Navigating Geopolitical Uncertainty:

Strategies for Investor Relations Teams in a Changing World

Setting the Stage

To the dedicated Investor Relations Officer (IRO), there is little that compares to the constant rumble of global disruption. One moment, an obscure regulatory update in Brussels changes supply-chain economics; the next, a shift in diplomatic allegiances between major economies reverberates across markets before you’ve finished the first cup of tea for the day. Amid these crosscurrents, the IRO’s responsibilities have evolved from merely discussing quarterly figures to interpreting global events that can determine a corporation’s strategic footing.

Recent tensions—ranging from the complexities of the Russia–Ukraine conflict to intensifying rivalries between large economies—have sent shockwaves through corporate forecasts, revenue models, and risk assessments. Indian issuers, in particular, sit at a crossroads of opportunity and caution: they can potentially seize market share when global enterprises diversify supply chains, yet they must also be prepared for sudden surges in commodity costs and geopolitical fluctuations that threaten investor confidence.

Defining the IRO’s Role in Times of Crisis

Where IROs were once primarily tasked with translating balance sheets into digestible stories, they now serve as the point of convergence for wide-ranging concerns—from trade tariffs to currency shifts, from compliance mandates to reputational management. They must sift through a deluge of data and contradictory policy pronouncements, discerning which elements are truly material to investors.

In times of crisis, the IRO also becomes a linchpin for cross-functional alignment. Whether collaborating with legal, compliance, supply chain, or the executive suite, the IRO ensures consistent messaging. This harmonization is vital in an era when even minor inconsistencies can cast doubt on corporate preparedness and disrupt trust in management’s foresight.

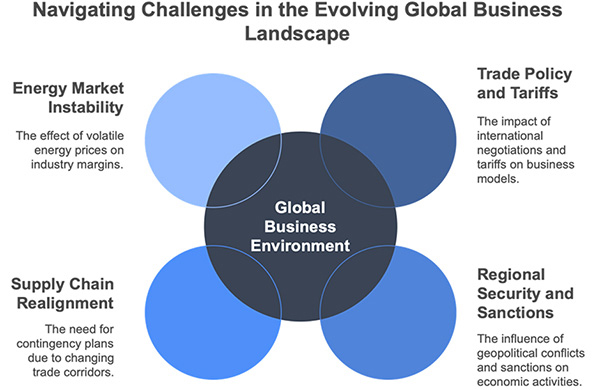

Key Geopolitical Risk Areas

-

Trade Policy and Tariffs

Negotiations among major economic blocs—and the retaliatory tariffs that often follow—can remake entire business models overnight. Once, these disputes might have meant minor incremental costs; now, they can necessitate relocating manufacturing or diversifying suppliers altogether. -

Regional Security and Sanctions

From Eastern Europe to East Asia, ongoing conflicts and fluid political alliances increase the risk of economic sanctions that restrict capital flows and technology transfers. This can test the limits of an organization’s tolerance for uncertainty and introduce compliance obstacles at every turn. -

Supply Chain Realignment

The familiar rhythms of global freight routes have been replaced by ever-changing trade corridors and regulatory requirements. IROs need to prepare contingency plans that address both near-term operational shifts (such as rerouting cargo) and longer-term structural changes (like nearshoring or dual sourcing). -

Energy Market Instability

Volatile prices for oil, natural gas, and critical commodities can drastically affect margins—especially in heavy industries, infrastructure projects, and logistics. Even for sectors less dependent on hydrocarbons, the ripple effects can alter consumer behaviour, financing costs, and broader market sentiment.

The Indian Perspective: Priority Sectors

Strategic Communication Tactics

-

Scenario Planning and Transparency

Incorporate best-, moderate-, and worst-case scenarios into standard investor communications. By candidly outlining potential geopolitical outcomes, IROs can reinforce the perception that the organization is prepared for both market tailwinds and sudden disruptions. -

Engaging the Board and C-Suite

In times of geopolitical turbulence, alignment at the highest level is crucial. IROs must keep executives apprised of emerging risks, while ensuring any public statements or policy changes announced by the board are reflected in investor communications. -

Building Investor Confidence

Move beyond generic reassurances by providing concise, data-driven explanations of how threats are monitored and mitigated. Targeted updates—such as bulletins on new tariffs or conflict escalation—can amplify credibility.

Actionable Next Steps for IROs

-

Geopolitical Risk Dashboard

Establish a live, in-house risk assessment that tracks relevant changes in tariffs, sanctions, or energy prices. Periodically share this distilled information with management and investor audiences. -

Institutionalize Scenario Planning

Conduct tabletop exercises and crisis simulations that outline potential operational bottlenecks. Present these results to the board to demonstrate the company’s preparedness. -

Showcase Supply Chain Resilience

Highlight diversified supplier bases, nearshoring strategies, or multi-region production hubs in presentations. This not only differentiates the organization in the eyes of investors but also helps maintain trust if a disruption arises. -

Elevate Compliance and ESG Transparency

Investors and regulators increasingly scrutinize a company’s compliance track record. Incorporate robust disclosures around environmental standards, labor practices, and anticorruption measures to underscore responsible corporate citizenship. -

Frequent, Targeted Investor Outreach

During uncertain times, provide shorter, more frequent updates on pressing geopolitical events. Host calls, webinars, or roundtables specifically addressing pivotal issues, from raw material costs to sanctions exposure.

Looking Ahead

In an era where key policy decisions can shift seemingly overnight, Indian issuers gain a tangible edge by embracing a proactive, strategic mindset rather than responding reactively to global uncertainty. The role of the IRO, once circumscribed to interpreting balance sheets, now transcends multiple disciplines-supply chain resilience, scenario planning, and reputation management among them. Consistent vigilance, clear communication, and robust collaboration with internal teams can turn each wave of geopolitical turbulence into an opening for sustainable growth. Indeed, the capacity to anticipate global pivots-both menacing and opportune-has become as integral to success as any product breakthrough. By harnessing these shifting currents, Indian issuers can reinforce investor trust and position themselves at the forefront of a rapidly transforming global landscape.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK in Accountancy & Finance, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

Navigating Geopolitical Uncertainty

To download and save this article.

Authored by:

Manoj Saha

Managing Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment