Designing the Invisible Hand:

Adam Smith trusted the invisible hand. SEBI prefers to design it, no longer letting the market’s invisible forces self-correct; it’s building the tech architecture that makes market trust possible.

India’s capital markets are undergoing a quiet revolution. One not of headlines, but of systems. The Securities and Exchange Board of India (SEBI), long a cautious steward of market stability, has entered a new phase of assertive modernisation. In recent months, it has embarked on a two-pronged strategy: upgrading the market’s digital “plumbing” while tightening the screws on governance, particularly in the high-velocity but loosely governed Small and Medium Enterprise (SME) segment.

The subtext is unmistakable: transparency is no longer a moral preference; it is the price of participation.

Rewiring the System: Technology as the First Line of Regulation

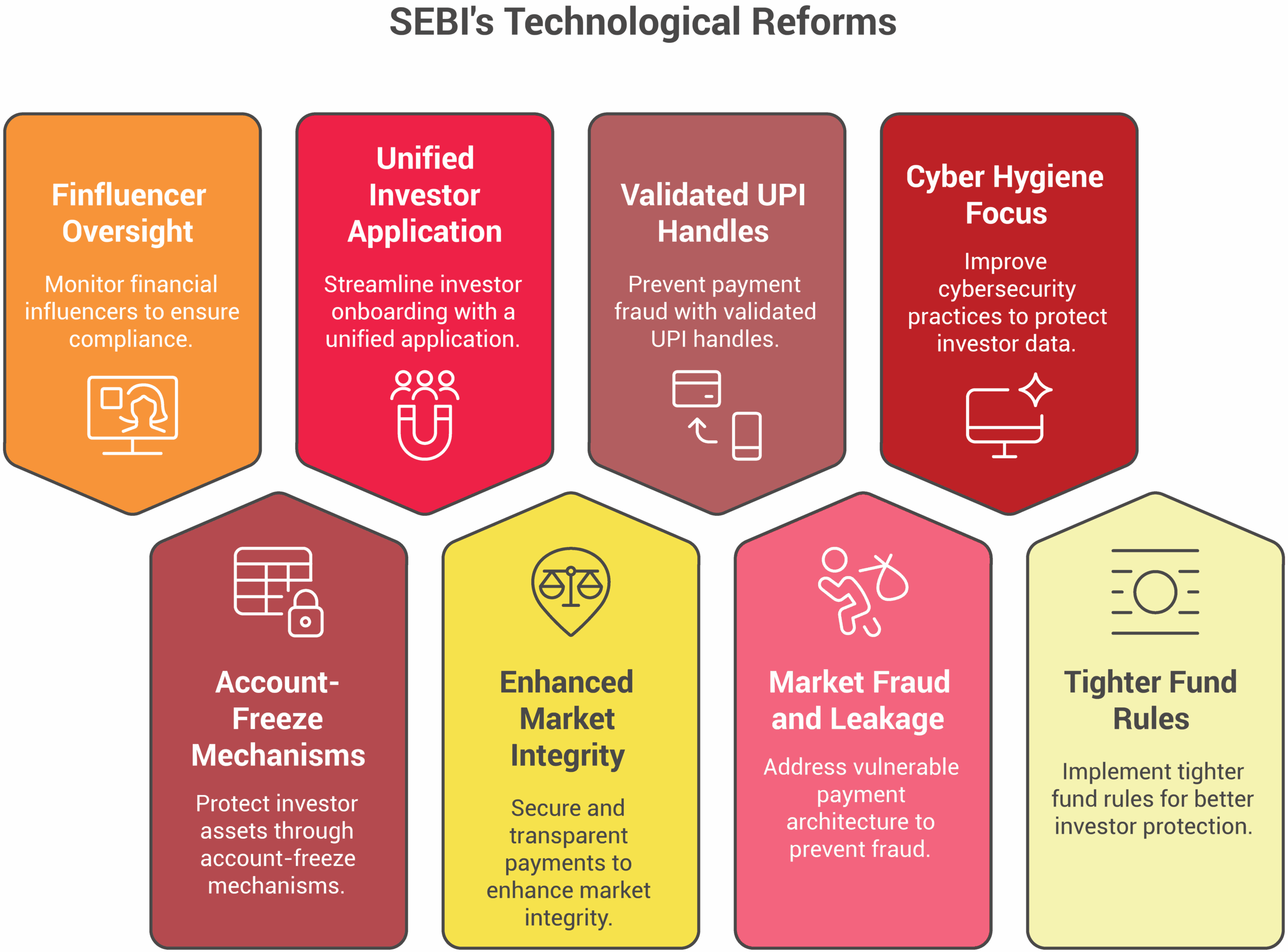

SEBI’s technological reforms may appear incremental, but their cumulative intent is systemic. The rollout of Validated UPI Handles, a Unified Investor Application, and voluntary account-freeze mechanisms is more than an efficiency drive. It is a pre-emptive strike against fraud and leakage in the market’s payment architecture.

These measures come alongside broader oversight of “finfluencers,” tighter rules on fund upstreaming, and a growing insistence on cyber hygiene. Collectively, they signal the regulator’s belief that market integrity begins in code.

“Market integrity now begins in code.”

For issuers, the compliance translation is immediate and non-trivial. Offer documents referencing UPI must incorporate validation disclosures, and Annual Reports are now expected to demonstrate a granular understanding of payment-system controls. Investor Relations teams, often the quiet diplomats of compliance, must update “Risk Factors” and “Internal Control” sections to align with this new technological scaffolding. The digital firewall, in short, is becoming part of the governance narrative.

Enforcement with Velocity: The SME Reckoning

If infrastructure reform represents SEBI’s hand of design, enforcement is its clenched fist. The regulator’s recent actions, most notably against Synoptics Technologies, whose promoters were barred over alleged diversion of IPO proceeds, mark a new threshold of intolerance. The simultaneous sanctioning of its lead manager underscores a message of collective accountability: weak diligence will no longer be excused by market exuberance.

This episode, amplified by the media and mirrored by further actions against Trafiksol ITS Technologies, has reframed SME governance as a public-interest concern. The regulator’s focus on tracing related-party linkages and end-use of funds reflects an evolved understanding of market abuse: in the SME space, opacity is the most tradable commodity.

“In the SME space, opacity was the most tradable commodity.”

The numbers tell their own story. Penalties surged elevenfold to ₹813.83 crore in FY25. Nearly 900 entities were charged with fraudulent or unfair practices, while SEBI’s litigation success rate exceeded 70% before the Securities Appellate Tribunal and 90% before the Supreme Court. The age of polite warnings appears over.

The Economics of Compliance

This muscular oversight, however, comes with cost. “Lawyers and market practitioners caution that over-engineered rules could discourage smaller, legitimate enterprises from listing, constraining capital formation in precisely the segment India seeks to nurture.” But few dispute the trade-off. Market depth built on mistrust is, at best, a mirage.

For the regulator, the philosophy seems clear: credibility now outweighs convenience.

| Regulatory Measure | Objective and Market Impact |

|---|---|

| Mandatory Profitability | Issuers must post ₹3 crore operating profit in any two of the past three years, filtering out financial pretenders. |

| OFS Restriction | Offer-for-Sale capped at 20% of issue size to prevent promoter-driven exits. |

| Minimum Allottees Raised | From 50 to 200, broadening liquidity and diffusing manipulation risk. |

| Promoter Lock-in Extended | Five-year holding requirement reinforces skin in the game. |

| Stricter Fund Monitoring | Oversight threshold reduced to ₹20 crore; “General Corporate Purpose” capped at 10% or ₹10 crore. |

| RPT Alignment | Main-board related-party rules extended to SMEs, codifying disclosure parity. |

The implicit bargain is one of maturity: India’s SME exchanges are being forced to evolve from fundraising platforms into regulatory ecosystems.

Market Utilities and the Public Interest

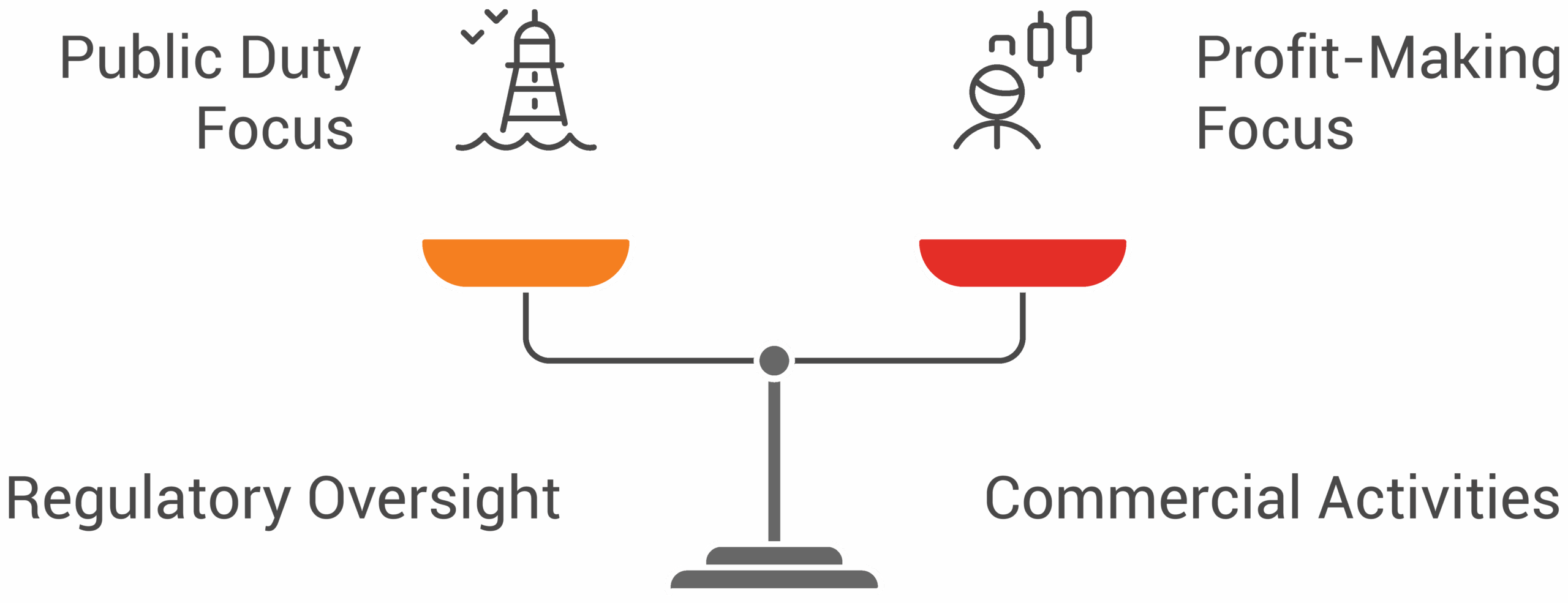

SEBI’s reforms extend beyond issuers to the very architecture of market utilities. The regulator has mandated a reorganisation of the Market Infrastructure Institutions (MIIs), stock exchanges, depositories, and clearing corporations, into three verticals: Critical Operations, Regulatory Oversight, and Commercial Activities.

Two new Executive Directors will now head the first two verticals and sit on governing boards, reporting directly to oversight committees without the Managing Director’s presence. This segregation of power seeks to eliminate the long-standing tension between profit-making and public duty.

Codified Key Management Personnel (KMP) roles, such as the Chief Information Security Officer (CISO) and Chief Technology Officer (CTO), formalise accountability for both system resilience and data integrity. In essence, SEBI is redefining market institutions not as profit engines, but as custodians of systemic trust.

Cybersecurity: From Compliance to Core Function

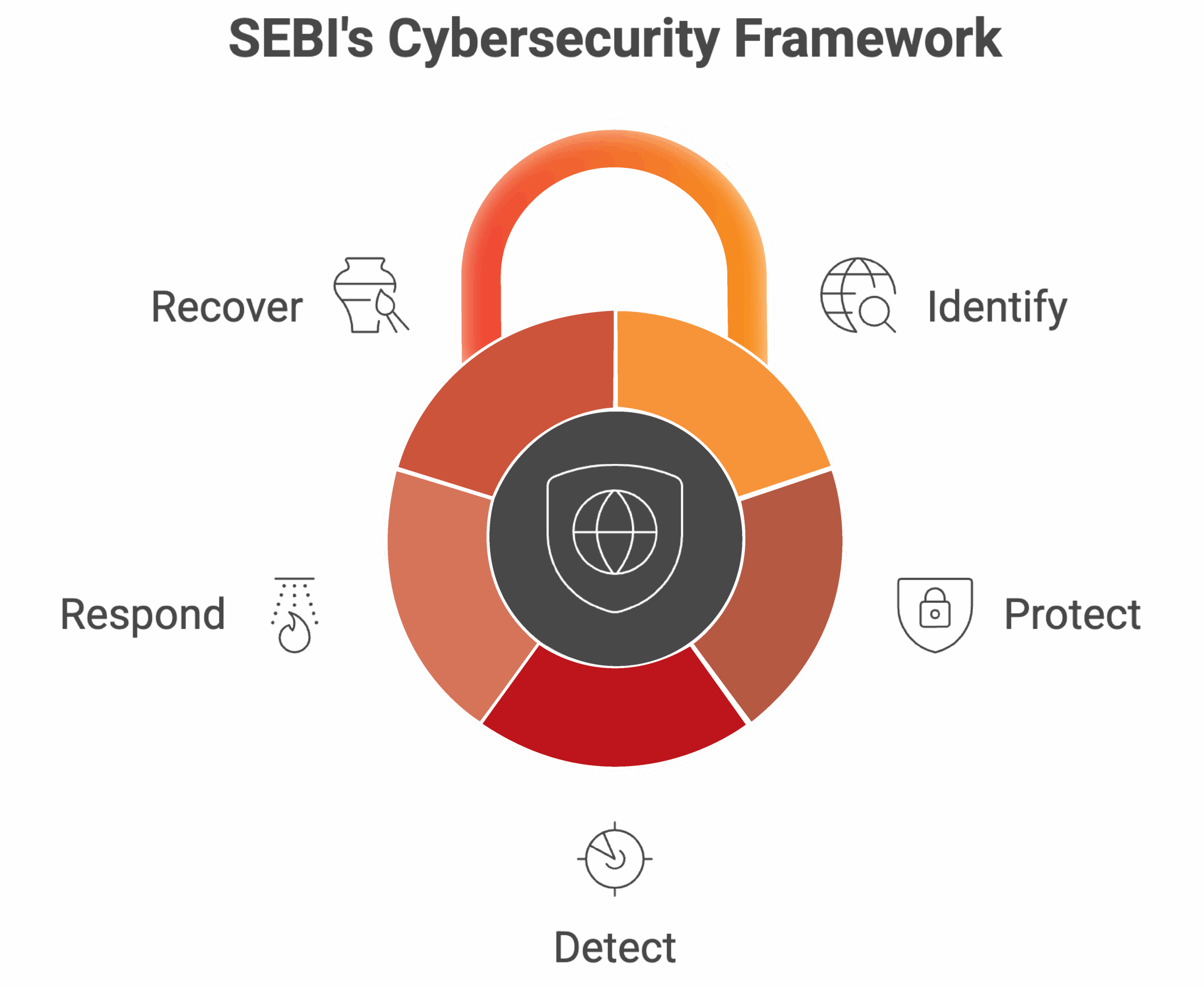

The consolidation of prior circulars into the Consolidated Cybersecurity and Cyber Resilience Framework (CSCRF) reveals SEBI’s deeper thesis: cyber stability is market stability.

The framework mirrors the NIST standard’s five pillars, Identify, Protect, Detect, Respond, Recover, and applies them across all Regulated Entities with graded intensity. Its prescriptions are stringent: a Security Operations Centre (SOC) for continuous 24×7 monitoring, breach reporting within six hours, a two-hour recovery target for critical systems, and ISO 27001 certification for MIIs.

“In SEBI’s calculus, resilience is regulation.”

These are not checkboxes, they are design principles for a market that increasingly trades in data as much as in equity. In SEBI’s calculus, resilience is now a form of regulation.

The IR Mandate: Governance as Strategy

Investor Relations, often viewed as a communications function, now sits squarely in the path of regulatory scrutiny. SEBI’s evolving disclosure framework makes IR departments the front line of compliance translation.

For SME issuers in particular, governance storytelling has become inseparable from risk management. Strengthened use-of-proceeds monitoring, tighter related-party registers, and meticulously documented audit-committee minutes are no longer best practices, they are survival mechanisms.

“Governance storytelling has become inseparable from risk management.”

In the current environment, investor engagement must speak the language of systems: how money moves, how data is secured, how control is evidenced. The market, in turn, rewards those who can explain, not just promise, how compliance underwrites growth.

The Broader Arc

SEBI’s actions reveal an institution increasingly aligned with the logic of modern financial regulation: that the health of a market depends less on volume and more on verifiable integrity. By combining enforcement prowess with systemic foresight, India’s market guardian is shifting from reactive oversight to anticipatory governance.

“The invisible hand is no longer left to chance, it’s being intelligently engineered.”

If these reforms succeed, India’s capital markets will emerge not merely larger, but cleaner, quicker, and more credible, a marketplace where confidence is designed in, not enforced after the fact.

References

-

Securities and Exchange Board of India (SEBI), Annual Report FY2024–25.

-

SEBI Circular: Consolidated Cybersecurity and Cyber Resilience Framework (CSCRF), June 2024.

-

SEBI Discussion Paper: Review of Regulatory Framework for SME Listing, July 2024.

-

National Stock Exchange (NSE) Data Repository, SME IPO Trends 2023–25.

-

Financial Express, “SEBI bars Synoptics promoters, lead manager in IPO fund misuse case,” July 2025.

-

Reserve Bank of India (RBI), Report on Trend and Progress of Banking in India 2024–25.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Shankhini Saha, the Director of Investor Relations at Dickenson, holds an MPhil with distinction from the University of Cambridge, UK, and a BA magna cum laude from The New School, USA. Specializing in stakeholder engagement across diverse sectors, Shankhini is dedicated to transparent communication and providing strategic insights into clients’ financial performance and growth initiatives. With a proven track record of managing complex investor relations for a diverse portfolio of global clients, she excels in crafting impactful narratives that resonate with investors, analysts, and stakeholders. Shankhini’s leadership in high-profile quarterly results hosting and comprehensive IR campaigns showcases her commitment to creating lasting value for issuers in the global capital market.

Designing the Invisible Hand

To download and save this article.

Authored by:

Shankhini Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment