Navigating the ESG Landscape in FY25-26 :

8 Key Trends Issuers Must Track

As we exit CY2024 head into the next Fiscal Year, issuers face an ESG landscape that is shifting rapidly—marked by new regulations, evolving investor preferences, and heightened scrutiny over corporate sustainability efforts. In 2024, significant developments across environmental, social, and governance (ESG) sectors have created both challenges and opportunities for issuers. Understanding these shifts and adapting your strategy accordingly will be crucial for staying competitive, maintaining investor confidence, and meeting regulatory demands.

In this article, I explore 8 key ESG trends from 2024 that issuers must keep on their radar. By understanding these developments, issuers can stay ahead of the curve and effectively align their strategies with the expectations of both investors and regulators as we move into FY25-26.

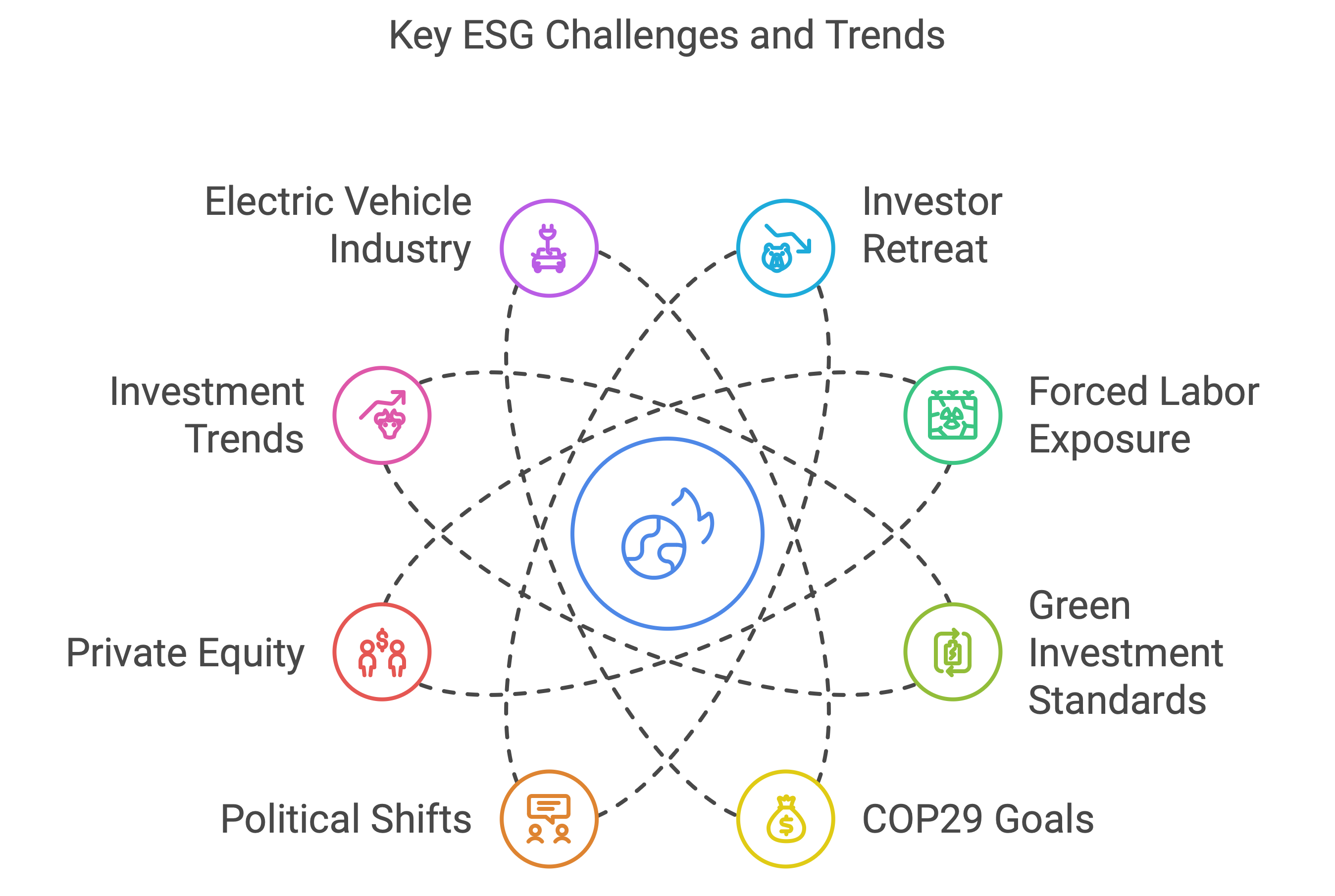

8 Key Trends Issuers Must Track

1. Investor Retreat from Sustainable Funds: Time for Transparent Results

One of the most important shifts in ESG investing in 2024 has been a notable retreat from sustainable funds, particularly in Europe. For the first time in a decade, investors have pulled out of ESG funds, with over $24 billion in outflows globally. The primary driver behind this is the perception that ESG funds have underperformed when compared to traditional investment funds, with many funds failing to deliver returns that justify their higher costs.

This trend has been exacerbated by stringent European regulations aimed at curbing greenwashing. Investors are becoming increasingly cautious, demanding clear, verifiable evidence of tangible results from ESG initiatives rather than promises of good intentions.

“The time has passed when ESG could be viewed as an add-on or a ‘nice-to-have.’ Today, it is a central aspect of corporate identity, influencing everything from capital allocation to brand reputation.”

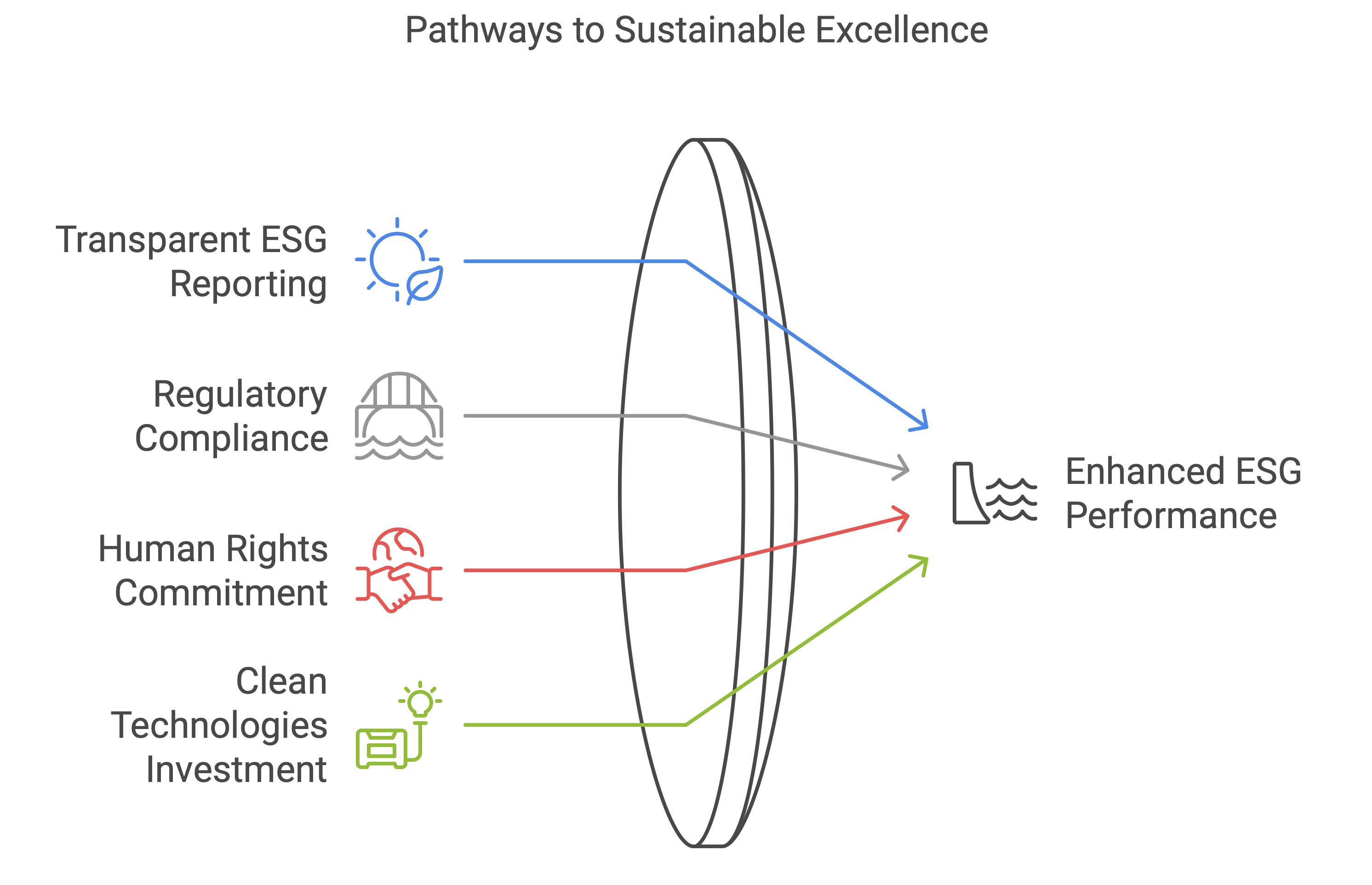

Key Takeaway for Issuers: Issuers must align their ESG claims with measurable financial and operational performance. To regain investor confidence, issuers should ensure transparency in ESG reporting and provide clear, data-driven results that demonstrate the direct impact of sustainability efforts on the bottom line. Companies that can successfully bridge the gap between ESG aspirations and real-world performance will be better positioned to attract capital moving forward.

2. Navigating Forced Labor Exposure: The Risk to Your ESG Reputation

In 2024, an unsettling discovery was made when it was revealed that numerous global ESG funds had invested over $1.4 billion in companies linked to forced labour practices, particularly in the Xinjiang region of China. This exposure spans across industries like electric vehicles (EVs) and solar energy—sectors widely considered to be environmentally “green” investments.

This case underscores the significant limitations in ESG screening processes and highlights the risks associated with insufficient due diligence. Investors and regulators alike are putting greater emphasis on ensuring that ESG claims are not only credible but also verifiable.

“In this evolving ESG landscape, the key to success lies in going beyond mere compliance. Companies must strive to exceed the expectations of investors, regulators, and consumers alike.”

Key Takeaway for Issuers: For issuers, this situation presents both a challenge and an opportunity. Companies with strong, transparent supply chains and proven commitments to human rights and ethical sourcing will stand out in a crowded ESG market. Issuers must ensure that their sourcing practices are ethically sound and that they can provide investors with verifiable evidence of compliance with human rights standards. This will not only protect reputation but also enhance long-term investor relations.

3. Green Investment Standards: Staying Ahead of Regulatory Changes

Regulatory developments around ESG are intensifying, particularly in Europe. The European Securities and Markets Authority (ESMA) proposed new regulations to prevent ESG funds from investing in companies with significant pollution exposure, particularly those whose revenue comes from fossil fuels. These regulations aim to protect investors from misleading “green” investments.

However, in response to industry backlash, ESMA has allowed more flexibility: while equity funds must exclude high-emission companies, “green”-labelled funds can still invest in green bonds issued by companies with significant pollution exposure, provided these bonds meet specific criteria.

Key Takeaway for Issuers: Issuers must stay on top of evolving regulations, particularly those concerning green investments. Companies need to ensure their ESG practices comply with the latest regulations to avoid falling foul of greenwashing accusations. This means investing in clear, consistent reporting, particularly around emissions, carbon offsetting, and other environmental commitments. Issuers who can navigate regulatory changes successfully will stand out as credible and trustworthy in the eyes of investors.

4. COP29 and the New Collective Quantified Goal on Climate Finance

The COP29 climate conference in 2024 was a pivotal moment for global climate policy. One of its key outcomes was the approval of the New Collective Quantified Goal on Climate Finance, which sets the target for developed countries to increase climate finance flows to developing nations to $300 billion annually by 2035. This is part of a broader push to raise overall climate finance to $1.3 trillion per year.

This represents a significant opportunity for companies involved in climate solutions, renewable energy, and green technologies. By aligning their sustainability strategies with these international climate finance goals, issuers can tap into an expanding pool of capital aimed at addressing climate change.

Key Takeaway for Issuers: Issuers should align their sustainability strategies with global climate finance goals to attract the growing pool of capital designated for climate-related investments. Demonstrating an active role in advancing climate solutions, whether through renewable energy projects or other sustainable initiatives, will be crucial for companies seeking to access this funding.

5. Political Shifts and ESG in a Polarized World

In 2024, the political landscape has become more polarized, particularly in markets like the United States, where the election of President Trump raised concerns about the future of ESG regulations. Historically, his administration has been supportive of fossil fuel industries, and there is uncertainty about whether federal policies will continue to support ESG initiatives.

Nevertheless, ESG investors remain optimistic, especially in sectors such as renewable energy, electric vehicles, and clean technology. While political shifts may pose challenges, the global momentum towards green energy and sustainable solutions continues to grow.

“Navigating political shifts will require agility and the ability to pivot while maintaining a strong focus on long-term sustainability goals.”

Key Takeaway for Issuers: Issuers must prepare for political volatility and ensure their ESG strategies are flexible enough to adapt to changes in policy. Navigating political shifts will require agility and the ability to pivot while maintaining a strong focus on long-term sustainability goals. Companies that can continue to make progress on their ESG initiatives, regardless of political shifts, will earn the trust of investors who prioritize long-term value.

6. Private Equity and the Rising Cost of ESG Compliance

In 2024, private equity firms have faced increasing costs associated with implementing ESG practices. A survey by Bfinance revealed that 89% of asset managers acknowledge the rising costs of ESG compliance. Some firms have attempted to pass these costs onto investors, leading to tensions as investors question whether they should bear the added expense.

For issuers, the rise in compliance costs signals that ESG regulations are becoming more stringent and complex. Issuers must account for these costs in their ESG strategies and ensure that their practices are both effective and sustainable without imposing undue burdens on their investors.

Key Takeaway for Issuers: Issuers need to factor in the rising cost of ESG compliance when planning their sustainability strategies. This may involve investing in more efficient processes, adopting technology to streamline ESG reporting, or absorbing some of the costs internally. Transparent communication with investors about how these costs are being managed will also be important to maintain trust.

7. ESG Investment Trends and Market Dynamics

Despite challenges, ESG investments continue to attract substantial capital. For example, sustainable funds in Europe saw net inflows of over $10 billion in the third quarter of 2024, reflecting robust demand. However, there are contrasting trends in the U.S. market, where concerns about greenwashing and underperformance have led to some investors pulling back.

Issuers must be aware of these market dynamics, as ESG investments are increasingly tied to performance. Investors want assurance that their capital is being used effectively and that companies are genuinely driving sustainable change.

Key Takeaway for Issuers: To attract and retain ESG investments, issuers must demonstrate tangible results. This means aligning performance metrics with sustainability claims and ensuring transparency in ESG reporting. Companies that can prove they are making a measurable impact on environmental and social outcomes will stand out in an increasingly crowded market.

8. The Electric Vehicle (EV) Industry and ESG Commitments

The electric vehicle (EV) industry, while crucial to reducing global emissions, was notably absent from many of the discussions at COP29. The transportation sector is responsible for 15% of global energy-related emissions, and significant investment is needed to accelerate the transition to clean energy in this space.

This lack of focus on EVs at COP29 highlights the need for further decarbonization efforts in the transport sector. Issuers involved in the EV industry or with significant emissions from transportation must be prepared to demonstrate how they are contributing to this transition.

“Issuers in the EV space or with significant transportation emissions must be prepared for greater scrutiny, with clear, transparent communication about how their efforts contribute to reducing transportation emissions.”

Key Takeaway for Issuers: Issuers in the EV space or with significant transportation emissions must be prepared for greater scrutiny. Clear, transparent communication about how their efforts contribute to reducing transportation emissions will be critical to maintaining investor and regulatory confidence.

Conclusion: Adapting to the New ESG Normal

As we approach FY25-26, it is evident that Environmental, Social, and Governance (ESG) considerations have evolved from a peripheral concern to the very heart of corporate strategy and investor relations. The world of business is no longer defined solely by financial performance; instead, it is increasingly judged by how companies perform on sustainability, ethics, and long-term value creation.

The time has passed when ESG could be viewed as an add-on or a “nice-to-have.” Today, it is a central aspect of corporate identity, influencing everything from capital allocation to brand reputation. As the market becomes more sophisticated and investors demand greater accountability, companies must demonstrate that their ESG efforts are not only credible but measurable and impactful. Issuers who embrace this new reality, by delivering transparent, verifiable ESG performance and adapting swiftly to regulatory shifts, will be better positioned to thrive in the years ahead.

In this evolving ESG landscape, the key to success lies in going beyond mere compliance. Companies must strive to exceed the expectations of investors, regulators, and consumers alike. Simply meeting the baseline of regulatory standards is no longer enough—companies must lead by example, demonstrating real progress and a genuine commitment to sustainability. Whether it’s reducing carbon footprints, improving supply chain transparency, or addressing social issues such as equity and diversity, those who embrace these changes will set the tone for the future of business.

“ESG is no longer optional. It is a business imperative. The companies that rise to the challenge, delivering both sustainable and profitable outcomes, will emerge as the true leaders of tomorrow.”

The growing focus on ESG is not just about managing risks; it is about seizing opportunities. Companies that align their strategies with global climate finance goals, for example, will be well-positioned to benefit from the expanding pool of capital aimed at addressing climate change. Likewise, those who integrate sustainability into their core business models are likely to find themselves ahead of the curve as markets increasingly reward innovation and resilience.

However, navigating this complex new environment is not without its challenges. Regulatory frameworks are still in flux, and there is an ever-present risk of greenwashing accusations as scrutiny over ESG claims intensifies. This means that issuers must be agile—ready to pivot when necessary and ensure that their ESG strategies remain aligned with evolving expectations.

By proactively addressing these trends and embracing the changes underway, issuers can safeguard their position in the market while leading the charge in shaping the future of sustainable investing. Those who can demonstrate real, measurable outcomes will not only secure their relevance in an increasingly competitive market but will also become the benchmarks by which others are judged.

As we move into FY25-26, the message is clear: ESG is no longer optional. It is a business imperative. The companies that rise to the challenge, delivering both sustainable and profitable outcomes, will emerge as the true leaders of tomorrow.

By proactively addressing these trends and embracing the changes underway, issuers can safeguard their position in the market while leading the charge in shaping the future of sustainable investing. Those who can demonstrate real, measurable outcomes will not only secure their relevance in an increasingly competitive market but will also become the benchmarks by which others are judged.

As we move into FY25-26, the message is clear: ESG is no longer optional. It is a business imperative. The companies that rise to the challenge, delivering both sustainable and profitable outcomes, will emerge as the true leaders of tomorrow.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Kinneri is an Economics Major graduate, with minors in Liberal Arts and Business Study from NY University (NYU). She joined Dickenson full-time in May 2016 as an Associate Consultant within the firm’s Investor Relations practice, and as an Editor for the Corporate Reporting practice. Since then, she has successfully developed strong skills in developing investor presentations, in Bloomberg/ Factset data mining, News Release preparation, IR Analytics, Investor Targeting reports and curating the content’s team work for the Corporate Reporting and Financial PR practices of Dickenson. In February 2017, she took up the responsibility of seeding the company’s UK presence and based herself permanently in London. As a Director of the company’s UK arm, she is currently responsible for developing the firm’s business in the North Atlantic markets.

Navigating the ESG Landscape in FY25-26

To download and save this article.

Authored by:

Kinneri Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment