The 5 Most Neglected Areas Impacting Governance Scores:

A Call to Action for CFOs

As Chief Financial Officers (CFOs)—the custodians of financial integrity and strategic foresight—it is imperative to recognize and address the governance gaps that erode stakeholder trust and diminish investor appeal. This article delves into the five most neglected areas in corporate governance contributing to poor ESG ratings, explores the significance of rectifying these shortcomings, and offers actionable insights on how CFOs can spearhead improvements with the support of ESG and Investor Relations (IR) specialists.

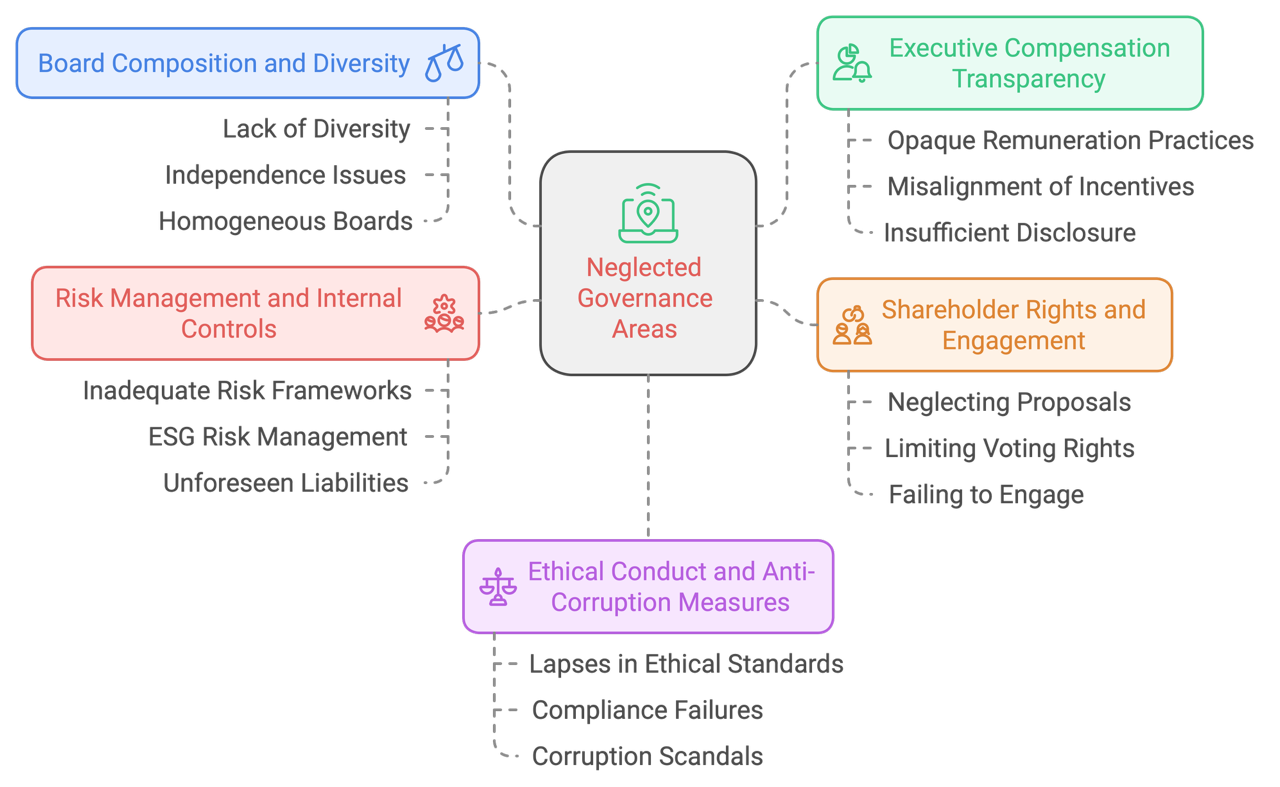

The Five Most Neglected Areas Impacting Governance Scores

-

Board Composition and Diversity

A homogeneous board lacking diversity and independence signals significant governance weaknesses. Such boards may not possess the breadth of perspective necessary for robust decision-making. Rating agencies penalize companies whose boards do not reflect a balance of skills, experience, gender, and independence, negatively impacting governance scores.

Real-World Example: Consider the case of Company X, which faced investor backlash and a downgraded ESG rating due to a board comprised entirely of longstanding members from similar backgrounds. The lack of fresh perspectives hindered innovation and strategic adaptability.

-

Executive Compensation Transparency

Opaque remuneration practices for executives raise concerns about misalignment between management incentives and shareholder interests. Insufficient disclosure on how compensation aligns with performance metrics can lead to lower governance scores. Transparency in executive compensation is crucial for demonstrating accountability and aligning interests.

Real-World Example: When Company Y failed to disclose the performance criteria for executive bonuses, shareholders questioned whether the leadership was incentivized to prioritize short-term gains over long-term sustainability.

-

Shareholder Rights and Engagement

Neglecting shareholder proposals, limiting voting rights, or failing to engage meaningfully with investors undermines corporate democracy. Weak shareholder relations are viewed unfavorably by rating agencies, affecting governance assessments and potentially diminishing the company’s appeal to investors who prioritize strong governance practices.

Real-World Example: Company Z faced a shareholder revolt when it attempted to implement a dual-class share structure without adequate consultation, leading to a drop in its governance rating and share price.

-

Risk Management and Internal Controls

Inadequate frameworks for identifying and managing risks, including those related to ESG factors, can expose a company to unforeseen liabilities. Rating agencies assess the robustness of risk management systems, and deficiencies can result in lower scores, signalling to investors that the company may not be adequately prepared to handle potential risks.

Real-World Example: The fallout from a significant data breach at Company A highlighted weaknesses in its risk management practices, resulting in financial losses and a damaged reputation.

-

Ethical Conduct and Anti-Corruption Measures

Lapses in ethical standards, compliance failures, or corruption scandals can have severe reputational and financial repercussions. A lack of strong ethical policies and compliance programs is a red flag for rating agencies evaluating governance, leading to diminished trust from stakeholders and lower governance scores that adversely affect the company’s overall ESG rating.

Real-World Example: Company B’s involvement in a corruption scandal led to legal penalties and a sharp decline in investor confidence, underscoring the critical importance of ethical conduct.

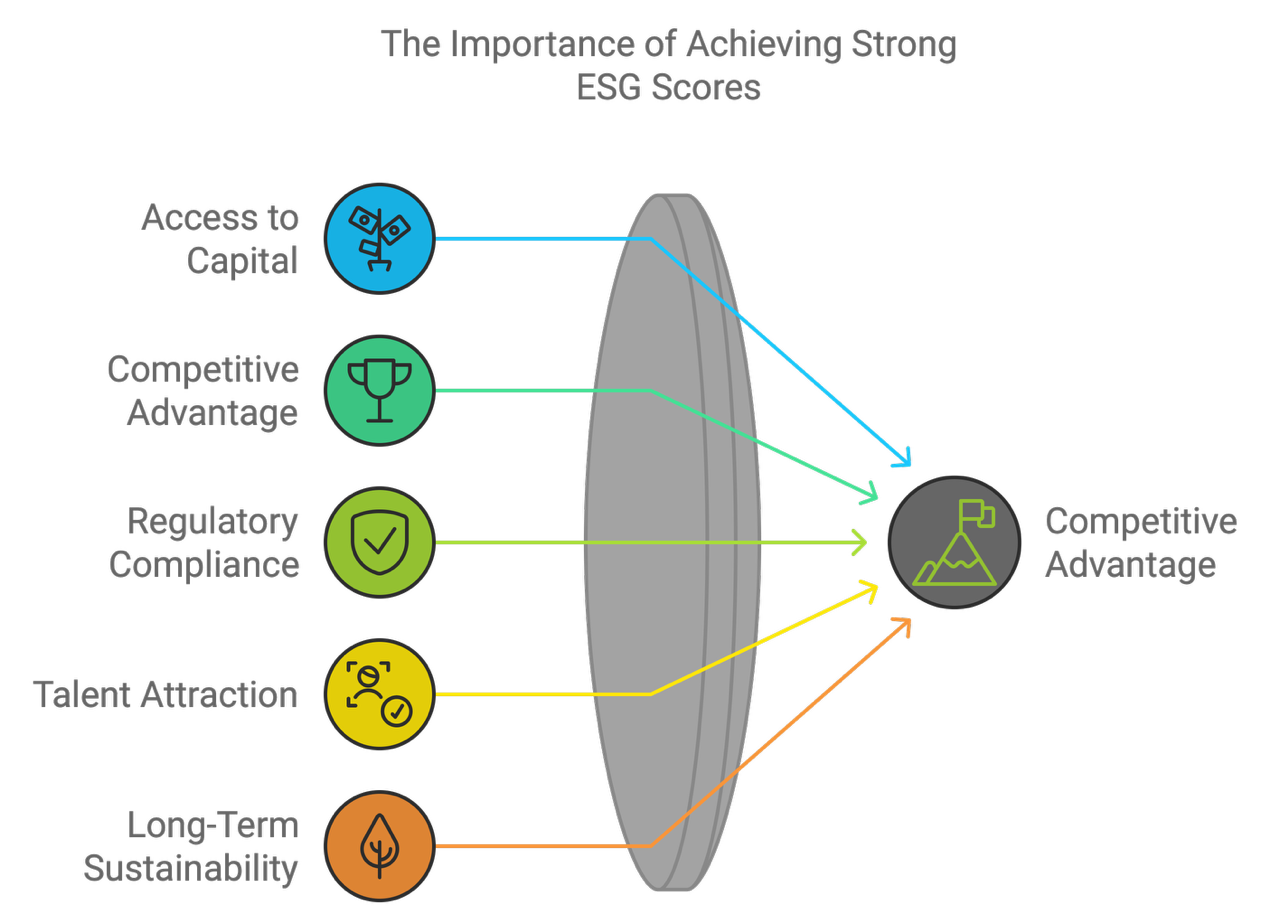

The Importance of Achieving Strong ESG Scores

The significance of strong ESG scores is amplified by the sheer scale of capital allocated towards sustainable investments. According to recent estimates, global sustainable investment assets have surpassed $35 trillion, reflecting the immense financial power directed towards ESG-focused companies. This represents a substantial portion of the global investable market, indicating a paradigm shift in investment priorities.

Access to Capital

Investors are actively seeking companies that demonstrate robust ESG performance, viewing them as proxies for long-term sustainability and resilience. For CFOs, excelling in governance is not just about compliance or ethics—it’s a strategic imperative to attract and retain investment from this rapidly growing pool of capital dedicated to sustainable and responsible investing.

Competitive Advantage

Companies with high ESG ratings enjoy a competitive edge:

- Attracting Investors: They become preferred choices for institutional investors, pension funds, and asset managers focused on sustainability.

- Brand Enhancement: Strong ESG performance enhances brand reputation, fostering customer loyalty and differentiating the company in the marketplace.

- Operational Efficiency: ESG-focused companies often benefit from improved operational efficiencies, better risk management, and increased innovation.

Regulatory and Compliance Benefits

High ESG scores position companies favorably amid evolving regulations:

- Regulatory Compliance: Proactive ESG practices ensure adherence to current and anticipated regulations, reducing the risk of legal penalties.

- Government Incentives: Companies may qualify for government incentives, grants, or favorable treatment in public procurement processes.

Talent Attraction and Retention

Employees increasingly prefer to work for companies that align with their values:

- Employee Engagement: Strong ESG practices boost employee morale and engagement.

- Attracting Top Talent: Companies known for sustainability and ethical practices are more attractive to prospective employees.

Long-Term Sustainability and Risk Mitigation

High ESG scores correlate with long-term business sustainability:

- Risk Reduction: Effective governance reduces the likelihood of scandals, fraud, and operational disruptions.

- Resilience: ESG-focused companies are better equipped to navigate environmental and social challenges.

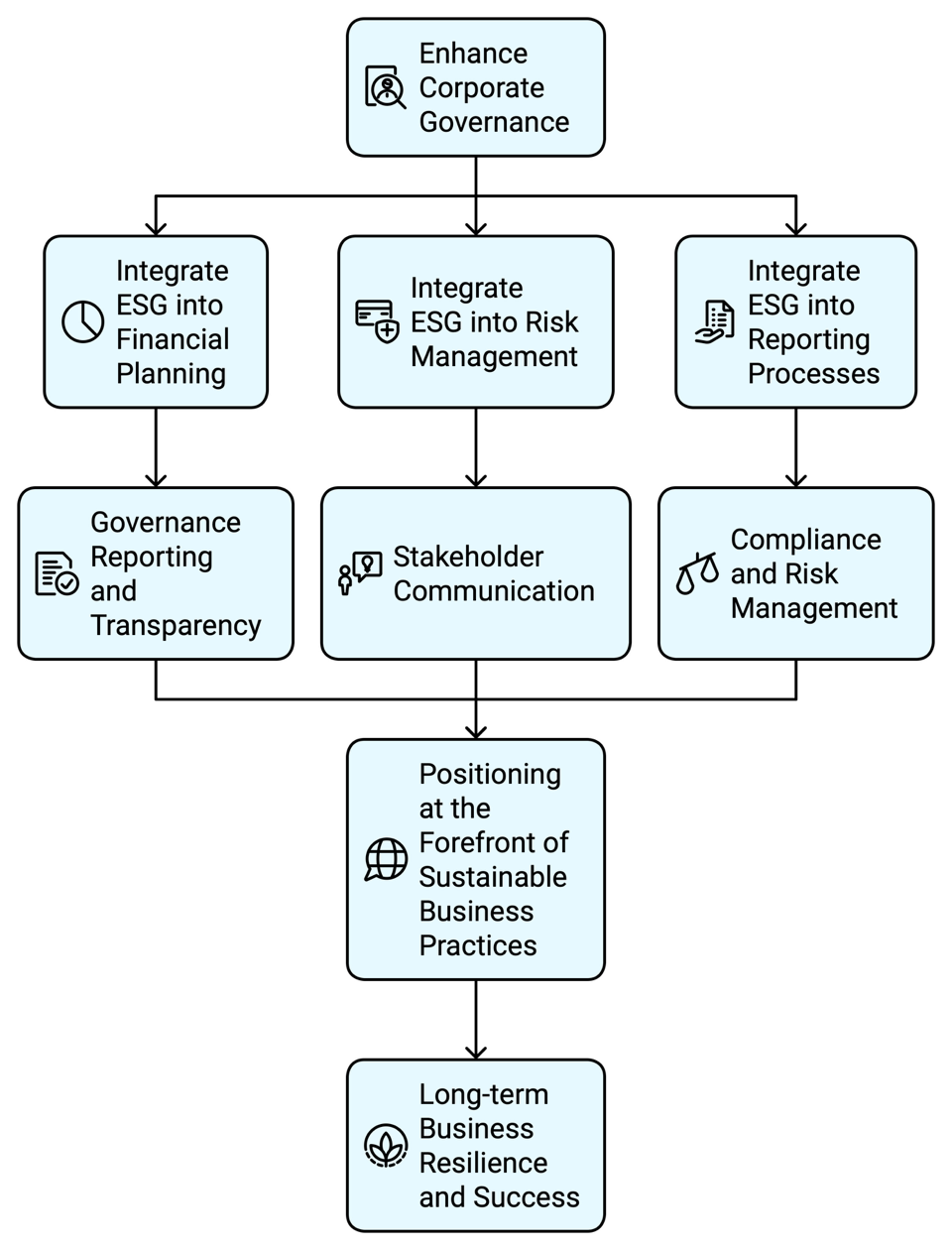

The Imperative for CFOs

For CFOs, this reality underscores the urgency of addressing gaps in corporate governance. Enhancing governance practices is not merely a compliance exercise but a strategic initiative that can unlock significant value. CFOs are uniquely positioned to drive governance improvements by integrating ESG considerations into financial planning, risk management, and reporting processes.

Practical Strategies for CFOs

-

Advocate for Board Diversity: Encourage the appointment of directors with diverse backgrounds and expertise to enhance decision-making.

-

Enhance Transparency: Lead efforts to improve disclosure practices, ensuring stakeholders have clear insights into governance structures and policies.

-

Align Incentives: Restructure executive compensation to align with long-term performance metrics, including ESG targets.

-

Engage with Shareholders: Foster open communication channels with investors to address concerns and incorporate feedback into governance practices.

-

Strengthen Risk Management: Implement robust risk assessment frameworks that include ESG factors to mitigate potential liabilities.

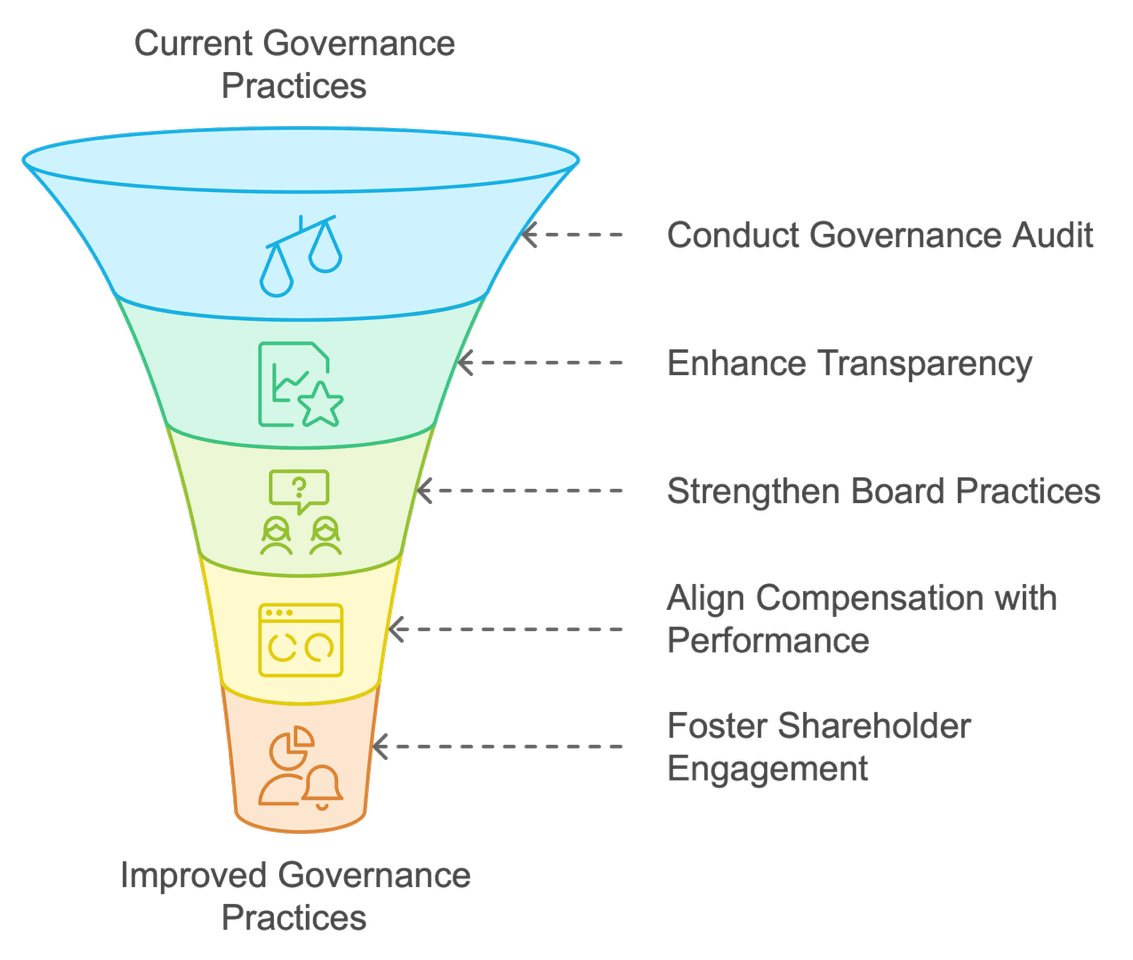

Actionable Steps for CFOs

-

Conduct a Governance Audit

Evaluate current governance structures, policies, and practices against industry benchmarks and regulatory requirements. Identify gaps and areas for improvement, setting the stage for strategic enhancements.

-

Enhance Transparency and Disclosure

Provide detailed disclosures on board composition, executive compensation, risk management, and ethical policies. Utilize annual reports and sustainability disclosures to communicate governance practices effectively.

-

Strengthen Board Practices

Promote diversity in the boardroom—including gender, ethnicity, experience, and expertise—and ensure a sufficient number of independent directors to provide unbiased oversight.

-

Align Executive Compensation with Performance

Tie compensation to clear performance indicators, including ESG targets. Be transparent about remuneration policies and how they drive company objectives.

-

Foster Shareholder Engagement

Establish regular communication channels with shareholders to address their concerns and incorporate their feedback. Uphold and protect shareholder rights, facilitating active participation in corporate governance.

Leveraging Expertise from ESG and IR Specialists

How ESG and IR Consultants Can Help

CFOs need not navigate these complex challenges alone. Partnering with seasoned ESG and IR professionals can provide invaluable support.

- Governance Reporting Enhancement: Specialists help craft comprehensive and compelling governance disclosures that meet and exceed the expectations of rating agencies, offering tailored reporting reflecting the company’s unique context and strengths.

Strategic Communication Development

- Messaging: Formulate clear and consistent messages about governance practices to resonate with diverse stakeholders.

- Multichannel Approach: Utilize various platforms—including investor presentations, press releases, and social media—to disseminate governance information effectively.

Crisis Management Support

- Preparedness: Develop contingency plans and communication strategies to address potential governance-related crises.

- Response: Provide guidance on swift and effective actions to maintain trust and credibility during challenging times.

Training and Workshops

- Education: Offer training sessions for board members and executives on the latest governance trends, regulations, and stakeholder expectations.

- Capacity Building: Empower leadership with the knowledge and tools to implement best-in-class governance practices.

In Closing

In a world where corporate accountability is under the microscope, overlooking governance is a perilous misstep. CFOs, with their comprehensive view of the company’s financial and strategic horizons, are uniquely positioned to champion governance excellence. By addressing the neglected areas that contribute to poor ESG ratings, CFOs can enhance their company’s reputation, attract investment, and ensure sustainable success.

The path to improved governance is a strategic journey that requires deliberate action and expertise. By implementing the actionable steps outlined and leveraging the support of ESG and IR specialists, companies can position themselves at the forefront of sustainable and responsible business practices. Strong governance not only enhances ESG performance but also contributes to long-term business resilience and success.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

enquiry@dickensonworld.com.

The 5 Most Neglected Areas Impacting Governance Scores

To download and save this article.

Authored by:

Manoj Saha

Managing Director

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment