Navigating a Shifting Landscape:

Trump, BRICS, and Investor Relations Imperatives

As the global economy adjusts to renewed geopolitical turbulence, Donald Trump’s threat of 100% tariffs on BRICS nations pursuing a shared currency has injected a potent mix of risk and uncertainty into financial markets. While this rhetoric may serve as a negotiating gambit, the potential consequences of such policies-and the protracted uncertainty they unleash-are far from benign. For Chief Financial Officers (CFOs), this represents a pivotal moment to reassess Investor Relations (IR) strategies and operational resilience.

The Global Ripples of a BRICS Currency Threat

The BRICS bloc-comprising Brazil, Russia, India, China, and South Africa, with other nations expressing interest in alignment-has long considered alternatives to dollar hegemony. Their ambitions, if realized, could disrupt global financial networks. Trump’s pre-emptive stance, designed to shield the dollar’s supremacy, underscores the escalating stakes. Yet the immediate impact is felt in the strengthening U.S. dollar, as markets brace for volatility and investors retreat to safe havens.

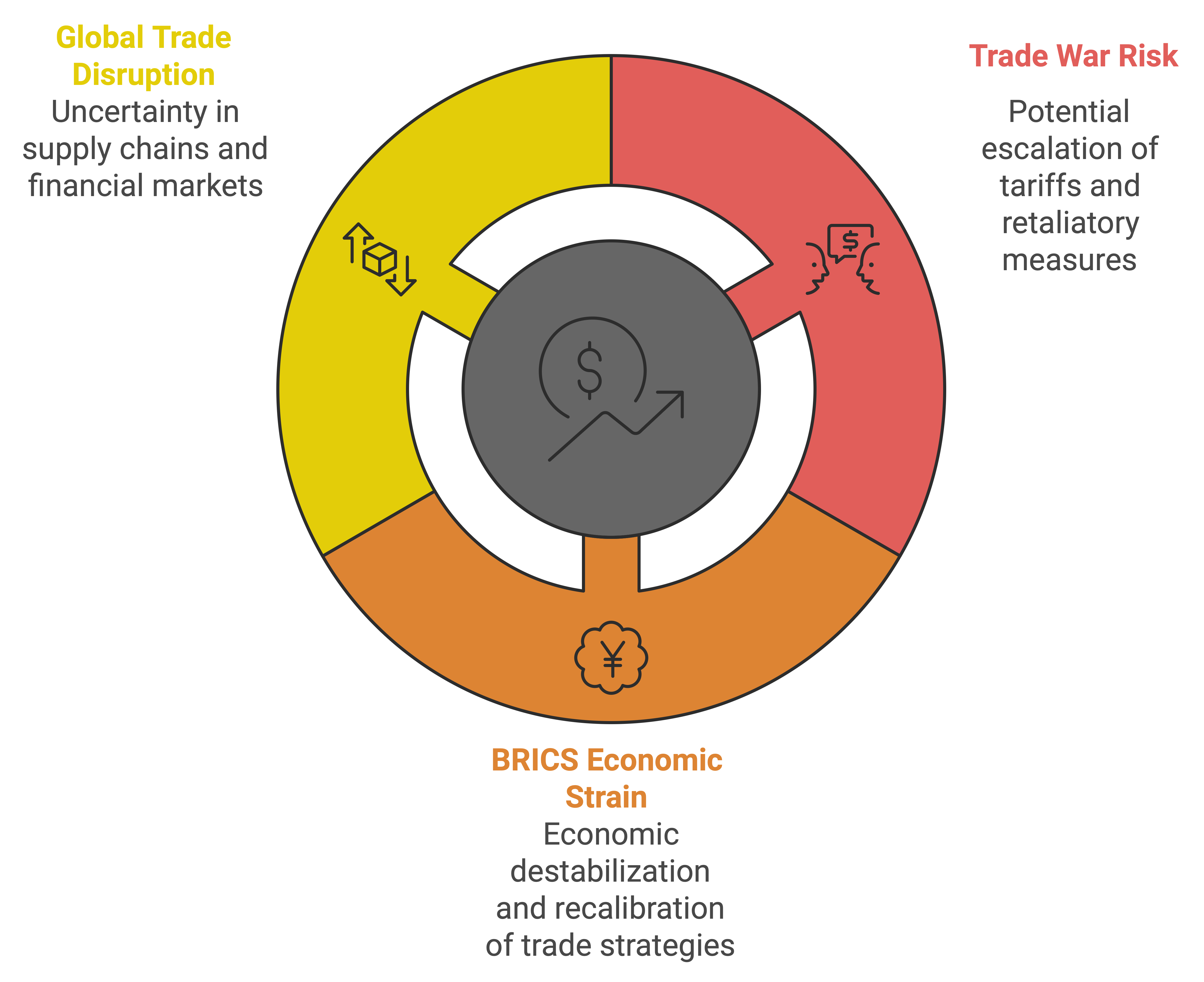

The consequences of this potential standoff are multifaceted:

-

Strengthening of the U.S. Dollar: As global markets absorb the implications, the U.S. dollar has exhibited upward momentum, underscoring its status as a safe-haven currency amidst geopolitical tensions.

-

Risk of a Trade War: Escalating tariffs could inflame trade relations with BRICS economies, leading to a cascade of retaliatory measures. This would not only impede global trade flows but could also contribute to stagflationary pressures worldwide.

-

Economic Strain on BRICS Nations: Tariffs of this magnitude threaten to destabilize export-driven economies within the bloc, compelling them to recalibrate trade strategies and alliances.

-

Disruption of Global Trade Networks: The imposition of tariffs would introduce uncertainty into supply chains, financial markets, and commodity flows, creating ripple effects that transcend the immediate parties involved.

Investor Relations Challenges in a Volatile Geopolitical Climate

For CFOs, this evolving narrative poses direct challenges to Investor Relations. Markets are extremely sensitive to uncertainties stemming from such geopolitical manoeuvres, especially for firms with significant exposure to BRICS economies or sectors prone to global supply chain disruptions. Investors are likely to scrutinize corporate strategies for navigating these risks, making it imperative for CFOs to offer clarity, foresight, and assurance.

Strategic Action Plan for CFOs

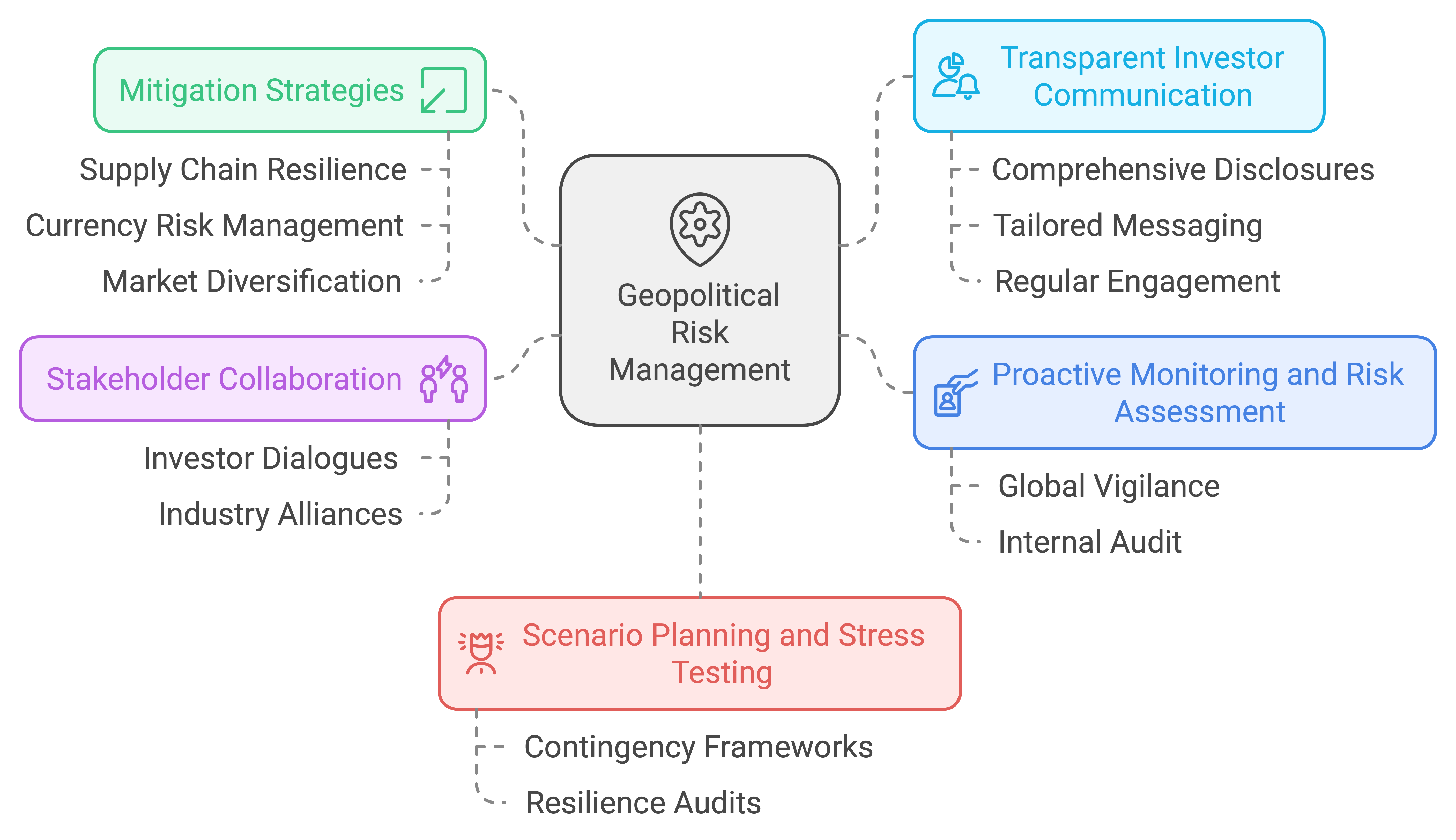

To mitigate risks and uphold investor confidence, CFOs must adopt a multidimensional approach tailored to the current climate:

Charting a Course Through Geopolitical Turbulence: A Narrative for CFOs

In the wake of escalating geopolitical tensions-marked by threats of 100% tariffs on BRICS nations and the spectre of a new currency to challenge the U.S. dollar-CFOs find themselves navigating an increasingly volatile business landscape. As the economic implications ripple through global markets, it is imperative for f inance leaders to craft strategies that mitigate risks while preserving investor confidence. Below, I outline a prioritized roadmap for navigating this storm, blending likelihood with relevance to create a proactive and effective response.

-

Transparent Investor Communication: The Non Negotiable Priority

In times of uncertainty, investors crave clarity and reassurance. CFOs must begin by fortifying communication channels to instil confidence and demonstrate control over the situation.- Comprehensive Disclosures: Companies must candidly outline their exposure to BRICS markets and the steps being taken to address risks. Transparency is non negotiable; vague or evasive statements will erode trust.

- Tailored Messaging: Investors appreciate specificity. Address their unique concerns with focused, proactive narratives that highlight mitigation measures already in motion.

- Regular Engagement: The cadence of communication should increase during volatile periods. Earnings calls, special updates, and investor briefings are essential to convey evolving insights and strategies.

By setting the tone with open, honest dialogue, CFOs can ensure investors remain aligned and assured.

-

Proactive Monitoring and Risk Assessment: Anticipating the Unpredictable

No strategy is complete without a deep understanding of the evolving landscape. CFOs must prioritize vigilance and internal evaluation to anticipate risks before they materialize.- Global Vigilance: Keep a finger on the pulse of geopolitical developments, particularly BRICS-related currency talks and U.S. policy shifts. Understanding the nuances of these dynamics enables informed decision making.

- Internal Audit: Conduct granular assessments of company operations, focusing on vulnerabilities tied to BRICS markets, global supply chains, and currency fluctuations. Knowing where the company stands is the first step to strengthening its position.

-

Mitigation Strategies: Building Resilience Before the Storm Hits

Preparation is everything. Companies with resilient systems are better equipped to weather geopolitical shocks. CFOs must act swiftly to implement the following safeguards:- Supply Chain Resilience: Diversify supplier networks and consider regionalizing supply chains to reduce dependency on BRICS nations. Geographic flexibility is crucial for continuity.

- Currency Risk Management: Volatility in exchange rates is inevitable in such environments. Employ hedging instruments like forward contracts or options to stabilize financial outcomes.

- Market Diversification: Businesses heavily reliant on BRICS economies must urgently explore alternative markets. Expanding to untapped regions mitigates concentration risks and builds long-term revenue stability.

-

Scenario Planning and Stress Testing: Preparing for the Worst

While unlikely scenarios may seem distant, the stakes are too high to ignore their possibility. CFOs must stress-test their strategies against a spectrum of potential outcomes:- Contingency Frameworks: Develop robust financial models that simulate scenarios ranging from minor trade disruptions to full blown economic decoupling. This foresight enables companies to pivot swiftly if needed.

- Resilience Audits:: Test operational and f inancial systems under extreme conditions to identify weaknesses and refine mitigation strategies. The goal is to ensure that the company can sustain shocks without compromising its core stability.

-

Stakeholder Collaboration: Building Collective Strength

Lastly, no CFO operates in isolation. Stakeholder collaboration adds depth and breadth to any strategy.- Investor Dialogues: Host tailored sessions with key investors to present detailed assessments of potential risks and mitigation efforts. Direct engagement reinforces trust and allows for feedback driven refinements.

- Industry Alliances: Leverage industry associations to align on shared concerns, pool insights, and advocate for favourable policy responses. Collective action amplifies influence and ensures no company is acting in a silo.

The challenges posed by geopolitical shocks, like Trump’s tariff threats and the prospect of a BRICS currency, demand that CFOs embrace their role as strategic navigators. Clear communication, informed risk management, and a commitment to resilience are the hallmarks of leadership in these times. This is a moment for action, not reaction. By addressing these priorities with purpose and urgency, CFOs can turn uncertainty into opportunity—strengthening their companies while earning the confidence of investors who value foresight and preparation.

The CFO as the Anchor in Global Storms

The evolving drama of Trump’s tariff threats and the prospect of a BRICS currency is not just a test of geopolitical endurance-it’s a clarion call for financial leadership. In a world teetering on the edge of economic realignment, CFOs hold the pivotal role of translating uncertainty into opportunity. This moment demands more than just spreadsheets and forecasts; it requires vision, clarity, and decisiveness. Proactive strategies that diversify supply chains, mitigate currency risks, and expand market footprints must be complemented by transparent, investor-focused communication. The stakes extend beyond quarterly results; this is about defining resilience in a turbulent global narrative. CFOs who rise to the challenge today will not only safeguard their companies but also lead the way in navigating a financial order being reshaped in real time.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Manoj Saha is the Managing Director of Dickenson World, a leading Capital Markets Communication solutions company. He leads Dickenson World in Investor Relations, Corporate Reporting and ESG Advisory.

Navigating a Shifting Landscape

To download and save this article.

Authored by:

Manoj Saha

Managing Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment