Digital Transformation and Technology Adoption:

A CFO’s Strategic Ally

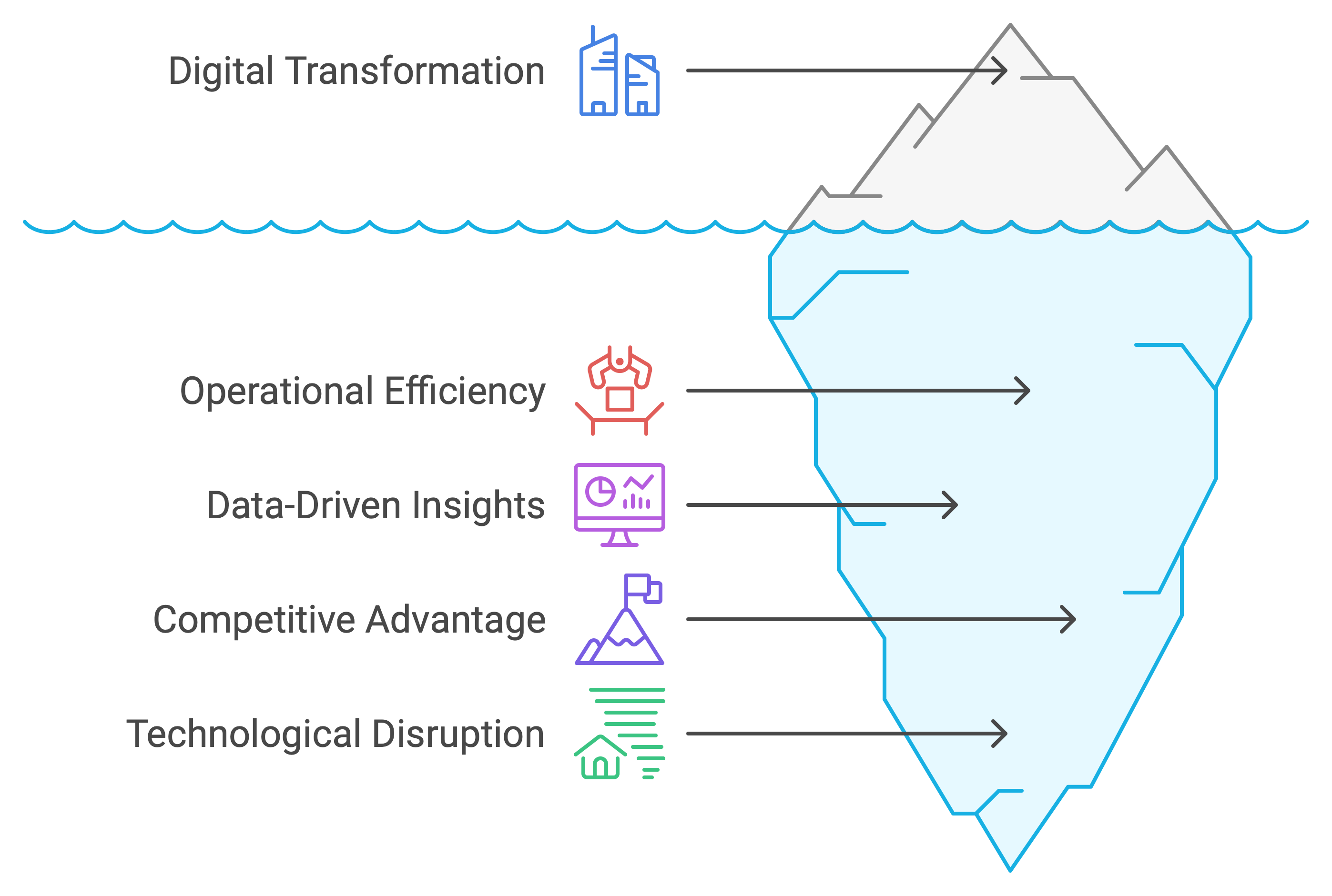

Why Digital Transformation Is Interesting and Relevant to CFOs

-

Enhancing Operational Efficiency

CFOs are constantly tasked with doing more with less. Digital transformation empowers them to drive operational efficiency, cut costs, and maximize productivity. Technologies such as Robotic Process Automation (RPA), cloud computing, and advanced Enterprise Resource Planning (ERP) systems allow for the automation of routine tasks, improved workflow, and reduced manual errors. According to Gartner, by 2025, 85% of enterprises are expected to have implemented RPA solutions, indicating its critical role in improving efficiency (Gartner, 2023) [https://www.gartner.com/en/newsroom/press-releases].

Cloud-based ERP systems such as SAP S/4HANA or Oracle Cloud Financials offer CFOs an integrated view of financial data, enabling real-time visibility into financial operations and processes. This real-time access provides better control, reduces process time, and improves the accuracy of financial reporting. By embracing these technologies, CFOs are positioned to transform the finance function from a cost centre to a value-generating entity.

-

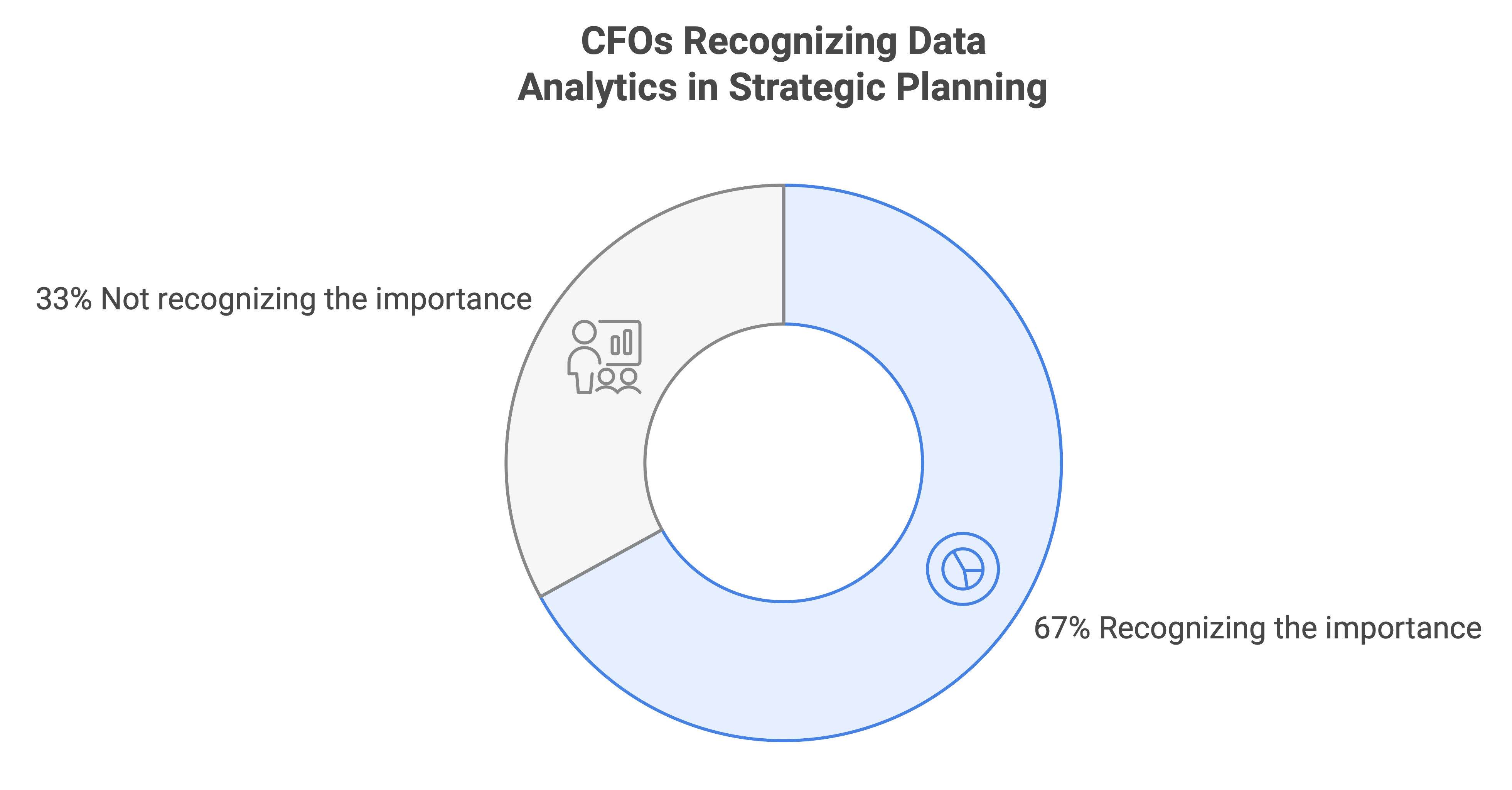

Data-Driven Decision Making

A Deloitte survey indicated that 67% of CFOs acknowledge the importance of data analytics in influencing their strategic planning decisions (Deloitte, 2023) [https://www2.deloitte.com/insights/us/en/topics/analytics.html].

The significance of data in the digital era cannot be overstated. CFOs need to leverage data to make informed and strategic decisions. Advanced analytics, predictive models, and artificial intelligence (AI) offer the capability to turn raw data into actionable insights. For instance, AI-driven algorithms can identify spending patterns, optimize working capital, and project future revenue streams with higher accuracy.

The concept of digital twins, wherein companies create a virtual model of their financial systems and assets, allows CFOs to run simulations and predict financial outcomes under various scenarios. This capability transforms financial planning and analysis (FP&A) activities, empowering CFOs to mitigate risks proactively and enhance capital allocation strategies.

-

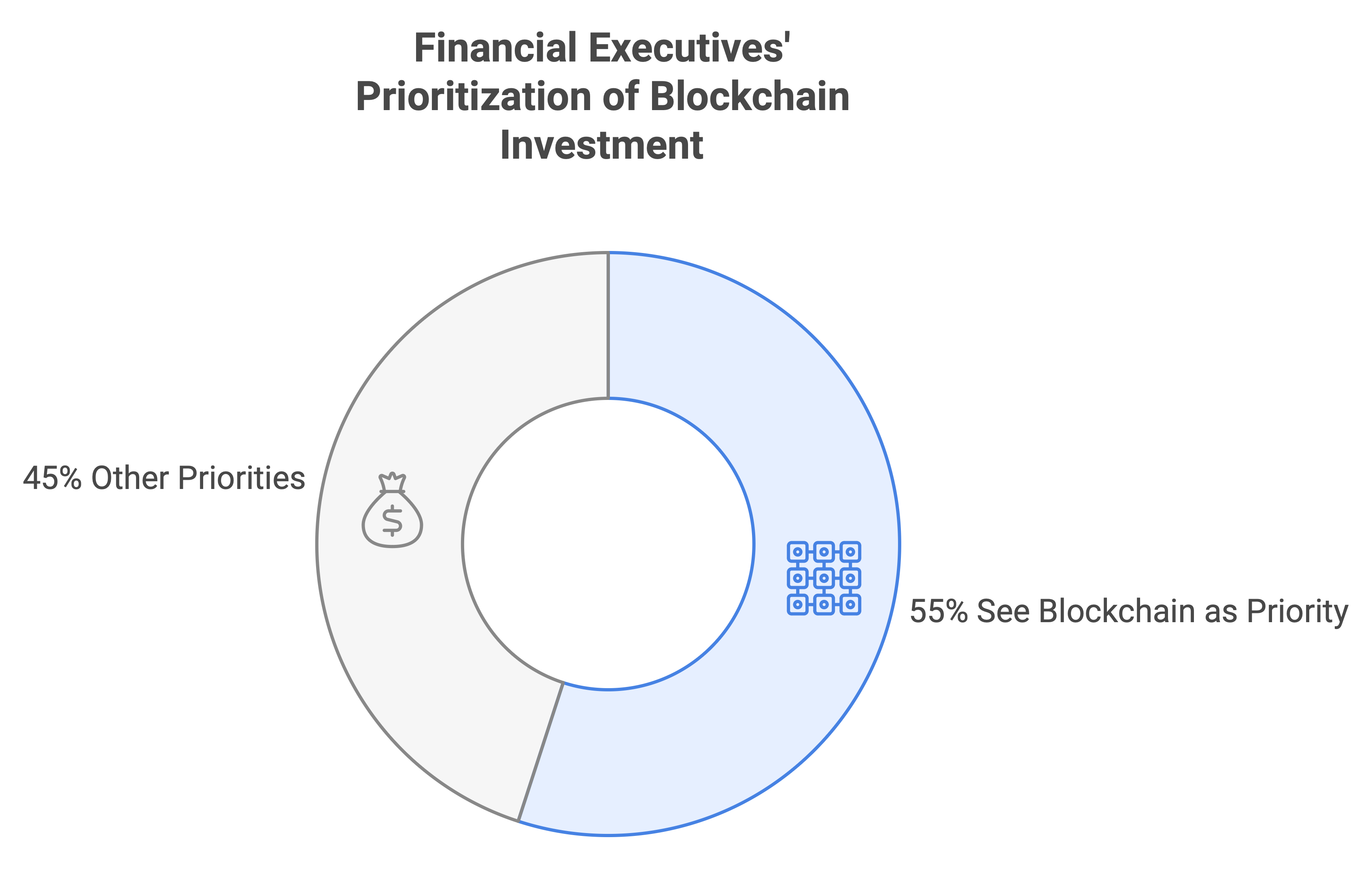

Gaining a Competitive Edge

PwC’s 2024 Global Blockchain Survey found that 55% of financial executives see blockchain as a priority investment for digital transformation (PwC, 2024) [https://www.pwc.com/blockchain-report].

In an era where technological disruptions can alter entire industries, embracing digital transformation becomes a differentiating factor. A company’s adaptability to new technologies often signifies its capacity to innovate and stay ahead of competitors. CFOs can play a pivotal role by directing investments in technologies that not only enhance internal efficiencies but also unlock new revenue streams.

For example, blockchain technology is making headway into financial operations, providing transparency and enabling faster transactions with reduced fraud risks. Companies that integrate blockchain to manage contracts, payments, and data sharing gain an undeniable advantage over their slower-to-adapt competitors.

How Your IR Agency Can Help CFOs Navigate Digital Transformation

-

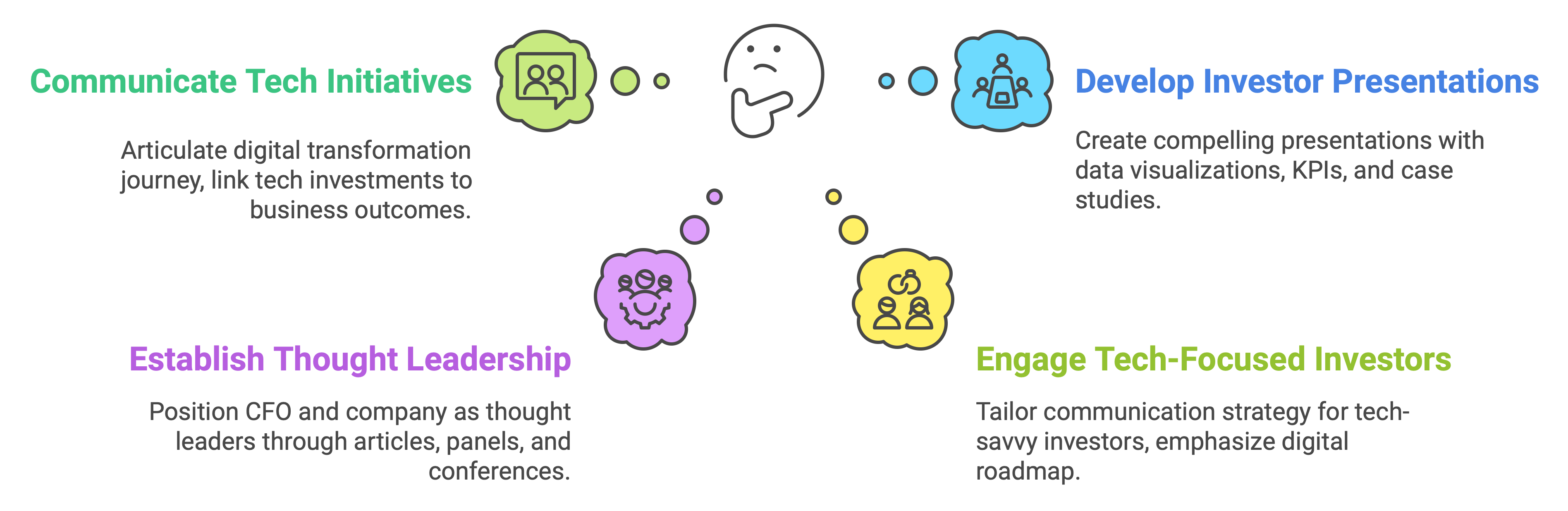

Communicating Tech Initiatives Effectively

Investor Relations plays a crucial role in articulating a company’s digital transformation journey. Communicating these initiatives involves not just outlining the technology investments but also linking them to tangible business outcomes. Investors need to understand how these investments will enhance value, drive growth, and mitigate risks.

An IR agency can assist CFOs by crafting a compelling narrative that resonates with investors. This includes demonstrating how the technology initiatives are aligned with overall corporate strategy, clearly showcasing the anticipated returns on technology investments, and communicating the positive implications for stakeholder value. Thoughtful communication helps foster investor confidence, a critical component when navigating significant transformation projects.

-

Developing Investor Presentations

Effective investor presentations are vital in conveying the message that technology adoption is driving growth and operational efficiency. An IR agency can develop these presentations by including data visualizations, key performance indicators (KPIs), and case studies that illustrate how the adoption of specific technologies has positively impacted the company.

Visual elements such as timelines of digital transformation milestones, efficiency gains from automated processes, and comparative analyses of pre- and post-adoption metrics can make these presentations compelling. Investors appreciate transparency, and showcasing how digital investments translate into concrete value can help build trust and foster long-term relationships.

-

Establishing Thought Leadership

Positioning the CFO and the company as thought leaders in digital transformation enhances credibility and reinforces the company’s commitment to innovation. Thought leadership can be established by crafting insightful articles, participating in high-profile panels, and speaking at relevant conferences. For instance, a CFO could write a whitepaper on the impact of AI on financial transparency or present it at a tech-driven finance forum.

An IR agency’s expertise in content creation and strategic communication can significantly enhance the effectiveness of these thought leadership initiatives. The agency can ensure that key themes such as innovation, adaptability, and future readiness are consistently highlighted across various channels.

-

Engaging with Technology-Focused Investors

Tech-savvy investors are increasingly interested in companies that embrace technology to differentiate themselves. Engaging with such investors requires a tailored communication strategy that emphasizes the company’s digital roadmap, ongoing technology partnerships, and integration of future-proof solutions. An IR agency can facilitate these interactions by organizing specific meetings and ensuring that CFOs are equipped with the necessary messaging that aligns with investor expectations.

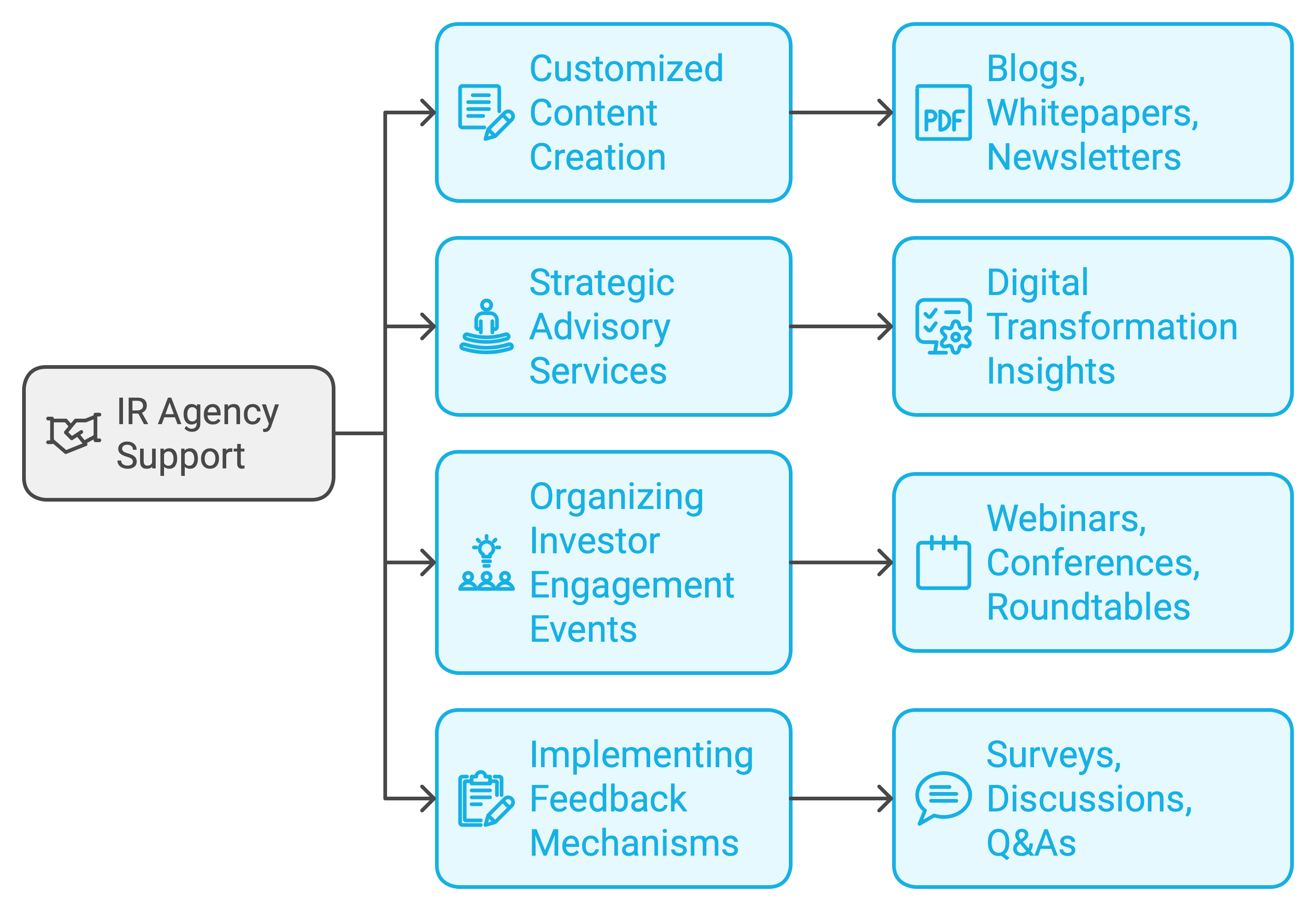

Leveraging Your IR Connect to Support CFOs

-

-

Customized Content Creation

Content is at the heart of effective communication. A tailored approach that speaks directly to the interests and needs of CFOs is essential. An IR agency can help create customized content such as blogs, whitepapers, newsletters, and industry reports that focus on areas like ESG, digital transformation, and governance—topics highly relevant to modern CFOs.

For instance, a whitepaper on “The Role of Blockchain in Enhancing Financial Transparency” could capture the attention of tech-savvy investors. Similarly, a blog exploring “How AI is Transforming Financial Forecasting” would appeal to those interested in cutting-edge technology in finance. This type of content not only highlights the company’s tech initiatives but also positions its leadership team as forward-thinking and innovative.

-

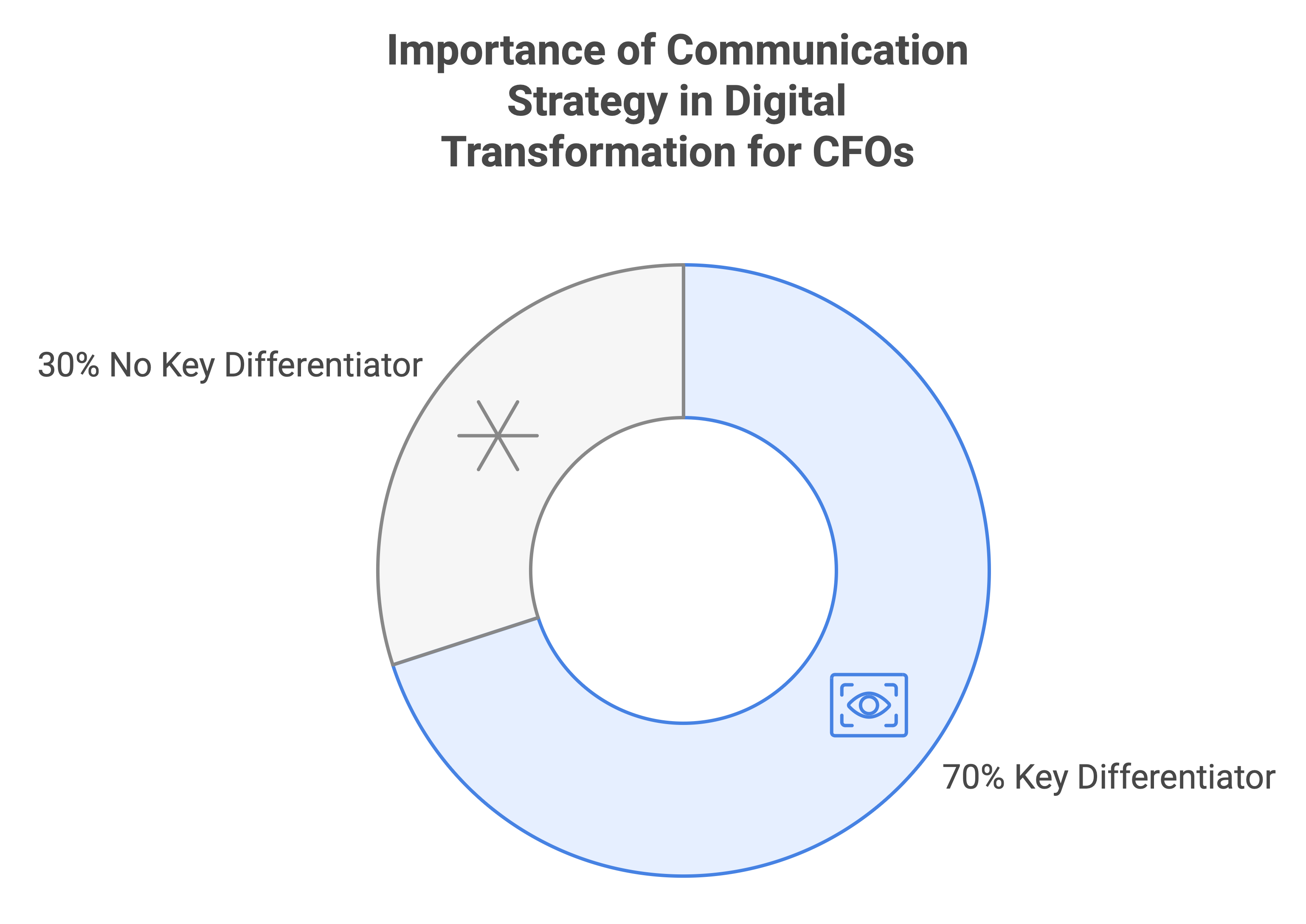

Strategic Advisory Services

McKinsey’s 2024 report on the evolving role of CFOs highlights that 70% of CFOs believe that a clear communication strategy around digital transformation is a key differentiator in investor relations (McKinsey, 2024) [https://www.mckinsey.com/corporate-finance/role-of-cfo].

CFOs can benefit from the strategic insights that an IR agency provides, particularly when integrating technology into financial communications and investor relations strategies. The expertise offered can cover the following:

- Identifying which aspects of digital transformation are most important to stakeholders and developing targeted messaging.

- Advising on the timing of communication, ensuring that digital initiatives are communicated effectively at earnings calls, roadshows, and other critical investor events.

- Assisting CFOs in addressing investor questions related to technology investments, expected returns, and risks involved.

-

Organizing Investor Engagement Events

Organizing targeted events is an excellent way to bridge the gap between the CFO and the investor community regarding digital transformation. Webinars, conferences, and roundtable discussions can provide valuable platforms for sharing knowledge and discussing challenges and opportunities presented by technology adoption.

For example, hosting a roundtable on “The Future of Financial Management in the AI Era” could attract both investors interested in tech and those looking at the financial stability of the company. A well-executed event positions the company as an authority on both finance and technology, reinforcing its appeal to a broader investor base.

-

Implementing Feedback Mechanisms

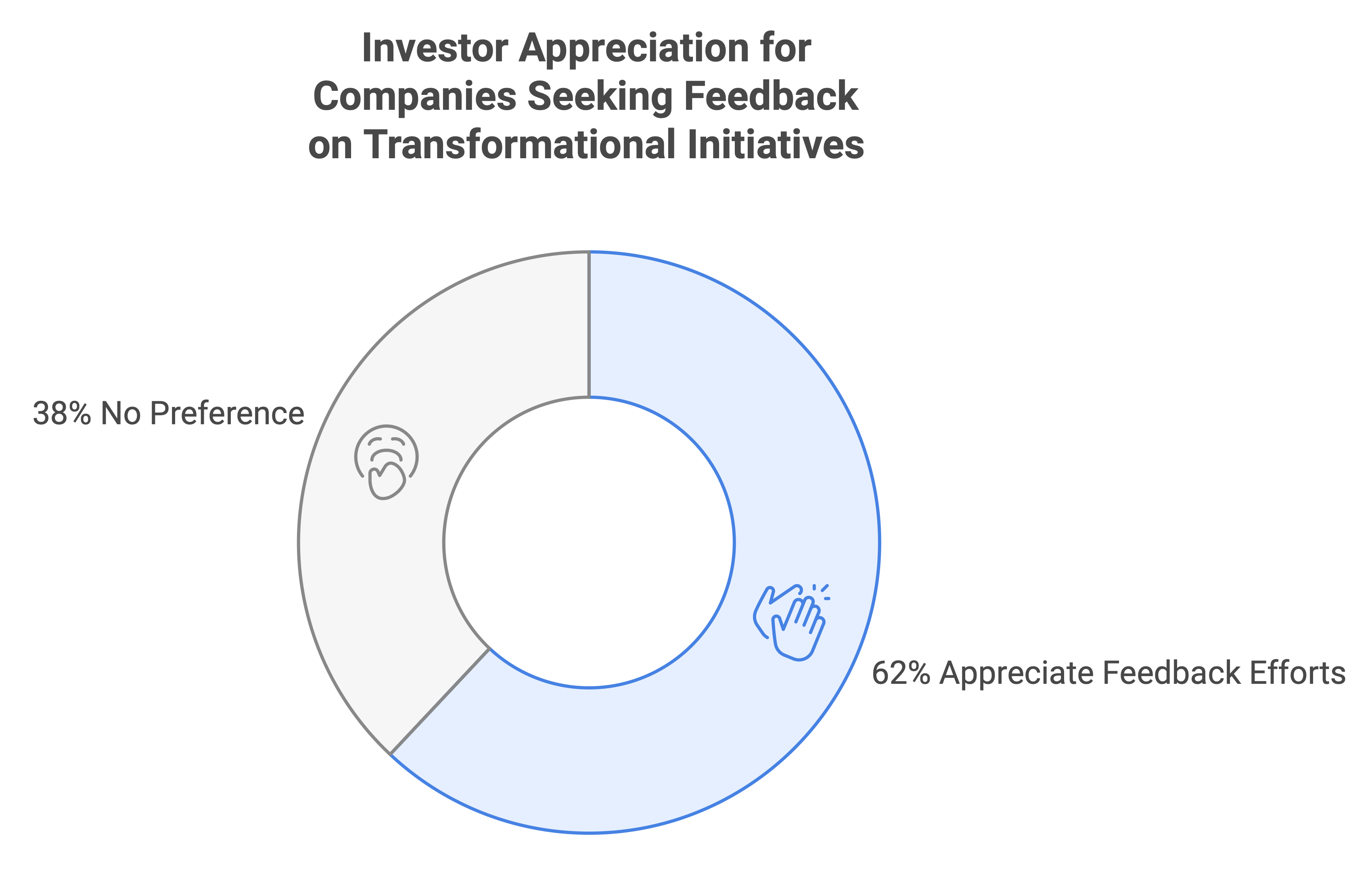

A KPMG report found that 62% of investors appreciate companies that actively seek their feedback on transformational initiatives (KPMG, 2023) [https://home.kpmg/xx/en/home/insights.html].

Continuous improvement in communication is key to investor satisfaction. Implementing feedback mechanisms such as surveys, investor roundtable discussions, or post-event Q&As allows CFOs to understand investor concerns and expectations better.

An IR agency can design and manage these feedback mechanisms, helping CFOs gather qualitative and quantitative data about investor perceptions. These insights can guide future communication strategies, ensuring they are more aligned with what investors find relevant and valuable.

-

Practical Case Studies and Examples

-

Walmart’s Digital Transformation Journey

Walmart’s digital transformation journey is a classic example of how technology can be leveraged to drive efficiency and gain a competitive edge. The retail giant invested heavily in data analytics, AI, and automation to streamline its supply chain and personalize customer experiences. CFO Brett Biggs played a vital role in ensuring that the digital investments aligned with Walmart’s broader financial goals, leading to increased profitability and a more agile supply chain.

The role of Investor Relations was pivotal in communicating these changes to investors. Walmart’s quarterly earnings calls highlighted the positive impact of technology investments on key metrics such as inventory turnover and customer satisfaction, thereby garnering positive feedback from shareholders (Harvard Business Review, 2024) [https://hbr.org/2024/04/walmart-digital-transformation].

-

Siemens and Thought Leadership in Digital Finance

Siemens took a proactive approach to digital transformation, integrating AI-driven financial systems and automation to enhance efficiency. CFO Ralf P. Thomas became a thought leader in the digital finance space, frequently authoring articles and participating in panels on technology in financial management. Siemens’ IR agency helped craft insightful content that showcased Thomas’s leadership and positioned Siemens as a pioneer in digital finance.

Their proactive communication strategy helped Siemens engage with technology-focused investors and secure their confidence. This emphasis on thought leadership and transparent communication resulted in an 18% increase in investor sentiment around Siemens’s commitment to innovation (Siemens Annual Report, 2023) [https://www.siemens.com/annual-report].

In Closing

For CFOs, the adoption of digital technologies is no longer an optional add-on; it is a strategic imperative that touches every aspect of the business. Operational efficiency, data-driven decision-making, and maintaining a competitive edge are just some of the benefits that digital transformation brings to the CFO’s domain. The effective adoption and integration of these technologies significantly influence a company’s growth trajectory and market perception.

Investor Relations agencies play an indispensable role in helping CFOs navigate the complexities of digital transformation. By articulating the digital journey effectively, developing engaging investor presentations, positioning the company as a thought leader, and facilitating stakeholder engagement, IR agencies help CFOs not only communicate value but also build trust and foster investor confidence.

Leveraging IR connections to create customized content, offer strategic advisory, organize engagement events, and implement feedback mechanisms provides CFOs with a robust support system as they embrace and advocate for digital transformation. The collective impact of these strategies ensures that companies are well-positioned to thrive in an increasingly digital world, capturing the interest and investment of those who recognize the strategic value of technological innovation.

About the Author

With over 25 years of experience in corporate finance and a deep-rooted understanding of ESG imperatives, Manoj Saha brings a wealth of knowledge to the discourse on corporate governance. Educated in the UK in Accountancy & Finance, he has dedicated his career to guiding organizations through the intricacies of financial management and stakeholder engagement across global markets, including India, the USA, the UK, and the Middle East and North Africa (MENA) region.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

enquiry@dickensonworld.com.

Digital Transformation and Technology Adoption

To download and save this article.

Authored by:

Manoj Saha

Managing Director

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment