Navigating the Convergence of ESG Reporting Standards

An overview for CFOs, IROs and CSs in the UK, India, and the MENA regions

The challenges don’t only exist in the UK. Indian and MENA-based companies with significant domestic or global operations are also feeling the pressure. They must meet these international standards while staying aligned with local regulations. India’s Business Responsibility and Sustainability Report (BRSR) and MENA’s growing ESG frameworks are examples. So, how do businesses, whether in London, Mumbai, or Dubai, tackle this complexity?

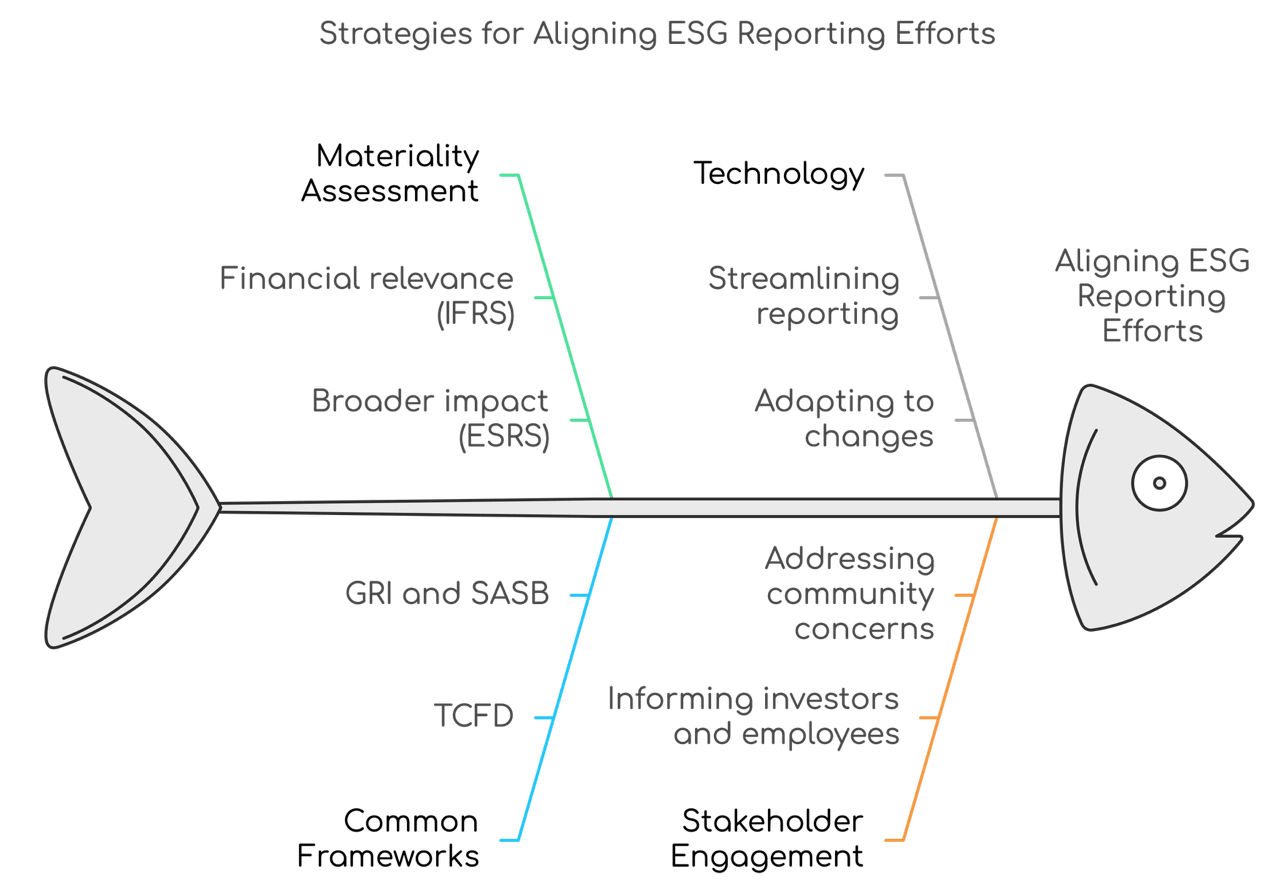

Aligning Reporting Efforts

Understanding the Key Framework

IFRS’s new standards aim to bring financial and sustainability reporting closer together. The focus is on providing clear, investor-relevant data. Meanwhile, ESRS is more comprehensive. It goes beyond financial impact to look at how a company affects the environment and society. The U.S. SEC rules are about transparency, specifically around climate risks and greenhouse gas emissions. And back in the UK, SDR is evolving to ensure companies align with the country’s net-zero commitments.

Navigating all these frameworks might seem overwhelming. But there are strategies that can simplify the process.

-

First, conduct a materiality assessment. This helps businesses identify the most relevant ESG issues for their operations. While IFRS is all about financial relevance, ESRS adds a broader layer—covering how companies impact society and the environment. This dual focus helps companies prioritize topics that matter across different jurisdictions.

-

Next, lean on common frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), and Sustainability Accounting Standards Board (SASB). These are well-accepted globally and cover essential metrics like greenhouse gas emissions and risk management. Using them as a base creates consistency, which can then be tailored for local compliance.

-

Technology also plays a role. Investing in good data management systems helps streamline ESG reporting. As standards change, companies need adaptable systems. This is especially crucial when dealing with multiple reporting requirements in diverse regions.

-

Engaging stakeholders early in the process is another must. ESG is no longer just a regulatory checkbox—it’s a conversation with investors, employees, customers, and communities. Keeping them informed ensures that ESG reports reflect broader expectations and address key concerns.

-

Finally, look at industry leaders. Companies like Tata Steel in India or Saudi Aramco in MENA are setting benchmarks. Studying their approaches can provide valuable insights into what works and what doesn’t.

Your Role in Shaping the Future

In an era where ESG reporting is not just an obligation but a strategic advantage, your role as a leader is pivotal. As CFOs, IROs and Company Secretaries, your ability to understand, adapt, and integrate these evolving standards sets the foundation for your company’s resilience and competitive edge. The convergence of frameworks may still be a work in progress, but your commitment to transparency and accountability is what will set you apart. By leveraging technology, stakeholder engagement, and best practices from industry front-runners, you’re not merely complying with regulations—you’re actively shaping the ESG narrative in your industry. This isn’t just about meeting today’s standards; it’s about defining tomorrow’s benchmarks in sustainability. Embrace this moment as an opportunity to build a legacy of leadership that transcends borders and sets new norms for responsible business practices worldwide.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

enquiry@dickensonworld.com.

Navigating the Convergence of ESG Reporting Standards

To download and save this article.

Authored by:

Kinneri Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment