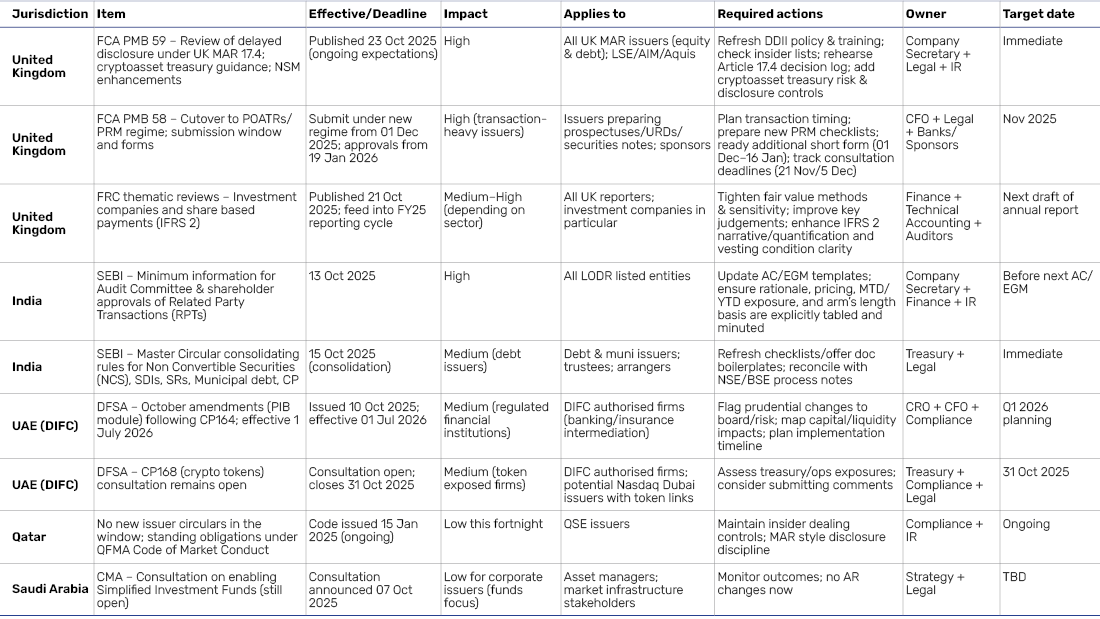

Weekly IRO and Annual Report Intelligence

Date: Monday, 27 October 2025

Coverage window: 13–27 Oct 2025 (14 days)

Scope: United Kingdom, India, UAE, Qatar, Saudi Arabia

United Kingdom

-

FCA PMB 59 – MAR “delay” discipline; crypto-treasury warnings; NSM upgrades

The FCA’s fresh thematic on delayed disclosure (MAR 17.4) flags longer average delays (≈35 days), late DDII notifications, and weak confidence classifying inside information. It also cautions listed companies adopting bitcoin/crypto treasury strategies to sharpen disclosures and MAR controls. Expect tighter supervision. (FCA) -

FCA PMB 58 – Prospectus cutover logistics (POATRs/PRM)

From 1 Dec 2025 you may submit draft documents under the new PRM; approvals only from 19 Jan 2026. A short additional form is required for submissions made 1 Dec–16 Jan; new checklists/forms land ~24 Nov. Plan calendars now (turnaround pauses 22 Dec–2 Jan). Consultation deadlines on Knowledge Base updates hit 21 Nov/5 Dec. (FCA) -

FRC thematic reviews – investment companies & share-based payments

FRC wants clearer key judgements, better FV methodology/sensitivity for investment companies, and crisper IFRS 2 narratives (vesting conditions, measurement, modifications). Fold this into FY25 drafts immediately. (FRC (Financial Reporting Council))

India

-

SEBI: Minimum information for RPT approvals (Audit Committee & shareholders)

Boards must receive/share standardised packs—purpose, pricing basis, MTD/YTD exposure, and arm’s-length substantiation—before approving RPTs. Update templates now; weak minutes will not fly. (Securities and Exchange Board of India) -

SEBI: Master Circular for non-convertible securities, SDIs, SRs, municipal debt & CP

Consolidates the debt rule-book—refresh issuer checklists, trustee workflows and offer-doc boilerplates accordingly. (Securities and Exchange Board of India)

(Practical pointer) NSE has already echoed the RPT circular to listed companies; ensure your CoSec team has aligned NEAPS/XBRL processes. (nseindia.com)

UAE (Dubai / DIFC)

-

DFSA: October amendments – Prudential (PIB) module

Post-CP164, DFSA made prudential changes (effective 1 Jul 2026). DIFC-authorised firms should model capital/liquidity and brief boards now, even if listed outside DIFC. (dfsa.ae) -

DFSA: CP168 (crypto tokens) still open

If you have any token exposure (treasury, customers, ecosystem), weigh in before the deadline and reconcile with FCA PMB 59 messaging if you’re dual-exposed to UK MAR. (dfsa.ae)

Qatar

No new issuer-wide circulars this fortnight; continue to run Code of Market Conduct standards (insider-dealing controls; disciplined disclosure). (qfma.org.qa)

Saudi Arabia

CMA’s consultation on enabling simplified investment funds remains open; monitor but no immediate AR changes for corporate issuers. (cma.org.sa)

UK – Inside information & MAR

-

Add a one-page box titled “Inside Information Governance” to your front-of-book compliance section.

-

Include: clear triggers for what counts as inside information, a DDII (delayed disclosure of inside information) decision log, insider-list hygiene (how you keep it current), and notification timeliness metrics.

-

Basis: FCA Primary Market Bulletin 59 (UK Market Abuse Regulation, MAR).

Treasury & financial risk – Crypto exposure

-

If you hold or are considering cryptoassets in treasury, expand your note to cover: purpose, governance, valuation method, volatility/impairment risks, and where MAR controls connect (e.g., who monitors price-sensitive moves).

-

Cross-refer to Audit Committee oversight.

-

Basis: FCA expectations.

India – Related-party transactions (RPTs)

-

Attach SEBI’s minimum-information table as a pre-meeting annex to Audit Committee packs and cross-reference it in the minutes.

-

Mirror the same detail in the shareholder notice: rationale, pricing basis, and cumulative exposure (MTD/YTD).

-

Basis: SEBI circular on RPT approvals.

UK – Prospectus/transactions cutover

-

Drop a sidebar in the CFO/MD&A explaining the new UK prospectus regime (POATRs/PRM):

-

Which documents migrate to the new rules,

-

The submission window (1 Dec–16 Jan), and

-

Checklist readiness if you plan any H1 FY26 issuance.

-

-

Basis: FCA PMB 58.

UK – Share-based payments (IFRS 2)

-

Tighten the IFRS 2 note: spell out performance conditions, grant-date fair-value inputs, any modifications and their effects, plus a short sensitivity analysis.

-

Basis: FRC thematic focus.

Sources

-

FCA PMB 59 (MAR & crypto treasury) (FCA)

-

FCA PMB 58 (POATRs/PRM cutover) (FCA)

-

FRC news: thematic reviews (investment companies & IFRS 2) (FRC (Financial Reporting Council))

-

FRC AEP consultation page (deadline) (FRC (Financial Reporting Council))

-

FRC open consultations overview (ISA 240/570/700/701/720, FRED 88 deadlines) (FRC (Financial Reporting Council))

-

SEBI RPT minimum-information circular (13 Oct 2025) (Securities and Exchange Board of India)

-

SEBI Master Circular – non-convertible securities etc. (15 Oct 2025) (Securities and Exchange Board of India)

-

NSE circulars page (RPT echo/XBRL references) (nseindia.com)

-

DFSA October amendments (PIB) (dfsa.ae)

-

DFSA CP168 (crypto tokens) (dfsa.ae)

-

QFMA Code of Market Conduct (standing obligations) (qfma.org.qa)

-

CMA KSA announcements (consultation on simplified investment funds) (cma.org.sa)

Triage grid (prioritised)

IR & AR WEEKLY ALERTS

To download and save this article.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

Leave A Comment