Should Indian Companies Proceed with

Their IPOs Amidst Market Volatility?

Over the past two quarters, the Indian economy has witnessed challenges such as inflationary pressures, RBI interest rate hikes, and global market volatility due to geopolitical tensions. These factors have influenced investor sentiment and made it harder to predict IPO outcomes. In this environment, investment bankers continue to play a crucial role in managing the financial structuring and the technical aspects of an IPO. However, the added layer of strategic communication, investor confidence-building, and positioning offered by an Investor Relations firm is invaluable in ensuring that the IPO not only meets its financial goals but also withstands external pressures.

How Pre-IPO Communication Solutions Complement Investment Bankers in the Current Scenario

Building a Robust Investment Narrative to Supplement the Banker’s Financial Structuring

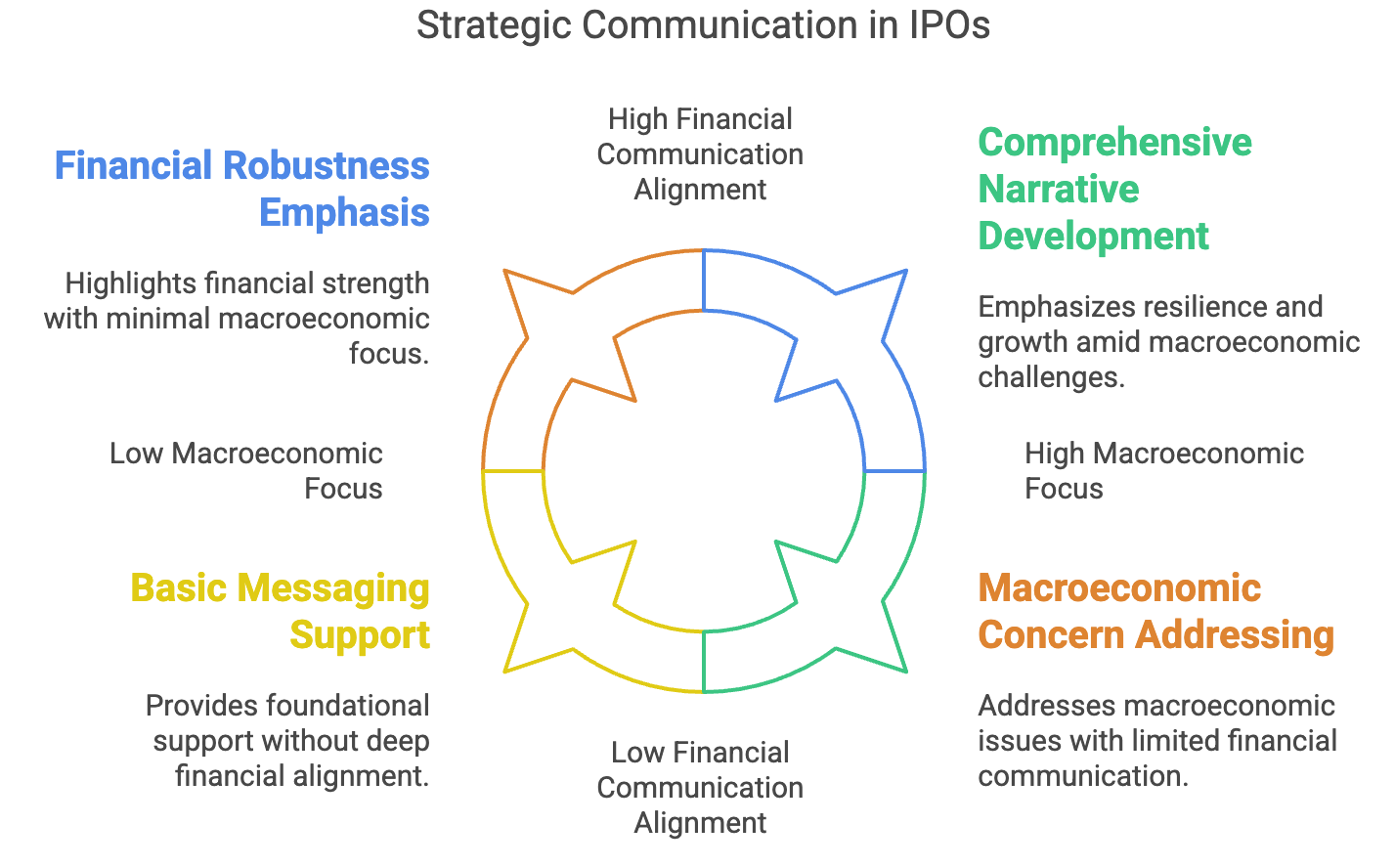

Investment bankers are experts at determining the optimal IPO structure, setting price ranges, and handling investor book-building. However, their focus is primarily on the financial and technical sides of the offering. A pre-IPO communication solution, driven by an IR firm, complements this by crafting a clear and compelling investment narrative that highlights the company’s value proposition in uncertain times.

Specifically, an IR firm:

- Develops a narrative that addresses macroeconomic concerns, such as inflation and interest rate hikes, while emphasizing the company’s resilience, growth potential, and strategic initiatives that align with India’s long-term economic growth.

- Helps shape the messaging to demonstrate the company’s market differentiation and financial robustness, providing a consistent voice to institutional investors and analysts, in alignment with the financials presented by the investment banker.

- Supports the investment banker to ensure that the company’s financials and growth prospects are effectively communicated to potential investors, especially in a climate where market sentiment is highly sensitive to macroeconomic shifts.

Enhancing Investor Engagement and Confidence Ahead of the IPO

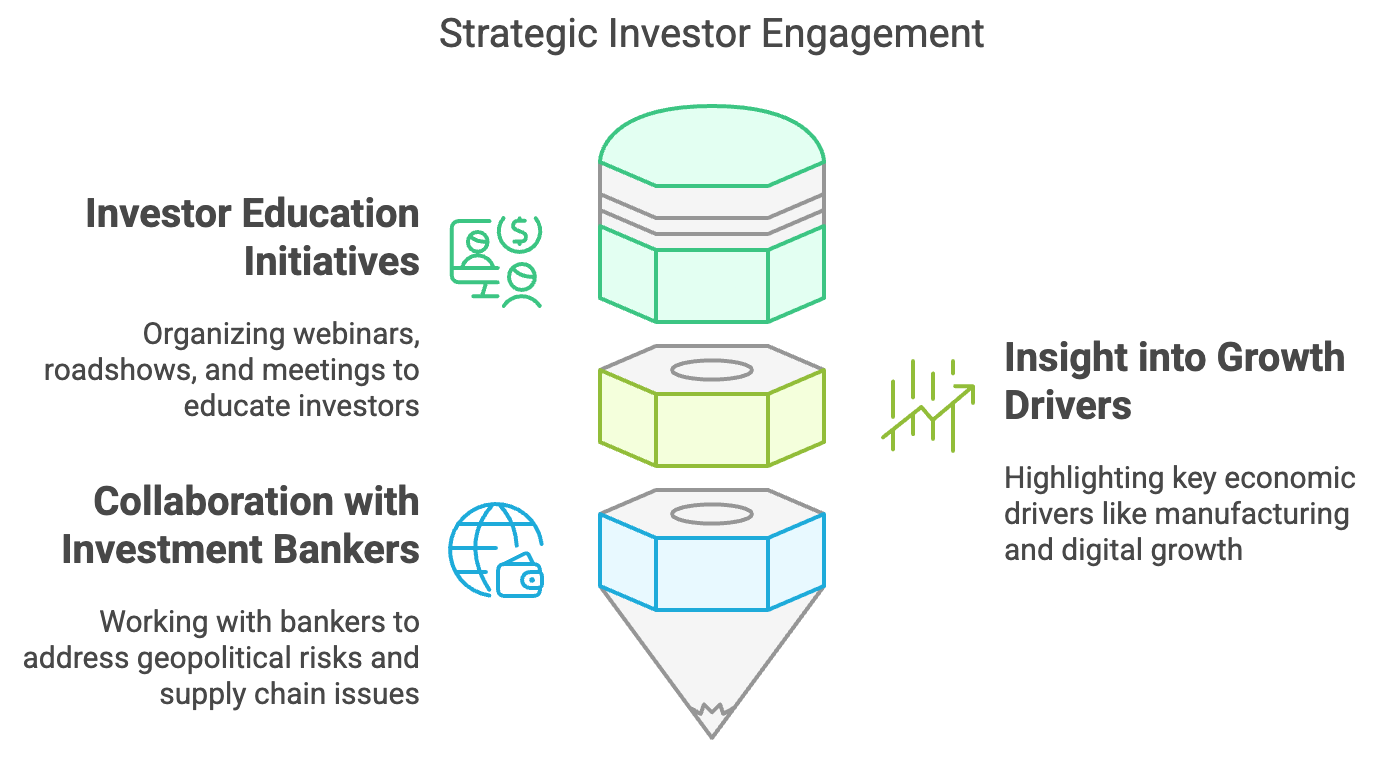

While investment bankers are focused on structuring deals and coordinating with institutional investors, an IR firm’s role is to engage these investors proactively and build long-term relationships. In a volatile market, where investor sentiment can shift quickly, early engagement is key to solidifying demand. An IR firm like Dickenson complements this process by:

- Organizing targeted investor education initiatives, including webinars, roadshows, and one-on-one meetings, to ensure that investors fully understand the company’s growth story, especially in light of global political uncertainties or domestic economic conditions.

- Offering insight into India’s current growth drivers—such as the government’s push for manufacturing through PLI schemes or the booming digital economy—that may not be immediately apparent in the financials alone.

- Working closely with the investment banker to ensure that institutional investors are not only attracted by the company’s financial performance but also by its ability to weather global uncertainties, such as geopolitical risks or supply chain disruptions.

Aligning Analyst Engagement with Financial Projections

Investment bankers frequently handle the relationship with analysts and ensure that earnings projections are accurate, but managing how the company is perceived by analysts and the broader market is another critical piece of the puzzle.

An IR firm:

- Collaborates with analysts early on, helping to shape their understanding of the company’s positioning and long-term growth strategy, while ensuring that financial forecasts are aligned with realistic market expectations, especially given the external pressures from inflation and geopolitical tensions.

- Provides strategic communication to analysts, ensuring that their views on the company’s valuation align with the narrative being built by both the investment banker and the IR firm.

- Preemptively addresses any concerns that could lead to misperceptions or volatility in analyst opinions, ensuring that their reports reflect an accurate and cohesive picture of the company’s prospects.

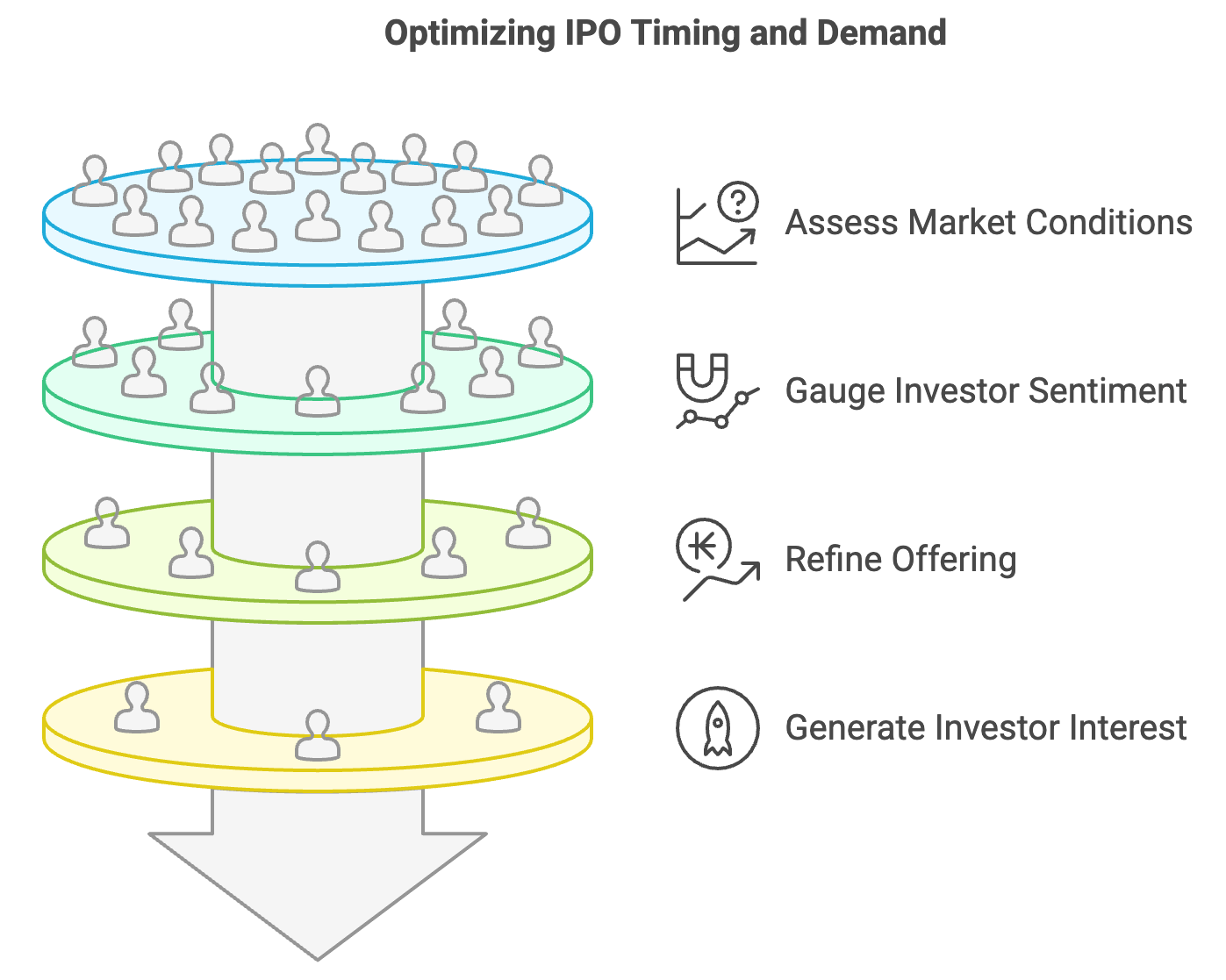

Optimizing IPO Timing and Demand Generation

Investment bankers will often monitor market conditions and advise on the right timing for an IPO launch. However, an IR firm enhances this process by ensuring that the timing aligns with investor sentiment and strategic positioning.

An IR firm:

- Works with investment bankers to assess current market conditions, investor sentiment, and geopolitical developments, advising on the most opportune moment for a launch, especially considering recent market movements driven by global events.

- Conducts pre-IPO investor feedback sessions to gauge investor appetite, allowing both the IR firm and investment banker to refine the company’s offering and ensure strong demand at the time of launch.

- Coordinates with the investment banker’s media and outreach efforts, generating investor interest even in a market where global events may otherwise create uncertainty, ensuring that the company’s story remains compelling in the lead-up to the IPO.

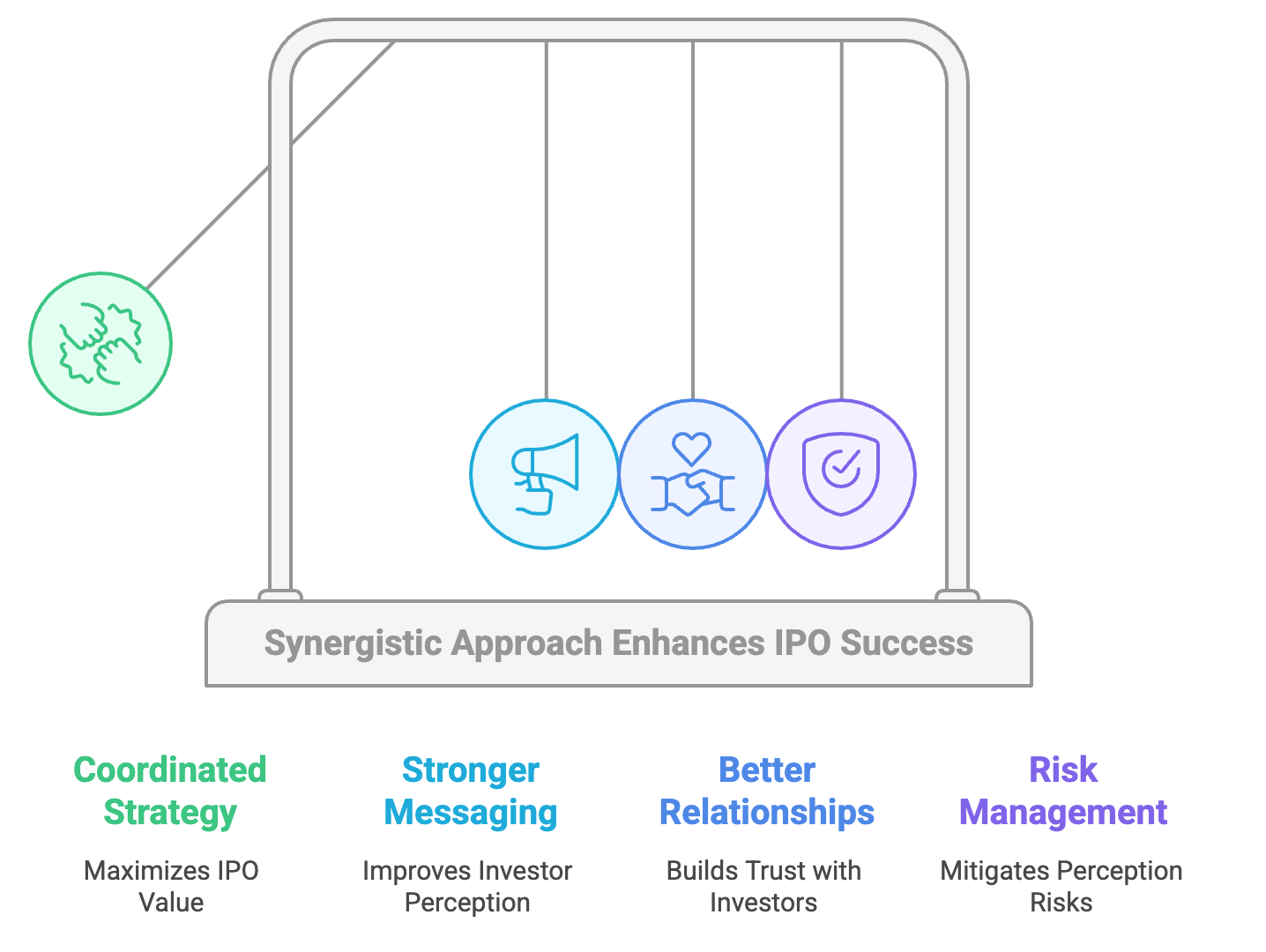

A Synergistic Approach to IPO Success in Volatile Markets

As India faces a mix of economic and geopolitical challenges, the path to a successful IPO requires a coordinated approach.

While investment bankers focus on structuring the deal and securing investor commitments, an experienced IR firm like Dickenson complements these efforts by refining the company’s messaging, building investor relationships, and managing perception risks. Together, they ensure that the company is well-positioned to launch its IPO in a manner that maximizes value while navigating the current volatility.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Shankhini Saha, the Director of Investor Relations at Dickenson, holds an MPhil with distinction from the University of Cambridge, UK, and a BA magna cum laude from The New School, USA. Specializing in stakeholder engagement across diverse sectors, Shankhini is dedicated to transparent communication and providing strategic insights into clients’ financial performance and growth initiatives. With a proven track record of managing complex investor relations for a diverse portfolio of global clients, she excels in crafting impactful narratives that resonate with investors, analysts, and stakeholders. Shankhini’s leadership in high-profile quarterly results hosting and comprehensive IR campaigns showcases her commitment to creating lasting value for issuers in the global capital market.

Should Indian Companies Proceed with Their IPOs Amidst Market Volatility?

To download and save this article.

Authored by:

Shankhini Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment