IR & AR WEEKLY ALERTS — ISSUE 115

Coverage window (IST): 12 January 2026 (post 18:00 IST) to 19 January 2026 (18:00 IST)

Jurisdictions: United Kingdom; India; UAE (DIFC); Saudi Arabia (plus a short Qatar watchpoint)

A. United Kingdom

1. POATR and PRM regime cutover completed on 19 January 2026 [LAW + IMPLEMENTATION]

The FCA confirms that 19 January 2026 is the full commencement point for the new regime, including the PRM sourcebook and updated submission forms and checklists. For any issuer preparing admissions documents or maintaining a standing “readiness” shelf, this is the point at which older references (UKPR and PRR framing) become operationally unsafe. (FCA)

Issuer-side implications to reflect in governance and IR process

-

Prospectus workflow: Ensure external counsel and internal owners are aligned that submissions for approvals from this date must align to PRM framing, including the updated cross-reference and submission artefacts. (FCA)

-

Interpretive guidance update: The FCA states the Knowledge Base would be updated on 19 January 2026 in line with Primary Market Bulletin 61, including technical notes relevant to prospectus content and process. (FCA)

2. Sponsor record-keeping is expressly being consulted under the new cutover references [CONSULTATION + GOVERNANCE]

Primary Market Bulletin 61 includes a consultation on updates to sponsor record-keeping requirements (TN 717.2), framed as consequential amendments following POATRs and associated UKLR references. While this is addressed to sponsors, issuer audit committees and transaction teams should treat it as a signal that evidencing diligence, judgement, and process discipline remains central to supervisory expectations. (FCA)

What to do now (practical)

-

Transaction readiness file: Ensure issuer-side documentation packs (Board approvals, verification notes, diligence trails) are organised so sponsor evidencing requirements do not become a last-minute constraint. (FCA)

-

IR coordination: Align the IR narrative calendar with the new regime’s documentation sequence so that public messaging does not get ahead of what is “approved” or submission-ready, particularly where forward-looking framing is used. (FCA)

B. India

1. SEBI introduces Closing Auction Session (CAS) and modifies pre-open auction session [CIRCULAR + MARKET STRUCTURE]

SEBI has issued the circular introducing a Closing Auction Session (CAS) and certain modifications to the Pre-Open Auction Session. (Securities and Exchange Board of India)

Public reporting of the circular indicates a phased rollout, with CAS implementation from 3 August 2026, and pre-open modifications from 7 September 2026. (Moneycontrol)

Operational contours (as described in market summaries of the SEBI circular)

-

CAS is described as a defined closing period (reported as 3:15 pm to 3:35 pm) to determine a single closing price through an equilibrium/auction method, with constraints on order types and price bands reported in summaries. (Team Lease Regtech)

Why issuers and IR teams should care now (not in August)

-

Results-day narrative risk: The closing price often becomes the headline reference for “market reaction”. Moving to a closing auction framework increases the need for IR teams to anticipate how liquidity and order imbalances may shape the printed close. (Team Lease Regtech)

-

Buyback and treasury execution narrative: Where Boards and investors scrutinise execution quality, the transition to an auction-based close can change how execution quality is evidenced and explained in governance oversight language. (Team Lease Regtech)

What to do now

-

Update the “results day” playbook: Add a CAS-aware explanation section for when the market begins adopting it, including a disciplined line on how the company interprets close-to-close moves during event days. (Moneycontrol)

-

Internal education: Brief treasury and IR on the differences between VWAP-derived close and auction-derived close so that future commentary remains consistent and technically correct. (Team Lease Regtech)

2. SWAGAT-FI framework for “trusted” foreign investors (FPIs and FVCIs) [CIRCULAR + MARKET ACCESS]

SEBI has published the circular establishing the SWAGAT-FI framework for FPIs and FVCIs. (Securities and Exchange Board of India)

Secondary reporting of the circular states that its provisions come into effect from 1 June 2026, and emphasises reduced repetitive compliance and documentation for eligible investors. (TaxGuru)

Why this matters for issuer communications

-

Shareholder base evolution: Simplifying onboarding for certain foreign pools increases the likelihood that issuers will see changes in foreign shareholding mix and engagement patterns, especially around larger institutions that are process-sensitive. (Moneycontrol)

-

IR responsiveness as a differentiator: If onboarding friction reduces, the differentiator shifts further toward issuer-side clarity on governance, disclosures, and engagement discipline.

What to do now

-

Refresh foreign investor onboarding collateral: Ensure core governance and disclosure artefacts (investor deck, governance policy extracts, capital allocation notes, ESG data pack) are current and internally consistent so that increased inbound interest does not create “inconsistency risk”. (Moneycontrol)

-

Track the implementation date: Treat 1 June 2026 as a planning milestone for IR calendar and investor access readiness. (TaxGuru)

C. UAE (DIFC)

1. DFSA investor alerts on impersonation and cloned channels [INVESTOR PROTECTION]

The DFSA has issued investor alerts warning of scams where fraudsters impersonate the DFSA and use fake credentials and channels. (bseindia.com)

Why this belongs in the issuer IR risk register

-

Channel authenticity risk: Investors can be misdirected to spoofed “regulator” or “issuer” pages, undermining trust and potentially triggering reputational fallout if the issuer’s official channels are mistakable.

What to do now

-

Harden the IR channel architecture: Ensure the investor relations site clearly displays canonical domains, verified contact points, and consistent routing from stock exchange pages and filings to the issuer’s authentic channels. (bseindia.com)

-

Add an “authenticity” note in governance disclosures: Consider a brief risk-control note describing how official disclosures are authenticated and where investors can verify source documents.

2. DFSA webinar on updated Crypto Token framework and DIFC digital assets ecosystem (27 January 2026) [IMPLEMENTATION SUPPORT]

The DFSA has announced a webinar on the updated crypto token regulatory framework and the DIFC digital assets ecosystem. (ICICI Direct)

Issuer and IR relevance

-

If the issuer’s stakeholder ecosystem includes tokenisation, digital assets, or fintech exposures, this signals continued tightening of operational expectations and interpretive guidance around digital asset activity.

D. Saudi Arabia

1. Market opening to all categories of foreign investors effective 1 February 2026 [REGULATORY CHANGE + IMPLEMENTATION WINDOW]

The CMA states it is opening the capital market to all categories of foreign investors, enabling them to invest directly, as of 1 February 2026, following approval of the relevant regulatory framework. (cma.gov.sa)

The CMA’s implementing regulations page also lists amended Rules for Foreign Investment in Securities among other amended instruments. (cma.gov.sa)

Why this matters for Annual Reports and IR

-

Investor-base broadening: Larger and more diverse non-resident investor participation increases the expectation for high-quality English disclosure, consistent governance articulation, and predictable investor engagement workflows. (cma.gov.sa)

-

Disclosure readiness: For issuers with upcoming corporate actions or capital events, the timing (effective 1 February 2026) is close enough that Boards should treat this as an immediate readiness item.

What to do now

-

Re-check the foreign investor narrative: Ensure the Annual Report’s governance, risk, and strategy narratives can withstand scrutiny from a broader foreign institutional lens (clear capital allocation logic, risk governance clarity, related party framing). (cma.gov.sa)

-

Align investor engagement controls: Confirm that inbound queries, meeting logs, and disclosure approvals follow strict internal controls suitable for a more internationalised investor population.

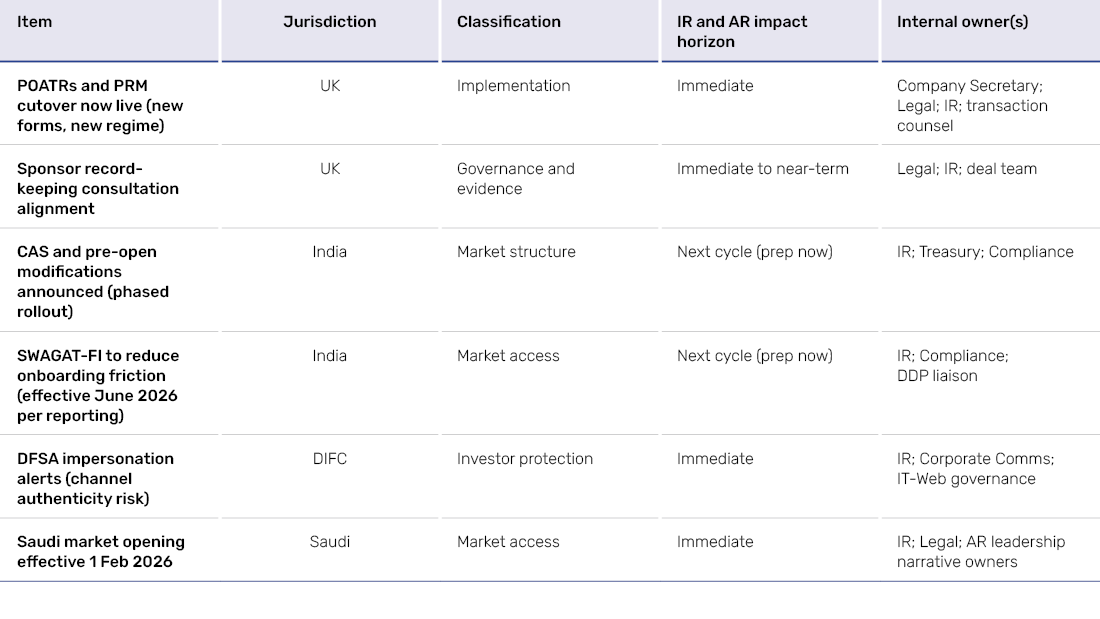

Triage grid (what to treat as “immediate” versus “next cycle”)

IR & AR WEEKLY ALERTS

To download and save this article.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

Leave A Comment