IR & AR WEEKLY ALERTS — ISSUE 110

Coverage window (IST): 07 December 2025 to 14 December 2025 (IST)

Jurisdictions: United Kingdom, India, UAE (DIFC), Saudi Arabia

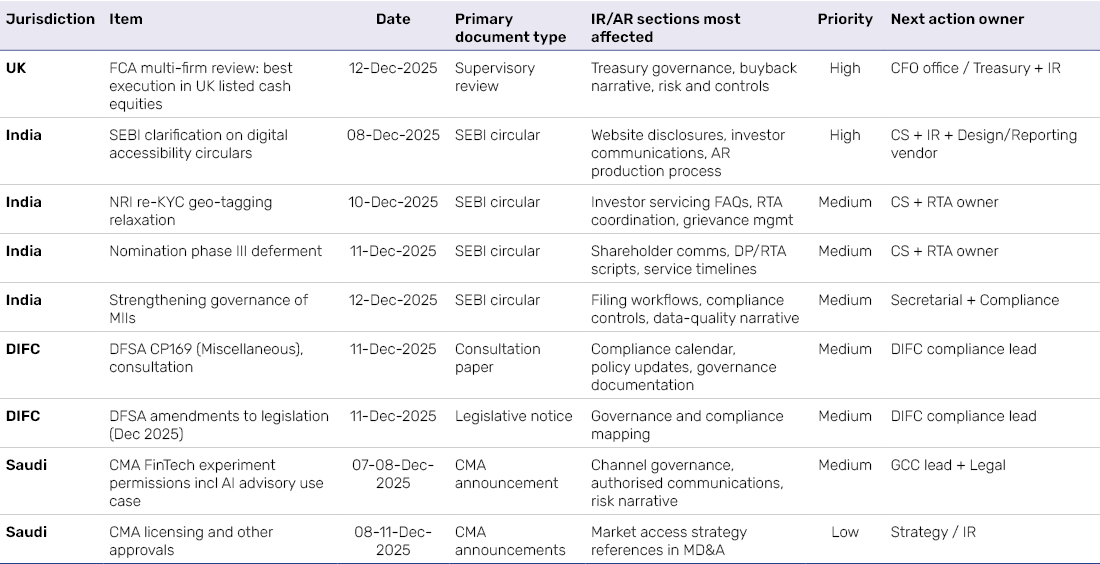

At-a-glance IR & AR actions for the next fortnight

UK-listed / London-traded groups

-

Ask Treasury/IR to obtain a short broker note explaining what the FCA’s best execution review implies for your broker panel, especially if you run buybacks, liquidity programmes, or frequent corporate actions.

-

In the Annual Report, ensure the Governance section’s description of treasury oversight explains how the Board gains comfort on execution quality and conflicts management for material trading activity (buybacks, placings, stabilisation where relevant).

Indian listed issuers

-

Treat SEBI digital accessibility expectations as a disclosure-quality control: investor presentations, annual reports, notices and key policies should be reviewed for accessibility readiness (format, navigability, readability).

-

Instruct the investor services team and RTA/DP coordination owners to map the operational impact of the NRI re-KYC geo-tagging relaxation and the nomination phase III deferment into shareholder communication templates and FAQs.

-

Monitor exchange/depository follow-through on SEBI’s MII governance strengthening circular, as this can change filing workflows, escalation routes, and compliance attestations over time.

DIFC and Saudi-linked groups

-

DIFC-regulated entities should log DFSA CP169 and the December legislative amendments into their compliance calendars, especially where issuer groups use DIFC entities for holding, financing, or regulated activity.

-

Groups active in Saudi markets should note the CMA’s ongoing regulatory enablement of FinTech experimentation including AI in advisory use cases, a direction that can influence expectations around product distribution, suitability framing, and governance narratives in investor materials.

A. United Kingdom — Best execution scrutiny and what it changes for issuers

What has happened

The FCA published a multi-firm review on best execution in trading UK listed cash equities (12 December 2025).

Why this matters for IR and Annual Reporting

-

Issuer-facing implication is indirect but real: buybacks, liquidity support, and broker selection increasingly sit in a governance frame where investors expect issuers to show discipline in how trading is executed and monitored. The FCA’s publication increases the likelihood that brokers will refresh their controls, data requirements, and client-facing reporting in response.

-

Board narrative consequence: Annual Report governance language often states that treasury and capital actions are conducted “in accordance with policy”. It is now more persuasive if the wording also describes how oversight works (metrics reviewed, broker oversight cadence, conflicts controls) for material trading activity.

Practical IR & AR actions

-

Update (or create) a one-page Treasury execution oversight note for the Audit Committee or a Treasury Committee: broker panel, review cadence, execution analytics received, and escalation triggers.

-

For issuers running buybacks, ensure results-day Q&A and AR disclosures can explain: programme governance, execution approach, and internal controls (without implying regulated best-execution obligations that apply to brokers rather than issuers).

B. India – Accessibility, KYC friction relief, nomination timing, and MII governance

1. SEBI clarification on digital accessibility circulars

What has happened

SEBI issued a circular titled “Clarification on the Digital Accessibility circulars of SEBI” (08 December 2025).

Why this matters

Investor-facing disclosure quality is moving from “availability” to “accessibility”. This is particularly relevant for listed issuers that rely heavily on PDFs, scanned documents, image-based notices, or non-navigable presentations on websites and stock exchange portals.

Practical IR & AR actions

-

Add a lightweight accessibility QA checkpoint to your disclosure workflow: before publishing investor-facing PDFs, confirm they are searchable, readable, and structurally navigable.

-

Ensure the Annual Report production process avoids last-mile conversions that break accessibility (for example, flattening text into images).

2. Relaxation on geo-tagging requirement for NRIs during re-KYC

What has happened

SEBI issued a circular on relaxation of geo-tagging requirement for NRIs undertaking re-KYC (10 December 2025).

Why this matters

Any friction reduction in KYC processes tends to show up in fewer shareholder grievances and faster servicing, which reduces operational and reputational noise around investor communications.

Practical IR & AR actions

-

Ask your RTA/DP coordination owner for an “operational impact note” and refresh shareholder FAQs or helpdesk scripts accordingly.

3. Deferment of nomination (phase III)

What has happened

SEBI issued a circular on deferment of nomination phase III (11 December 2025).

Why this matters

Nomination compliance requirements have been a recurring driver of investor queries and last-mile servicing workload. A deferment changes the timing of issuer and intermediary communications and reduces near-term processing pressure.

Practical IR & AR actions

-

Update your investor communication calendar (emailers, SMS text, website notices) to reflect the revised timeline and avoid sending contradictory reminders.

4. Strengthening governance of MIIs

What has happened

SEBI issued a circular titled “Provisions on strengthening governance of MIIs” (12 December 2025).

Why this matters

Even when a circular targets exchanges, clearing corporations, and depositories, issuers experience the effect through changes in filing processes, compliance attestations, escalation pathways, and data-quality expectations.

Practical IR & AR actions

-

Put a watchpoint on exchange/depository follow-up communications that operationalise SEBI’s direction, and ensure your secretarial team is prepared for workflow changes.

C. UAE (DIFC) — DFSA CP169 and December legislative amendments

What has happened

The DFSA published a notice releasing Consultation Paper CP169 (Miscellaneous) with a stated consultation deadline of 10 January 2026.

The DFSA also published a Notice of Amendments to Legislation: December 2025 (11 December 2025).

Why this matters

For issuer groups with DIFC-regulated entities, “miscellaneous” consultations and legislative amendments often contain the operational details that drive annual compliance attestations, policy refreshes, and governance documentation.

Practical IR & AR actions

-

DIFC compliance owners should log CP169 into the regulatory tracker and identify whether any internal policy updates are likely to be required ahead of FY2025–26 reporting sign-off.

D. Saudi Arabia — CMA approvals and AI experimentation as a governance signal

What has happened

The CMA announced multiple market updates during the window, including permissions for FinTech experimentation (including use of AI in advisory) and licensing actions, alongside other approvals.

Why this matters

Saudi regulators are continuing to expand market capability while keeping a visible governance lens on distribution models and technology. For issuers marketing to Saudi capital, the practical consequence is higher sensitivity to how investment propositions are framed, distributed, and governed, especially where digital channels are used.

Practical IR & AR actions

-

If Saudi investors are a target segment, ensure your channel authenticity and investor education language is consistent across platforms and avoids ambiguity around authorised sources and official communications.

Triage grid for internal use

IR & AR WEEKLY ALERTS

To download and save this article.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

Leave A Comment