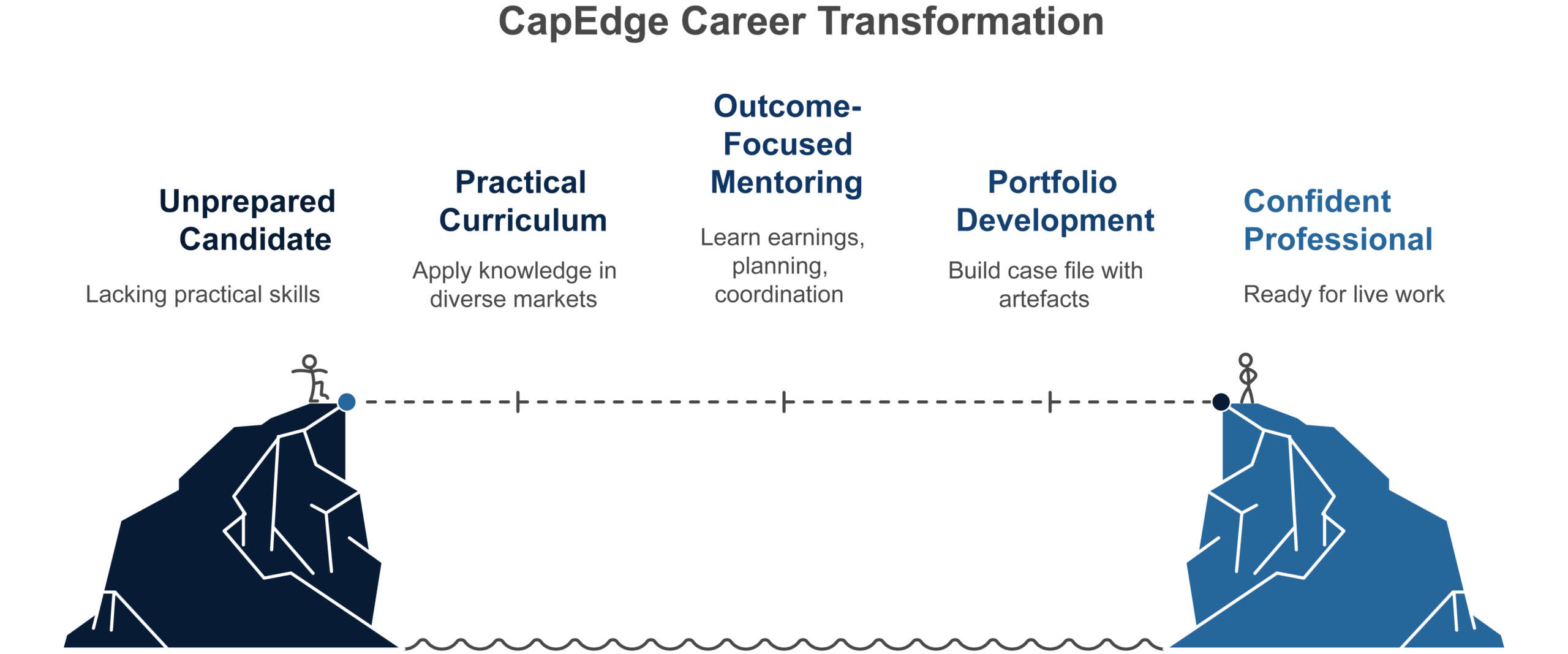

What candidates get with CapEdge

-

- A practical curriculum.

We teach the recognised body of knowledge and apply it in the UK, India, and GCC contexts so that you can switch markets with confidence. - Mentoring that focuses on outcomes.

You will learn earnings preparation, investor day planning, and media coordination with feedback that is specific and useful. - A portfolio that proves it.

Your earnings pack, presentation, Q&A notes, and website artefacts are all part of your case file. - A live pathway into work.

Placement is not left to chance. It is part of the programme.

- A practical curriculum.

Two fast start paths

-

- For CFOs and Company Secretaries

Commission a one-day design workshop. You will leave with a fit-for-purpose IR operating model, a clear role specification, and an onboarding plan tailored to your reporting calendar and regulatory perimeter. - For professionals entering IR

Book a short assessment call. We will map your current skills to the CapEdge modules and recommend where to start. Finance, communications, research, or journalism backgrounds all translate well.

- For CFOs and Company Secretaries

The bottom line

IR is capacity constrained where it matters most. Expectations are high, teams are lean, and markets in the Gulf are hiring. India has scale, the UK has process discipline, and Qatar wants consistent standards. The fastest way to close the gap is to train inside a capital-markets environment and then step into a seat with supervision. That is the CapEdge model. It is practical, fast, and built for the work you actually need to deliver.

If you are a CFO building a team, CapEdge shortens your ramp and reduces your supervisory load. If you are a finance or communications professional ready to enter IR, CapEdge gives you a portfolio, a mentor, and a seat at the table.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK in Accountancy & Finance, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

The IR talent crunch is real

To download and save this article.

Authored by:

Manoj Saha

Managing Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment