Opinion :

Strangling Innovation? SEBI’s Rules Could Hurt Early-Stage SMEs

The Securities and Exchange Board of India (SEBI) recently unveiled a set of stricter norms governing the listing of Small and Medium Enterprises (SMEs). These measures, aimed at enhancing transparency and protecting investors, have been positioned as a step toward improving the credibility of India’s capital markets. However, by prioritising profitability and compliance above growth potential, these reforms risk stifling the very dynamism that SMEs bring to the economy. As the backbone of India’s economic framework, SMEs are too critical to be constrained by rules that may inadvertently exclude high-potential, early-stage businesses from accessing much-needed public capital.

SEBI’s Stricter Norms: What Has Changed?

SEBI’s updated regulations are intended to mitigate risks associated with SME listings. The key changes include:

-

Profitability Requirements: Companies must demonstrate a minimum operating profit of ₹3 crore in at least two of the last three financial years.

-

Minimum IPO Size: Public offerings must now raise a minimum of ₹10 crore to qualify for listing.

-

Stronger Corporate Governance: SMEs are required to disclose related-party transactions in greater detail and update quarterly shareholding patterns.

-

Cap on Shareholder Divestment: Existing shareholders are restricted to selling no more than 20% of the total issue size during the IPO.

-

Mandatory Fund Monitoring: Independent monitoring is now required for IPO proceeds ranging between ₹20 crore and ₹50 crore.

The intent behind these measures is clear: safeguard investors by filtering out speculative players and enforcing robust governance practices. Yet their execution, as this opinion piece explores, risks creating unintended consequences that could undermine India’s SME ecosystem.

SMEs: Engines of Growth and Innovation

SMEs contribute nearly a third of India’s GDP and generate employment for over 203.9 million people, according to the Press Information Bureau. Beyond these figures, SMEs are drivers of regional development, fostering growth in underserved areas and providing employment where large corporations often do not venture. They account for approximately 45% of India’s exports, underscoring their importance in strengthening the nation’s global trade footprint. Most importantly, SMEs serve as incubators of innovation. They disrupt markets with new products, services, and processes, ensuring competition remains vibrant. By imposing strict profitability thresholds and higher IPO requirements, SEBI risks sidelining early-stage companies that prioritise innovation and growth over short-term profits. These are the enterprises that often catalyse breakthroughs, creating ripple effects across entire industries. For instance, the rise of technology startups has spurred the growth of ancillary sectors like cloud computing, logistics, and skill development. Nobel laureate Paul Romer’s endogenous growth theory emphasises how innovation generates spillover benefits across economies. Restricting SMEs’ access to public markets could disrupt this virtuous cycle, narrowing the flow of capital to high-potential sectors and stifling the ecosystems they build.

The Risks of Overregulation

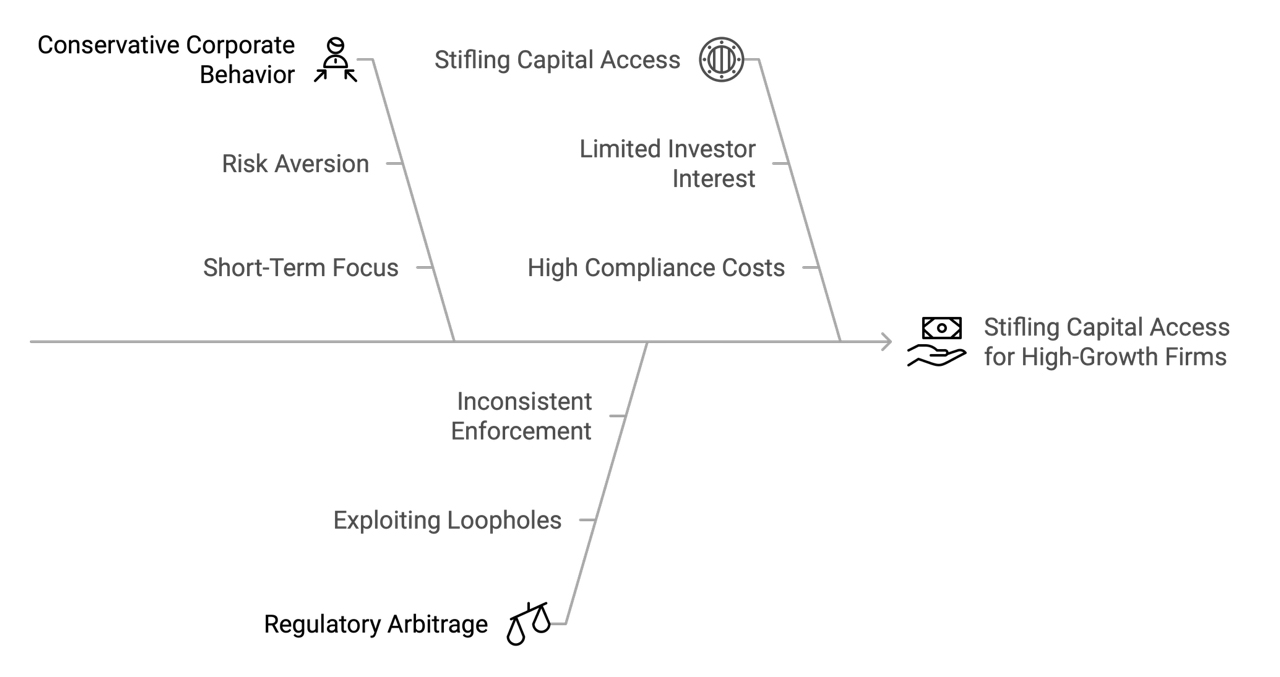

Stifling Capital Access for High-Growth Firms

The profitability requirement may exclude early-stage, high-growth SMEs in sectors such as technology and renewable energy, where upfront investments often precede profitability by several years. Public markets offer these companies a crucial lifeline for raising equity without the dilution of control inherent in venture capital funding. Denying them access to public markets risks slowing their growth trajectories and limiting the diversity of firms entering India’s capital markets.

Conservative Corporate Behaviour

The stricter norms are likely to shift SME boards toward risk aversion. Faced with higher barriers, leadership may prioritise regulatory compliance over bold, transformative strategies. This conservatism could dilute the entrepreneurial ethos that drives innovation and slows the pace of breakthroughs, particularly in industries where experimentation is key to growth.

Regulatory Arbitrage

Stricter rules may push SMEs toward less regulated funding avenues, such as private equity or offshore listings. While these alternatives provide access to capital, they lack the transparency and democratisation of wealth that public markets enable. Moreover, the migration of high-potential SMEs to foreign exchanges could erode India’s market depth and reduce opportunities for domestic investors.

Balancing Investor Protection and Growth

SEBI’s intentions are laudable, but its approach must reflect the nuanced realities of India’s SME ecosystem. Striking a balance between investor protection and fostering innovation requires recalibrating the current framework.

-

Tiered Regulation: Different norms could apply to early-stage, mid-sized, and mature SMEs, allowing companies to scale while meeting progressively stricter requirements. For instance, high-growth startups could focus on innovation metrics like intellectual property creation or market share expansion instead of profitability.

-

Governance Incentives: SEBI could reward SMEs that adopt best-in-class governance practices by offering faster approval processes or reduced compliance costs, fostering a culture of voluntary adherence over mandatory compliance.

-

Market Makers: Introducing market makers dedicated to SME stocks could reduce volatility and improve liquidity, addressing concerns about speculative trading.

-

Global Comparisons: India could draw lessons from countries like the United States, where the Small-Cap IPO market balances governance rigour with flexibility, ensuring that innovation thrives without compromising investor trust.

A Vision for the Path Ahead

If left unchecked, SEBI’s increasingly restrictive norms risk reshaping India’s SME ecosystem into a bifurcated structure. Larger, established firms with robust financial histories may monopolise public listings, while smaller, high-potential enterprises—often at the forefront of innovation— gravitate toward private funding. Such a shift would undermine the diversity and vibrancy of India’s SME platform, reducing its role as a driver of innovation, regional development, and employment growth.

While protecting investors from unscrupulous promoters is a legitimate concern, overregulation may do more harm than good. The occasional misuse of public capital is a short-term cost that must be borne to ensure the long-term rewards of nurturing successful, innovative businesses. Instead of raising entry barriers indiscriminately, SEBI could channel its efforts into educating investors to better discern between credible enterprises and speculative ventures. A more informed investor base is a far more sustainable deterrent to malpractice than regulatory rigidity.

India’s SME story has not yet been written. By collaborating with stakeholders to refine its norms, SEBI has the opportunity to create a framework that encourages innovation and entrepreneurial ambition. Failing to strike this balance could suppress the very dynamism that fuels economic growth. Thoughtful adjustments, however, could ensure that India’s SME platform evolves into a launchpad for the next generation of global disruptors, keeping the nation’s economic future as vibrant and innovative as its entrepreneurs.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK in Accountancy & Finance, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

Opinion: Strangling Innovation?

To download and save this article.

Authored by:

Manoj Saha

Managing Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment