Green Investor Groups at a Crossroads :

Rethinking ESG Amid Market Shifts and Political Uncertainty

Green investor groups have long been heralded as a driving force behind sustainable finance, mobilizing trillions of dollars to reshape global markets and combat climate change. However, recent developments challenge the efficacy and resilience of these groups, as investor withdrawals, political shifts, and market realities expose significant gaps in their impact. In this analysis, we explore the evolving role of green investor groups, critically assessing their successes, shortcomings, and the urgent need for recalibration.

Green Investment: A Turning Point or a Retreat?

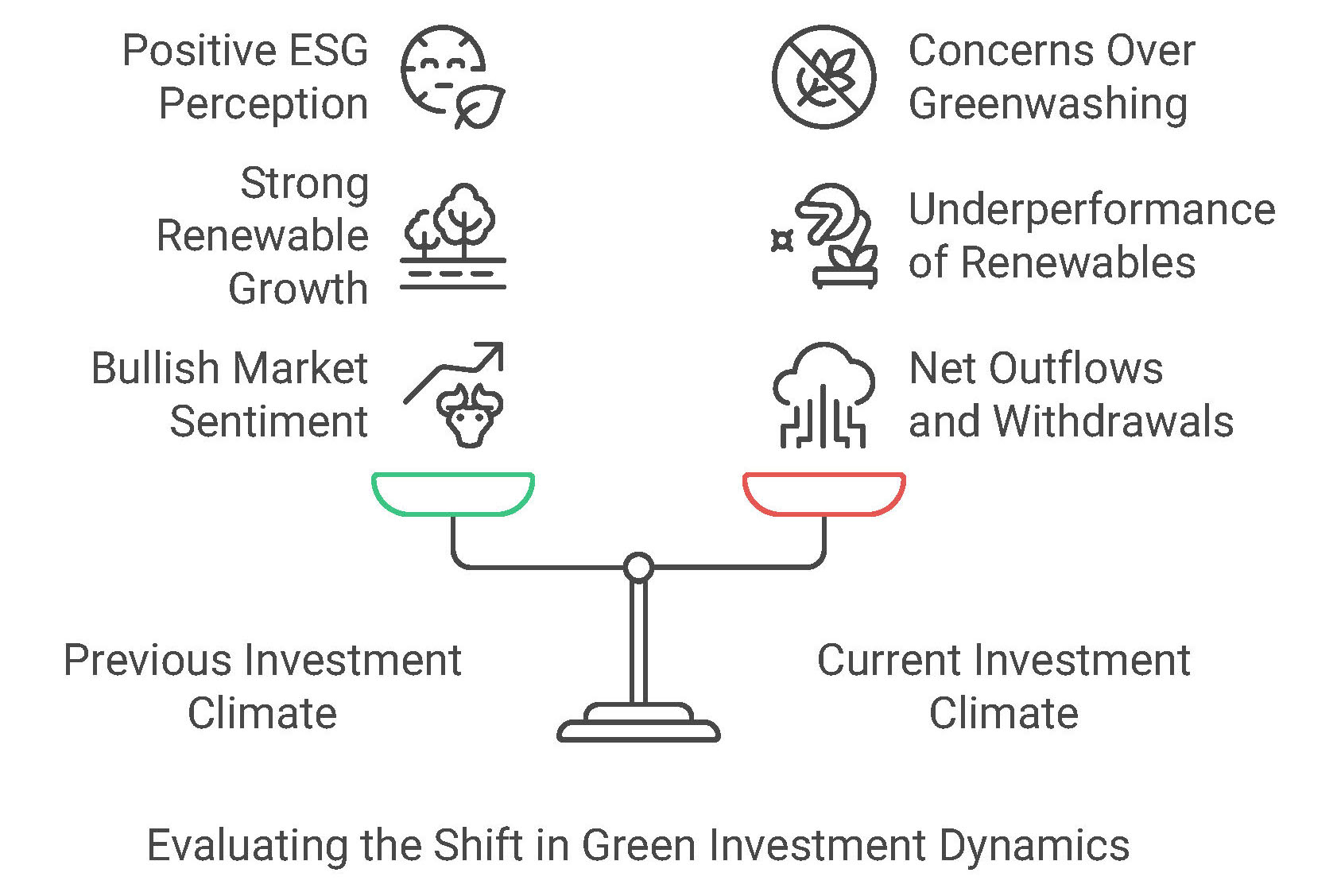

The premise of green investment rests on the idea that capital markets can be a catalyst for climate action. Yet, 2024 has been a turning point, as global climate funds are set to experience their first annual net outflows, with nearly $24 billion withdrawn in just the first nine months of the year. This shift is a stark contrast to the bullish sentiment of previous years and is attributed to a combination of factors, including underperformance of renewable energy stocks, concerns over greenwashing, and a rise in anti-ESG sentiments. High interest rates have also made growth-oriented green investments, such as solar and wind energy, less attractive, prompting institutional investors to re-evaluate their portfolios.

This mass exodus from climate funds raises fundamental questions: Are investors losing faith in the ability of sustainable finance to deliver competitive returns? Or is the market merely experiencing a cyclical correction amid broader economic conditions? Regardless, the episode underscores the fragility of ESG-driven investment models when faced with real-world financial pressures.

The Cracks in Climate Alliances

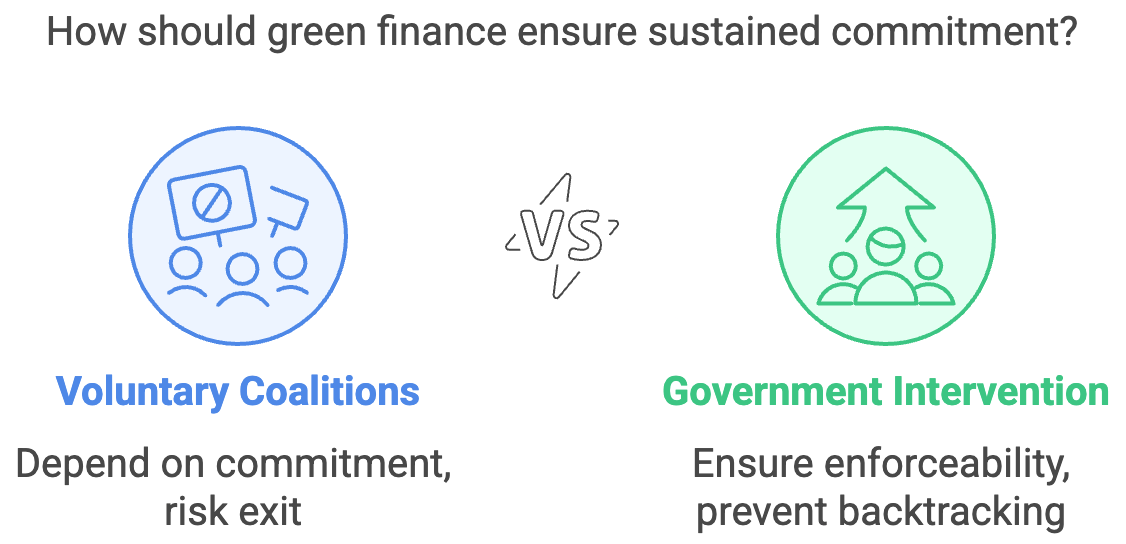

Beyond capital flows, the credibility of voluntary climate alliances is also being tested. Several major U.S. banks, including JPMorgan, have recently withdrawn from the Net Zero Banking Alliance (NZBA), citing regulatory and political uncertainties. This retreat highlights the limitations of voluntary commitments in the face of shifting political landscapes. The effectiveness of green investor groups has always hinged on the assumption that financial institutions will remain committed to long-term sustainability goals. However, when key players exit, it weakens the collective momentum, signaling to the market that financial interests may still take precedence over sustainability pledges.

Critically, this raises an important debate: Should green finance rely on voluntary coalitions, or is stronger government intervention required? The NZBA example suggests that regulatory oversight may be essential to prevent backtracking and ensure sustained commitment. Without enforceable measures, investor groups risk being reduced to well-intentioned but ultimately ineffective advocacy networks.

ESG Ratings: A Source of Clarity or Confusion?

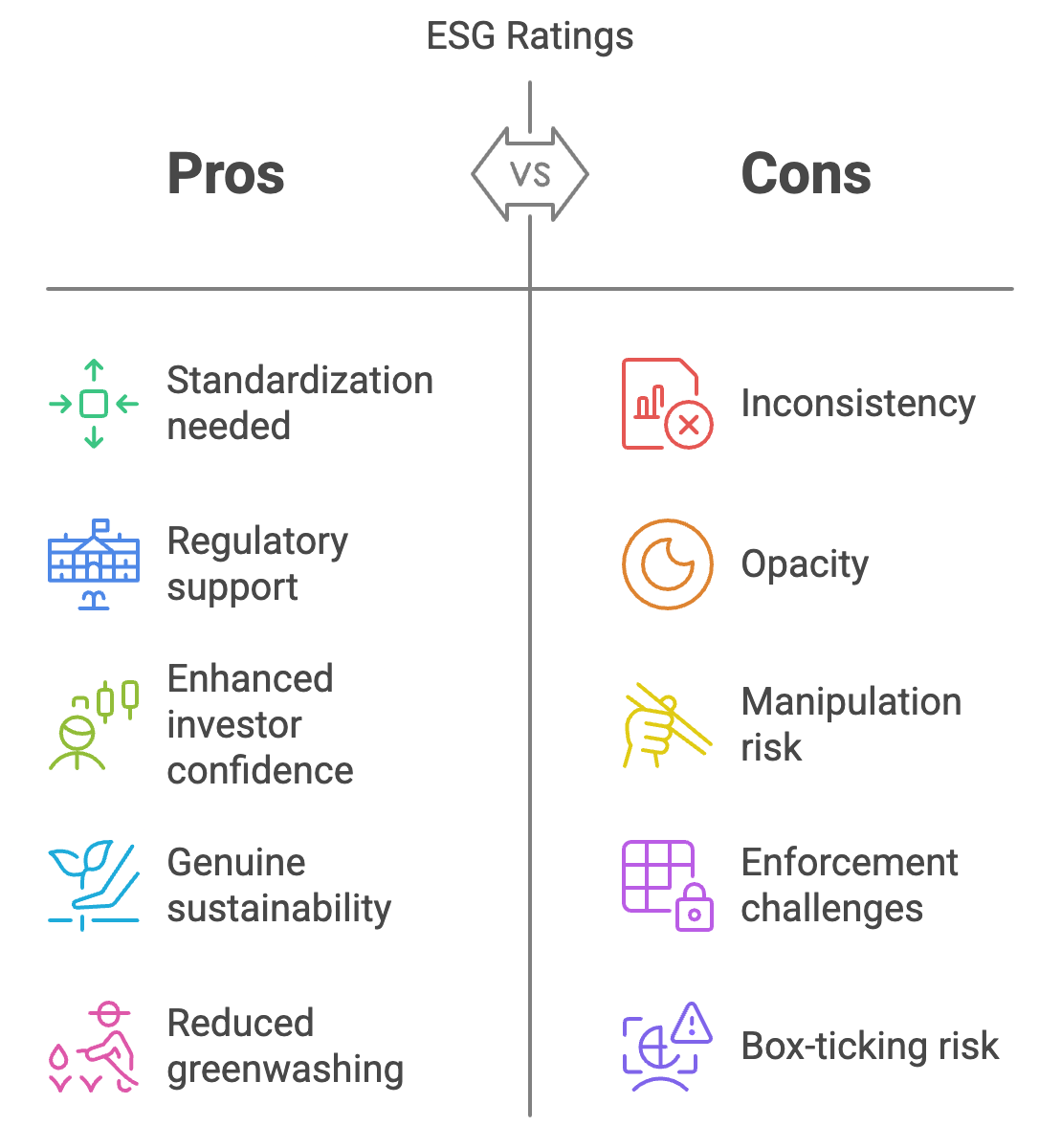

A major challenge facing green investor groups is the inconsistency and opacity of ESG ratings. Research highlights that investors are struggling with the lack of standardization in ESG assessments, leading to confusion in portfolio allocation. ESG ratings from different agencies often provide conflicting evaluations of the same company, making it difficult for investors to distinguish between genuine sustainability efforts and corporate greenwashing. This inconsistency undermines investor confidence and creates room for manipulation, where companies can selectively report favorable ESG data while omitting material risks.

To address this, there is an urgent need for standardized ESG metrics that are universally accepted across financial markets. The introduction of stricter ESG disclosure regulations by the SEC, the EU’s Corporate Sustainability Reporting Directive (CSRD), and the International Sustainability Standards Board (ISSB) are steps in the right direction, but enforcement and adoption remain key hurdles.

Moreover, as trends in ESG investment fluctuate, companies must recognize that high-quality ESG disclosures and a deeply embedded ESG culture are more critical than ever. Investors are increasingly scrutinizing not just the numbers, but also how sustainability is ingrained within corporate decision-making. Those that treat ESG as a box-ticking exercise will struggle to maintain credibility, while firms with authentic, transparent, and well-integrated ESG frameworks are more likely to retain investor confidence even during periods of uncertainty.

The Future of Green Finance: A Call for Evolution

Despite these setbacks, green investor groups remain essential in shaping the future of finance. The industry is witnessing the rise of innovative portfolio optimization techniques that incorporate ESG factors while maintaining financial performance. The concept of a ‘green efficient frontier,’ which balances sustainability with risk and return, is gaining traction among asset managers. Moreover, the integration of AI and big data in ESG investing is improving risk assessment, allowing investors to detect greenwashing and align capital with genuine sustainability leaders.

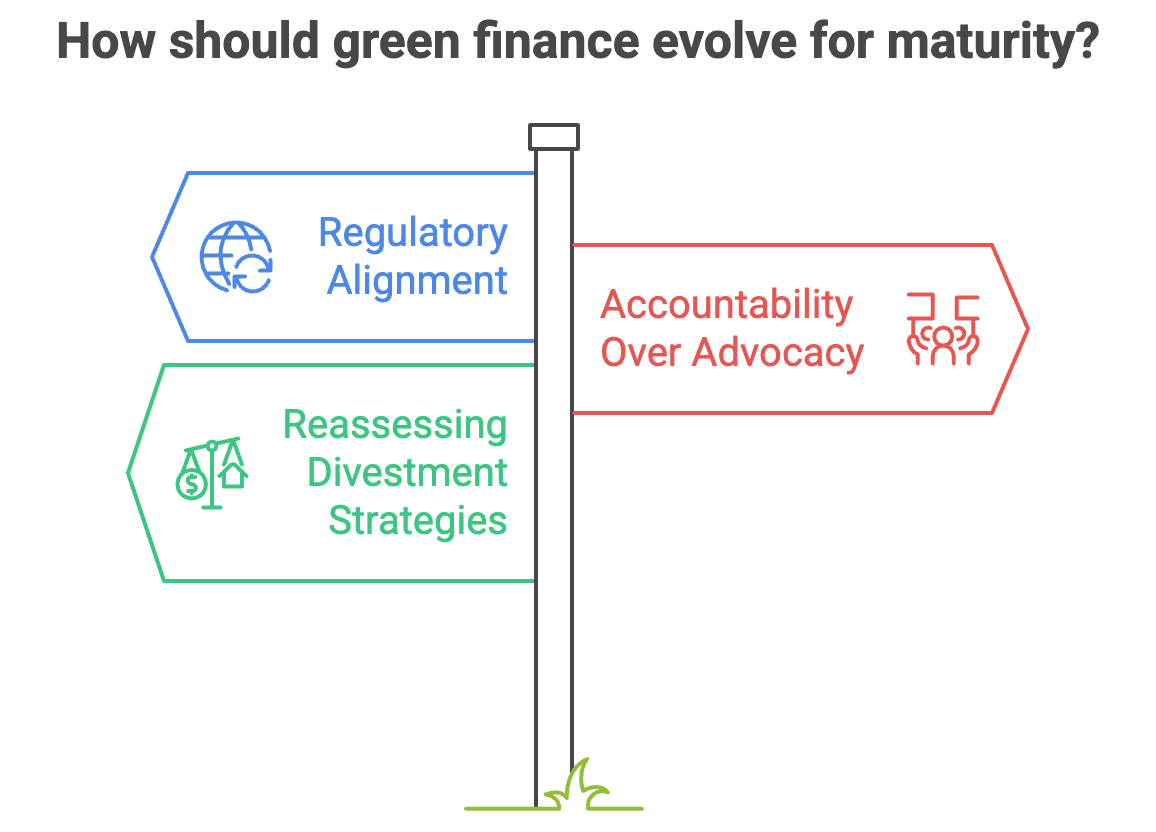

However, for green finance to mature, key structural changes are necessary:

- Regulatory Alignment: A global standard for ESG disclosures would provide clarity and reduce the risk of greenwashing.

- Accountability Over Advocacy : Rather than relying solely on voluntary alliances, enforceable commitments backed by regulatory agencies are needed.

- Reassessing Divestment Strategies : The debate between engagement and divestment must be revisited, ensuring that capital allocation is both financially and environmentally effective.

Green Investor Groups at a Crossroads

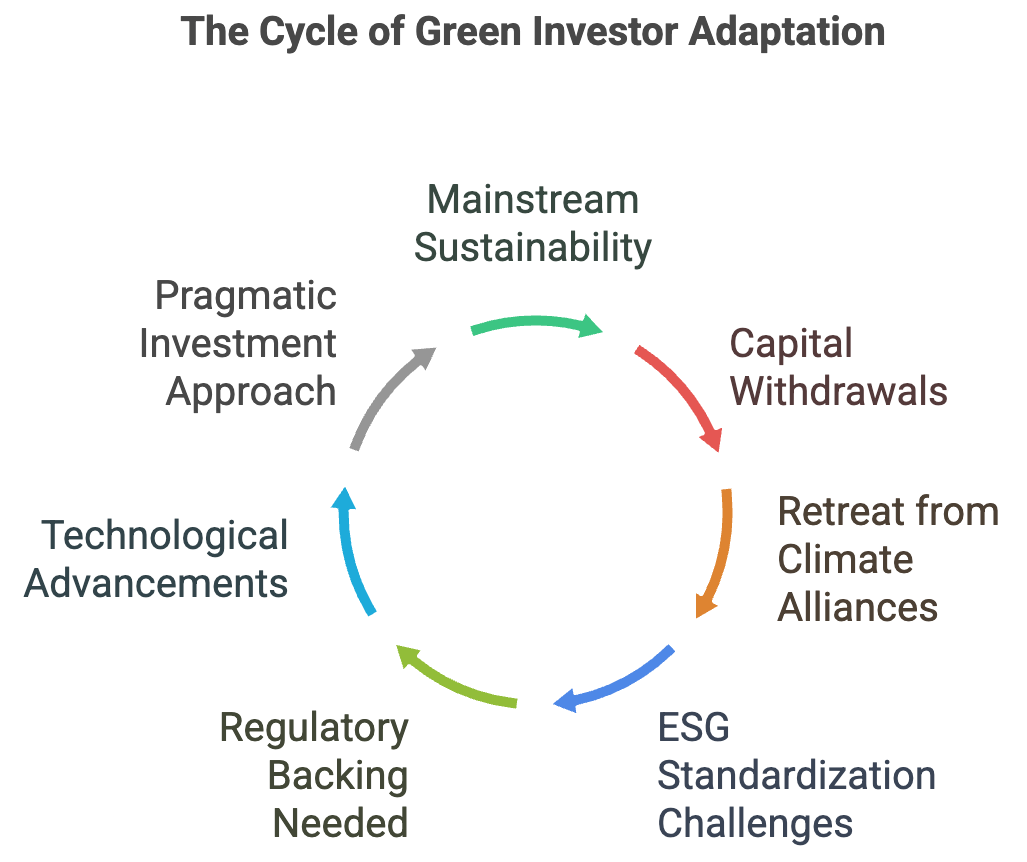

The rise of green investor groups has been instrumental in mainstreaming sustainability within financial markets. Yet, the recent wave of capital withdrawals, the retreat from climate alliances, and the challenges in ESG standardization reveal that sustainable finance is still in its evolutionary phase. To maintain their influence and credibility, these groups must transition from symbolic commitments to enforceable action, ensuring that ESG considerations remain a fundamental pillar of investment strategy rather than a passing trend.

In a financial world where climate risk is increasingly being recognized as financial risk, the role of green investor groups must adapt. The path forward requires greater regulatory backing, technological advancements in ESG analysis, and a more pragmatic approach to sustainable investment. The coming years will determine whether green finance remains a transformative force or if it succumbs to the pressures of traditional financial priorities.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Shankhini Saha, the Director of Investor Relations at Dickenson, holds an MPhil with distinction from the University of Cambridge, UK, and a BA magna cum laude from The New School, USA. Specializing in stakeholder engagement across diverse sectors, Shankhini is dedicated to transparent communication and providing strategic insights into clients’ financial performance and growth initiatives. With a proven track record of managing complex investor relations for a diverse portfolio of global clients, she excels in crafting impactful narratives that resonate with investors, analysts, and stakeholders. Shankhini’s leadership in high-profile quarterly results hosting and comprehensive IR campaigns showcases her commitment to creating lasting value for issuers in the global capital market.

Green Investor Groups at a Crossroads

To download and save this article.

Authored by:

Shankhini Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment