From the horse’s mouth:

why direct investor communication surpasses IR proxies

As Investor Relations (IR) consultants, we often find ourselves in the position of “demystifying” what it is we actually do to newly listed entities. At first glance to a recently IPO’d CXO, IR might seem like just another corporate role— managing investor queries, coordinating reports, or arranging roadshows. However, anyone deeply involved in the public markets, it’s understood that IR is much more than this. It’s a finely tuned balancing act, a strategic partner to both management and shareholders, where good IR is rooted in a culture of active transparency, consistent engagement, and ultimately, a commitment to raising shareholder value.

But here’s the “so what?” of the matter: Why does this complex, multi-pronged role matter, and why is it essential for CFOs and CEOs to seamlessly integrate IR into the fabric of their company?

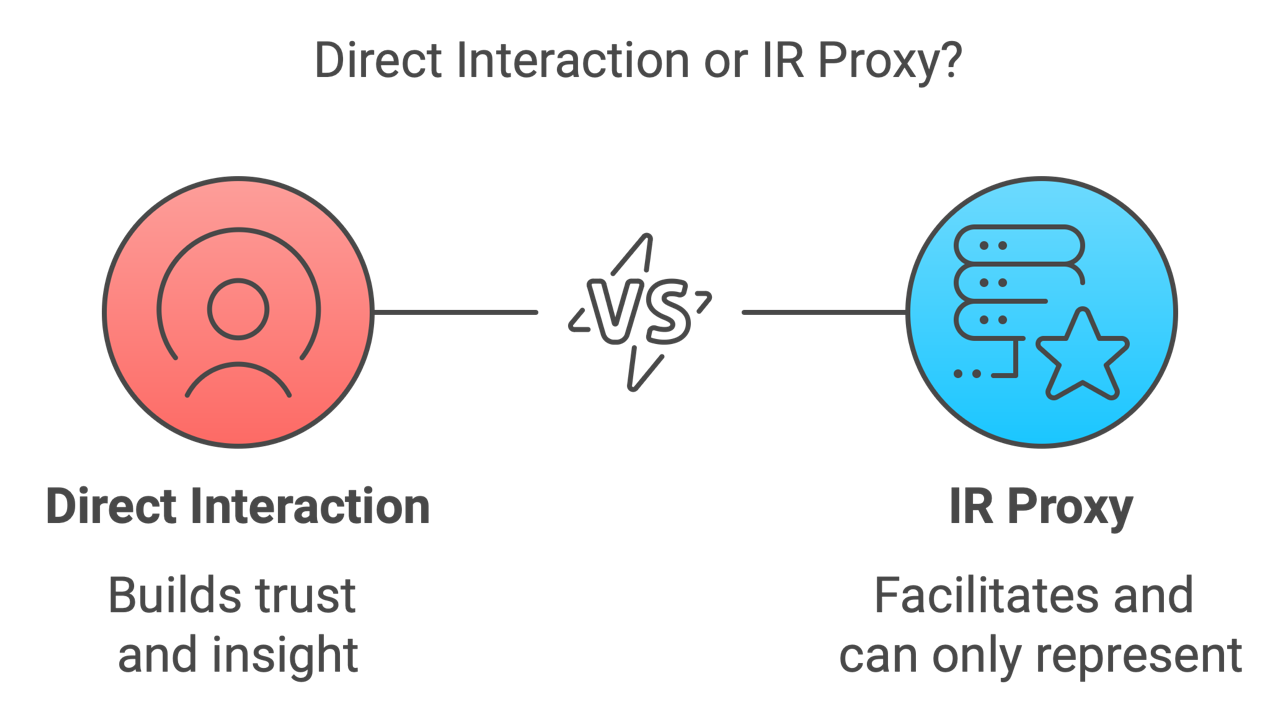

Investor Relations: Facilitating but Never Replacing

One of the most common misconceptions is that IR partners act as a “proxy” for management. Yes, as IR professionals, we facilitate access to the management team. We help translate the company’s strategy, highlight key risks, and ensure messaging is clear. But we can never replace that direct interaction. Investors need to “feel out” the management themselves—understand their mindset, how they view risks, and gain insight into their strategic psyche.

Management’s tone, confidence, and body language during meetings can reveal as much, if not more, than a written earnings report. Investors are not just evaluating numbers—they are gauging the leadership’s ability to navigate complex market environments, position the company competitively, and address sector-specific risks. As IR professionals, we help shape the narrative, but the true test is how the management team presents and responds in front of its investors. We are the facilitators of that critical dialogue, and supporting to the management to be best prepared for these interactions.

Storytelling: The Heart of IR Strategy

One of the cornerstones of our role is storytelling—but not in the traditional sense. We craft and manage the company’s narrative, positioning it in a way that speaks directly to the investor community’s concerns and expectations. Whether a company is preparing for an IPO or managing its post-IPO communications, the story must be compelling, transparent, and resonate with long-term value creation.

For newly IPO’d companies, this is especially crucial. Investors are looking for consistency in messaging, clarity on growth strategy, and a deep understanding of risks—especially in uncertain times. The narrative cannot be static. It must evolve with market conditions, regulatory changes, and internal developments. This is where IR’s role becomes vital: we ensure that the message delivered is aligned across all channels, and that investors have a clear, accurate picture of the company’s trajectory

Perception Studies: Listening to the Investment Community

Another key element of effective IR is feedback and perception studies. Understanding how the market perceives the company—how the narrative is resonating, what concerns are prevalent, and how the company’s actions are being interpreted—is invaluable. This is particularly important in times of uncertainty, such as layoffs or shifts in industry standards.

For instance, in a climate where Human Capital Management has come under scrutiny, companies must demonstrate not just financial resilience but also social responsibility. This is where stakeholder capitalism takes precedence—balancing the needs of employees, communities, and shareholders alike. Investors are paying closer attention to how companies treat their workforce, especially during difficult times like layoffs in sectors such as tech, where the headlines are dominated by workforce reduction.

IR professionals act as the bridge, ensuring management understands market sentiment and investors understand management’s vision for mitigating risks and aligning with emerging trends.

Navigating Risks and Corporate Governance

As IR professionals, we are often the ones on the front line, understanding the risks that investors are most concerned about. These are not always the obvious ones—like economic downturns—but more sector-specific risks like energy scarcity, supply chain disruptions, or the evolving ESG (Environmental, Social, Governance) landscape. Our role is to guide the conversation around how the company is de-risking itself, aligning with sustainability goals, and meeting regulatory expectations.

As we work closely with CXOs, one thing is clear: corporate governance cannot be an afterthought. ESG principles, sustainability frameworks, and corporate governance best practices must be woven into the company’s DNA. For newly IPO’d companies especially, these elements are scrutinized heavily by investors, and it’s up to the IR team to ensure these topics are addressed in every investor communication.

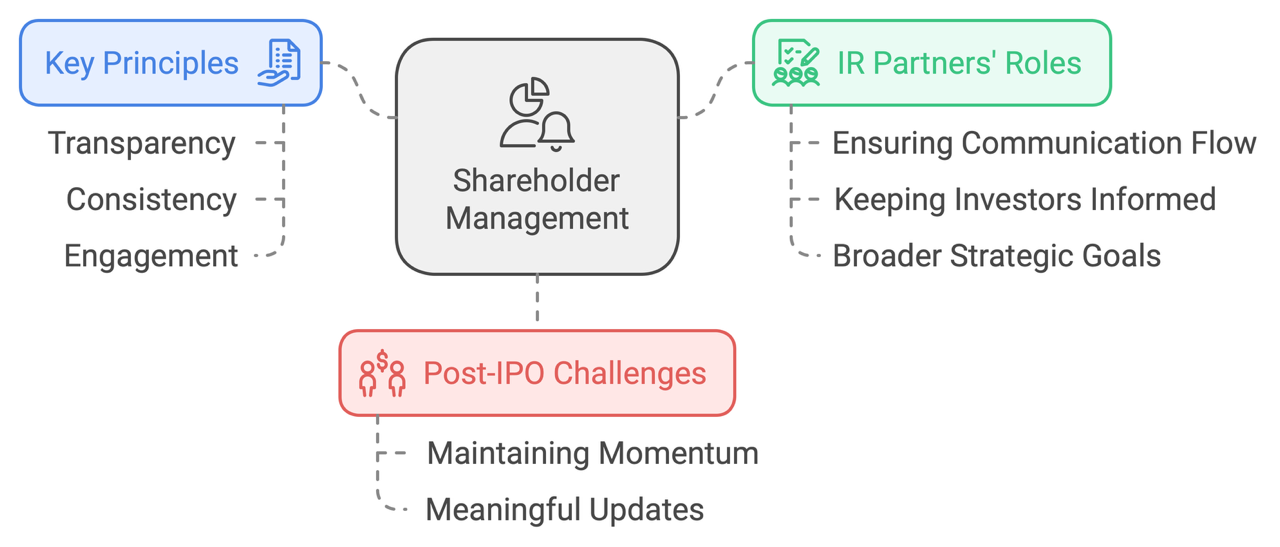

The Road Ahead: Building Relationships, Not Just Transactions

In today’s investment climate, shareholder management is about creating long-term relationships, not just transactional engagements. Shareholders—whether institutional or retail—expect ongoing communication and access. Transparency, consistency, and engagement are the cornerstones of this relationship.

Post-IPO, companies are often met with a wave of interest and excitement, but maintaining that momentum requires regular, meaningful updates. IR partners work to ensure the flow of communication remains steady and that investors always feel they are being kept in the loop, not just on financial performance but on broader strategic goals.

The Role of AI in Investor Engagement

As we look to the future, IR professionals must also be cognizant of the increasing role of AI in how investors evaluate companies. Investors are already using AI tools to track sentiment, analyse company communications, and identify themes. This means that every press release, earnings call, and even social media post must be meticulously crafted with these insights in mind.

Our role as IR professionals is evolving to not only manage perceptions in real-time but to anticipate how AI-driven models might interpret our messaging. The use of sentiment trackers and AI-powered analysis of management’s tone and language is becoming increasingly relevant, particularly during earnings calls where investors are not just looking for numbers but for signs of confidence, trustworthiness, and strategic clarity.

Conclusion: A Strategic Partner in Value Creation

At the heart of the IR function is a deep commitment to shareholder value. Our role is to ensure that the company’s strategy is communicated clearly and effectively, that the management team has access to valuable investor feedback, and that risks are proactively addressed. In this way, IR serves as a strategic partner to the CFO and CEO, facilitating relationships, fostering transparency, and driving long-term growth.

As companies navigate the complexities of today’s markets, IR’s role is more critical than ever. We are the bridge between the company and its investors— ensuring that the story told is compelling, the risks are prepared for, and that market opportunities are seized. But, ultimately, it’s the management’s authenticity and vision that seals the deal.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

enquiry@dickensonworld.com.

From the horse’s mouth: why direct investor communication surpasses IR proxies

To download and save this article.

Authored by:

Ms. Shankhini Saha

Director, Dickenson World

Mumbai

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment