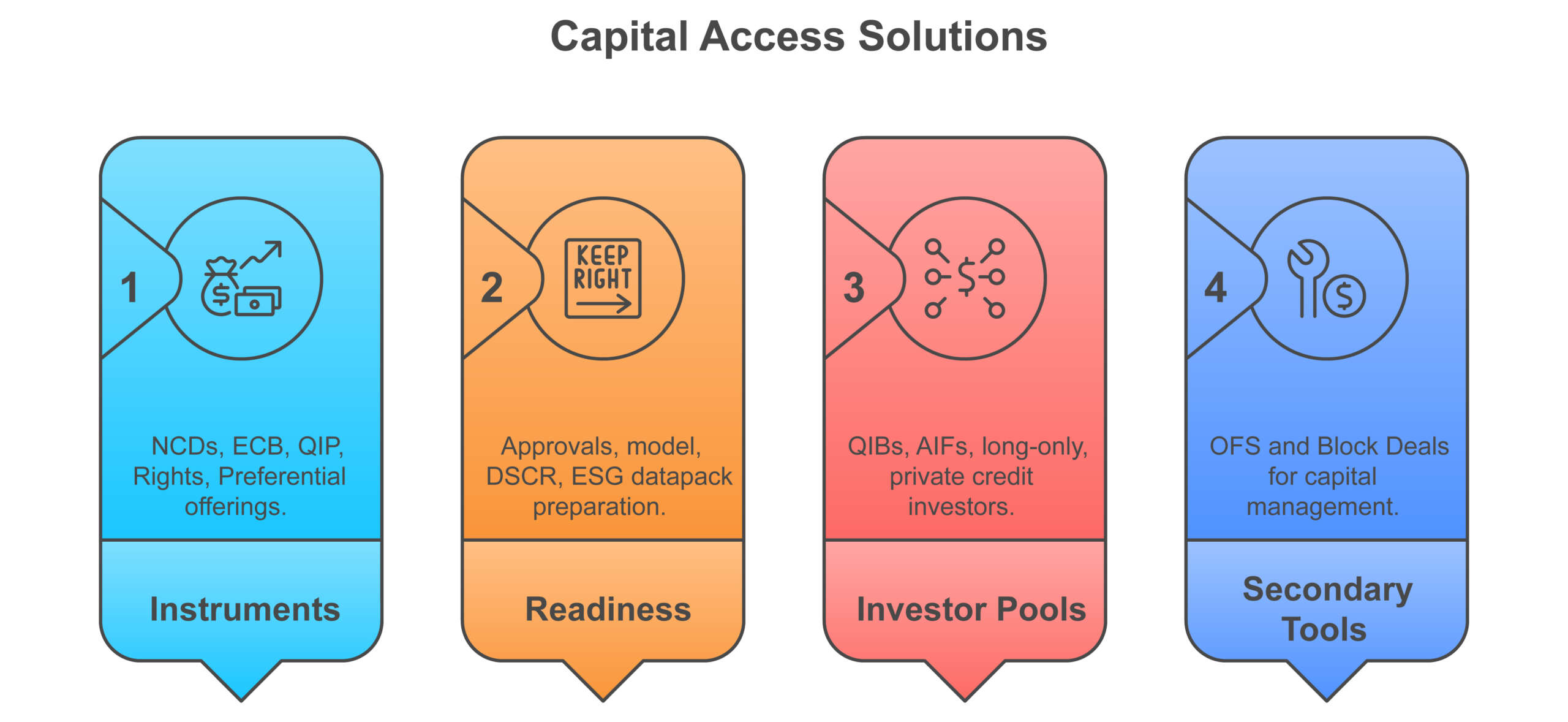

Capital Access Solutions

What we do:

We arrange long-term debt and non-IPO equity for expansion, infrastructure and strategic needs. Our role spans preparation, investor and lender outreach, term-sheet negotiation, diligence coordination, closing and post-closing reporting. Debt mandates follow the SEBI non-convertible securities and RBI ECB frameworks. Equity mandates follow SEBI’s ICDR, LODR and SAST regulations.

Debt Pathways

Private Placements of non-convertible debentures and related structures, with disciplined covenant and disclosure design.

Eligible cross-border borrowings under the ECB framework, with end-use, pricing and reporting aligned to RBI.

Equity Pathways For Issuers

QIP to qualified institutions, with pricing and relevant-date mechanics under ICDR.

Rights Issues with demat and on-exchange trading of rights entitlements for inclusive participation.

Preferential/PIPE for targeted institutional or strategic investors, with VWAP-based pricing and valuation requirements where applicable.

Secondary Liquidity Tools

Where required for shareholder reshaping or MPS, we coordinate:

Offer for Sale under the comprehensive exchange framework.

Block Deals under the October 2025 circular revising thresholds and bands.

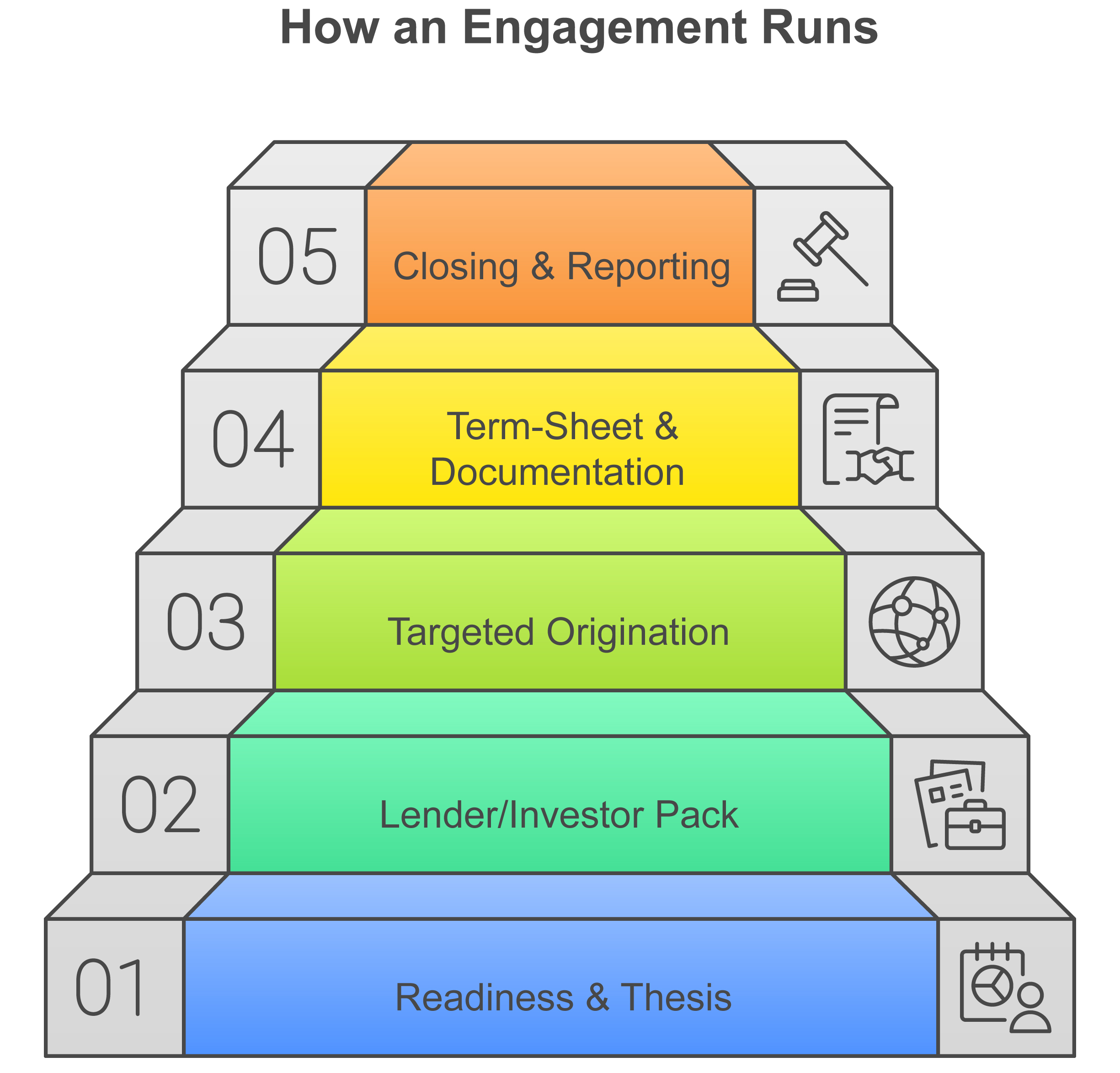

How an engagement runs

-

Readiness and thesis: cash-flow, DSCR and security review; equity dilution envelope and shareholder dynamics.

-

Lender or investor pack: investment memo, model, diligence index, ESG datapack, draft covenants.

-

Targeted origination: curated outreach across domestic and cross-border pools.

-

Term-sheet and documentation: pricing, fees, covenants and conditions precedent under the applicable SEBI or RBI route.

-

Closing and reporting: settlement logistics, trustee engagement and ongoing disclosures under LODR