Navigating the UAE’s New Tax Baseline:

How the IRO Must Lead the Enhanced Disclosure Narrative

The financial landscape of the United Arab Emirates (UAE) is undergoing a significant maturation, marked by the definitive establishment of corporate tax as a norm rather than a novelty. This regulatory shift is monumental, evidenced by over 640,000 businesses registered and a record volume of tax returns filed, with the UAE Federal Tax Authority (FTA) noting sharp rises in compliance levels. This environment requires immediate and enhanced action from Investor Relations Officers (IROs), who need to translate complex accounting and governance requirements into a straightforward, trustworthy narrative for the global investment community.

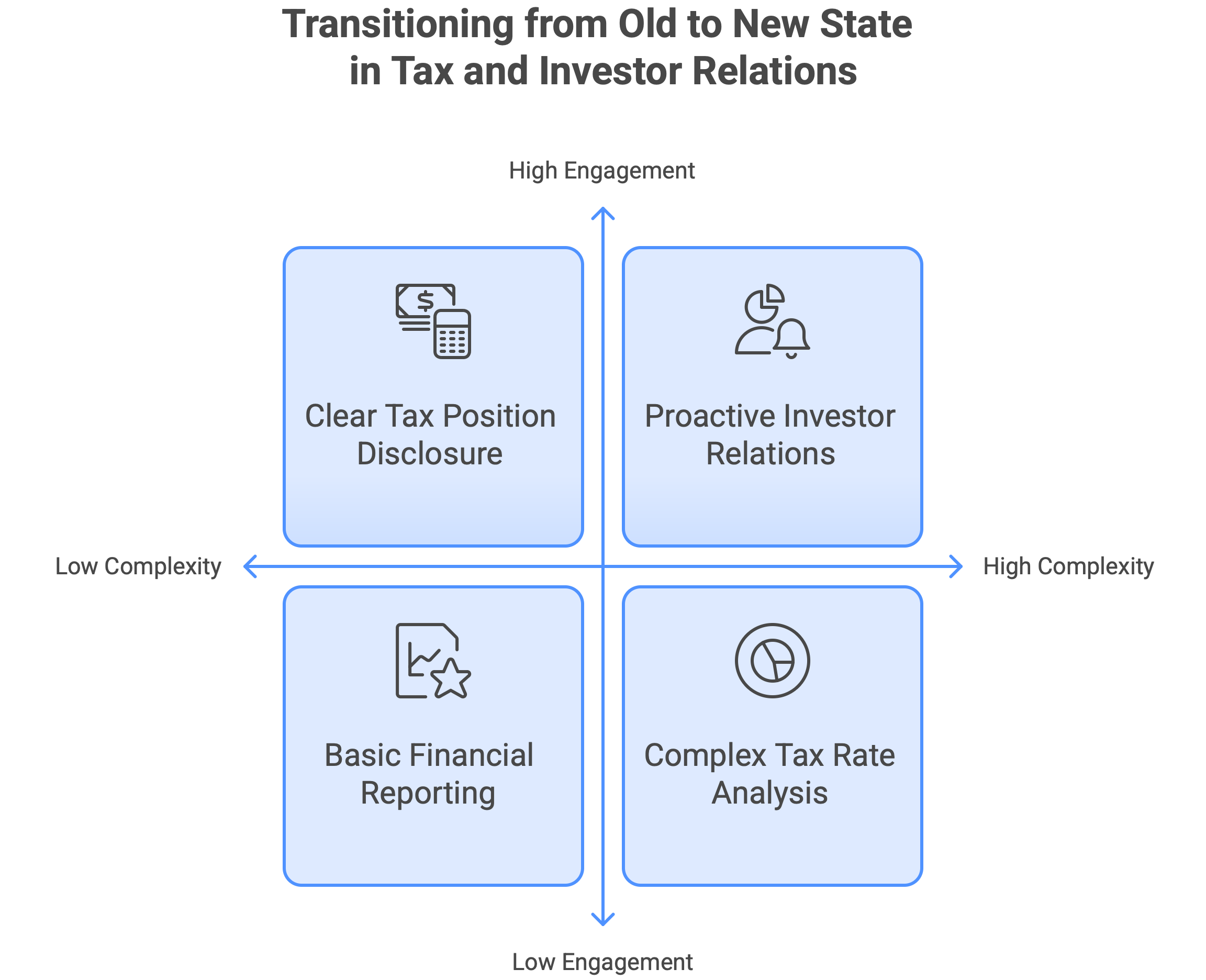

The Seismic Shift: From Novelty to Normalised Comparability

The most significant immediate implication for corporate reporting is the transition to more robust comparability of effective tax rates (ETRs) across peers in Annual Reports. Investors and analysts will no longer dismiss tax expense as a one-off item; instead, it becomes a crucial metric for evaluating financial health and efficiency. This mandates enhanced transparency that goes beyond mere numbers. Companies must provide a clear articulation of two core areas: tax governance and board oversight, as well as the management of uncertain tax positions (UTP) under IAS 12.

The Technical Tightrope: Mastering IAS 12 Disclosures

The implementation of corporate tax requires a thorough examination of IFRS, specifically IAS 12 (Income Taxes). This standard requires companies to account for the future tax consequences of assets and liabilities. The IRO must anticipate investor scrutiny on:

- First-time Recognition and Measurement of Deferred Taxes: Drafts of FY2025 reports must explain the approach to the initial recognition and measurement of deferred taxes (DTs) [Query, 175]. IAS 12 demands that deferred tax assets and liabilities be measured using the tax rates expected to apply when temporary differences reverse, based on enacted tax laws.

- Tax-Loss Carry Forward Assumptions : Any assumptions regarding the utilisation of tax-loss carry forwards must be clearly articulated.

- Uncertain Tax Positions (UTP) : Dealing with tax uncertainty is critical. This often involves complex areas, such as Transfer Pricing, where companies must substantiate that transactions with related or connected parties are at arm’s length value. While some disclosure thresholds exist (e.g., over AED 4 million for specific related party transaction categories like Goods or Services), all taxpayers must determine the arm’s length price of such transactions. The IRO needs to communicate that internal processes are robust enough to manage these complexities, as regulatory compliance around these issues is imperative.

This is not merely academic; these issues directly impact reported results. For companies that recognise a Deferred Tax Liability (DTL) provision, typically related to assets such as intangible assets or goodwill, the provision can significantly impact the reported Net Profit and Return on Equity (RoE). In such cases, the IRO plays a critical role in guiding investors to focus on the Normalised Net Profit, thereby enabling them to understand the underlying operational performance.

The IRO’s Mandate: Leading Transparency and Governance

The core response from the Investor Relations department should be anchored in maximising transparency, improving disclosure, and ensuring management accessibility.

1. Immediate Financial Reporting Updates

The IRO must ensure that FY2025 drafts are updated to cover the cash tax impacts on dividend capacity explicitly. Dividends are a key metric for investor decision-making, and transparency regarding cash flows is paramount.

2. Strengthening Governance and Board Oversight

The mandate is to add a sentence in the Governance section detailing the board’s oversight of tax risk and compliance processes. Governance and ESG (Environmental, Social, and Governance) issues are increasingly central to investment decisions. Poor governance information on a company’s website is viewed as weak disclosure. Investor interest in governance is high, with shareholder activism often focusing on governance structures and board representation. IROs at larger companies (mega-caps) especially note that governance and ESG-related challenges are often high priorities.

3. Proactive, Digital Engagement

The IRO must cite the FTA communication to provide necessary context for stakeholder interest in the tax changes. This proactive communication is highly valued by investors. The IR website is the critical starting point and an effective channel for this messaging, acting as the all-important first point of contact and a 24/7 presence to articulate the company story. A blog or a dedicated section allows for the posting of frequent industry and company updates.

“Corporate tax in the UAE is no longer a novelty. IROs must

now lead transparent, comparable, and governance-driven

disclosure narratives.”

IROs need to maximise this digital presence by adhering to best practices:

- Consistency is Key: Ensure absolute continuity in positioning and wording across all channels to avoid unintentional contradictions that muddle the intended narrative.

- Accessibility and Speed : Content should be easily found on the IR website, preferably within two clicks. Given that attention spans are short (decreasing to around 8 seconds online), content should utilise engaging elements, such as infographics or interactive charts, to increase engagement and retention.

- Leverage Technology : Digital communication is evolving quickly, and IROs need to integrate new technologies to engage shareholders. The site should feature a responsive design, allowing content to be optimally displayed across all mobile devices, as nearly 60% of searches are now conducted on mobile devices.

By clearly communicating the company’s strategy for navigating the new tax environment, explaining technical details such as the impact of IAS 12 using normalised metrics, and ensuring robust governance disclosure, the IRO transforms a compliance challenge into an opportunity to build trust and strengthen the corporate investment narrative.

Closing remarks

For the investment community, the effective handling of the UAE’s tax normalisation translates directly into trust and valuation. Investors consistently assign a premium to the share price for companies demonstrating superior Investor Relations, rooted in the comfort they gain from clear communication and the belief that corporate estimates are reliable. This mandatory increase in transparency, particularly around the “G” (governance) component of ESG, is critical, as shareholders demand assurance that management is effectively addressing long-term business drivers and risks. The Investor Relations Officer (IRO) is uniquely positioned to fill this communication void, moving from communicator to being counted among a public company’s most important executives. IROs should endeavour to act as experts who transforms technical numbers into a powerful narrative that fuels investor decision-making. By engaging directly, proactively addressing the material impact of regulatory shifts, and ensuring transparent, timely, and responsive disclosure, the IRO validates management credibility and reinforces the strategic outlook necessary for sustained value creation.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK in Accountancy & Finance, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

Navigating the UAE’s New Tax Baseline

To download and save this article.

Authored by:

Manoj Saha

Managing Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment