Breaking the Stalemate:

A Global Analysis of Inertia in the Electric Vehicle Market

The electric vehicle (EV) revolution, once synonymous with unbridled optimism and rapid disruption, has entered a phase of tempered progress. Heralded as a defining shift for the automotive and energy sectors, EV adoption represents humanity’s most ambitious step toward a sustainable future. Yet, the pace of this transformation increasingly resembles a cautious waltz rather than a sprint. Despite technological advancements and unprecedented investments, the global EV market faces systemic inertia-manifesting as adoption bottlenecks, fragmented policies, and structural supply chain vulnerabilities.

This inertia reflects neither a lack of ambition nor demand but rather a critical misalignment between aspiration and execution. Governments, industries, and consumers must collectively navigate the complexities of scaling this revolution across geographies, each with its unique economic, cultural, and geopolitical contexts.

North America: Growth Held Hostage by Structural Gaps

The North American EV market epitomizes the dichotomy of opportunity and challenge. U.S. EV sales surged by 48% in 2023, reaching 1.5 million units, and are projected to grow to 1.9 million by 2024, according to BloombergNEF. However, consumer satisfaction with the EV experience is wavering. McKinsey’s Mobility Consumer Pulse reveals that 46% of EV owners are considering a return to traditional vehicles, citing systemic issues: insufficient charging infrastructure, lack of ultra-fast charging stations, and high ownership costs.

“Mass EV adoption is a lot harder than early adoption,” notes Mark Fields, former CEO of Ford. His observation encapsulates the reality of scaling EV penetration from enthusiastic early adopters to the wider population, where scepticism and logistical challenges loom larger.

Economic incentives, like the Inflation Reduction Act’s $7.5 billion allocation for EV infrastructure and the $7,500 federal tax credit, have provided a lifeline. Yet, as Deloitte warns, the removal of such subsidies could trigger a 27% drop in demand, exposing the fragility of this nascent growth.

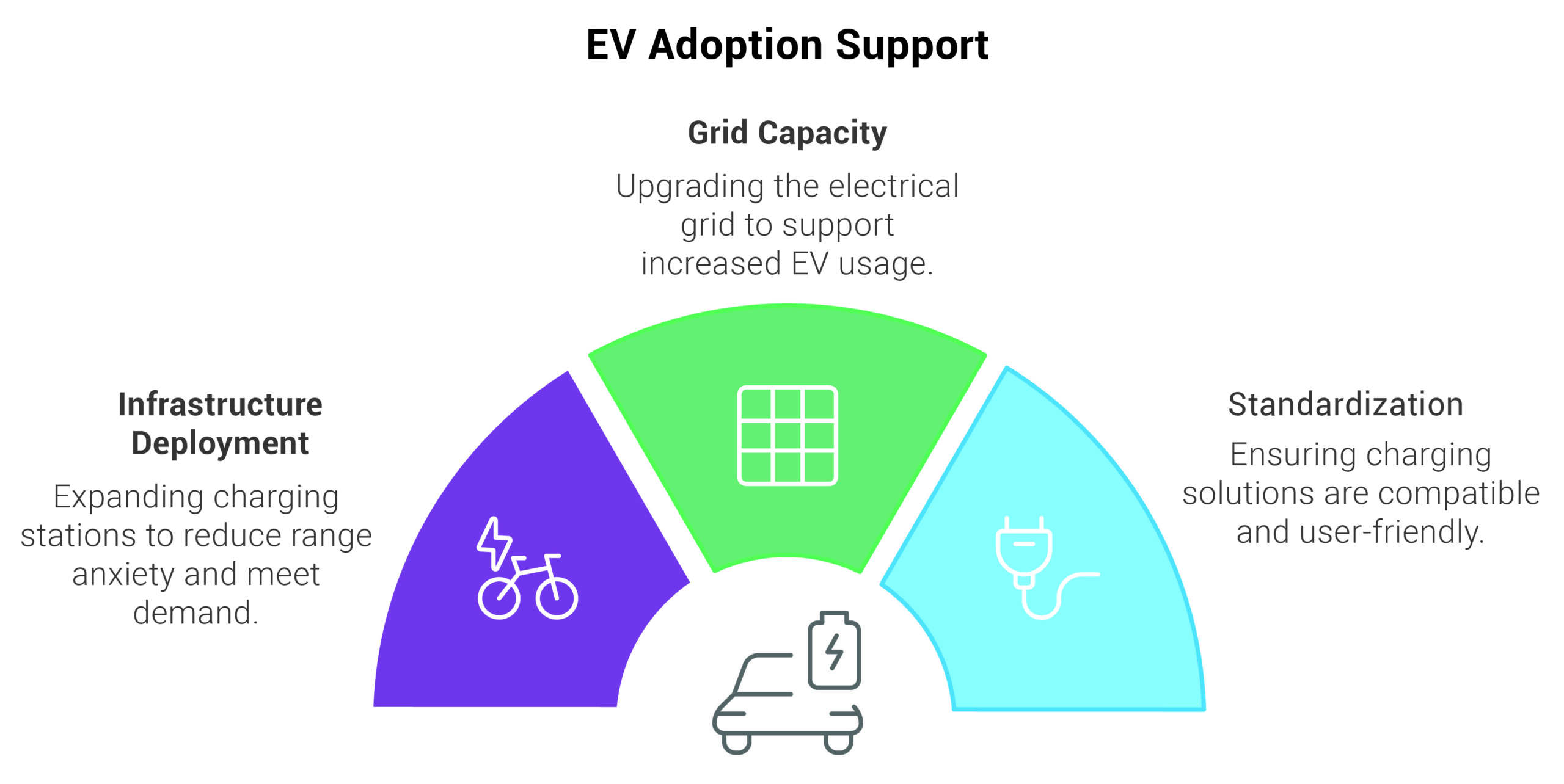

PwC highlights that the U.S. EV charging market could expand nearly tenfold by 2030, driven by government initiatives, automaker investments, and growing consumer interest. However, challenges remain:

- Infrastructure Deployment: Rapid expansion of charging stations is essential. Current infrastructure is inadequate to meet projected demand, leading to range anxiety among potential buyers.

- Grid Capacity: Enhancing grid capacity is necessary to accommodate the additional load from widespread EV adoption. Without upgrades, increased EV usage could strain the electrical grid.

- Standardization: Developing standardized charging solutions is crucial to ensure compatibility and user convenience. A fragmented system could deter consumers wary of incompatible or obsolete technology.

KPMG’s survey reveals further hurdles: only 20% of Americans would choose an EV over a gas-powered vehicle or hybrid, even if pricing and features were equivalent. Additionally, while 60% of U.S. consumers desire charging times within 20 minutes, only 41% of auto executives believe this expectation is achievable in the near term. These findings highlight the gap between consumer expectations and current capabilities.

Europe: Balancing Policy Ambition with Consumer Realities

Europe has emerged as a frontrunner in the global EV landscape, driven by ambitious decarbonization goals and an expansive policy framework. The Fit for 55 package, targeting a 55% reduction in emissions by 2030, and the proposed 2035 ban on internal combustion engines have positioned Europe as a leader in regulatory foresight. These measures, coupled with generous subsidies and a rapidly expanding charging network, have propelled the market toward an anticipated USD 743.07 billion valuation by 2030.

However, European automakers face intensifying competition. Market share for domestic manufacturers fell from 80% in 2015 to 60% in 2023, as American and Chinese automakers capitalized on aggressive pricing and scaling strategies. Bridging the affordability gap remains a priority, with automakers like Volkswagen committing €52 billion over five years to develop affordable, innovative models.

Yet consumer sentiment reveals barriers that must be addressed to accelerate broader adoption. McKinsey’s recent analysis found that 37% of prospective EV buyers cite high purchase prices as their primary deterrent. Additionally, 36% express concerns about the insufficient range of EV batteries, and 35% are apprehensive about their longevity. Public charging availability and rising electricity prices also feature prominently, with 28% of respondents identifying these as significant obstacles.

According to BloombergNEF, European EV sales are projected to grow to 3.4 million units in 2024, a 10% increase from the prior year, despite subsidy changes in major markets like France and Germany. However, diminishing pressure from fuel-economy targets may dampen momentum.

Ian Plummer, Commercial Director at Auto Trader, underscores the importance of addressing these concerns: “We need to help people overcome their fears with empathy,” he states, emphasizing the critical role of consumer education. Infrastructure development, such as the EU Commission’s goal of one million public chargers by 2025, and innovations in battery technology will be pivotal in overcoming these hurdles.

India: A Case Study in Emerging Market Dynamics

India’s EV market presents a dynamic interplay of high growth potential and unique challenges. According to McKinsey, 70% of tier-one Indian car buyers are willing to consider an EV for their next purchase, a figure that dwarfs the global average of 52%. This enthusiasm is most evident in the two-wheeler segment, where electric scooters and motorcycles account for over 70% of EV sales. By 2030, these vehicles are expected to dominate, comprising 60% to 70% of new sales.

Government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, paired with state-level incentives, are propelling adoption. Yet, KPMG highlights that penetration in passenger EVs and heavy commercial vehicles will lag, projected to reach only 10%–15% and 5%–10% of new sales, respectively, by 2030. These disparities reflect a fragmented market, where urban areas lead adoption while rural regions remain underserved.

Michael Oates, Country Sales and Delivery Manager at Tesla UK, stresses the importance of reaching untapped demographics. “Once the early adopters have adopted, we need to get in front of new audiences… that’s why second-hand EV markets are so important.” This insight underscores the role of used EV markets in making vehicles accessible to middle-income buyers and expanding adoption beyond urban centres.

Global Supply Chain: The Achilles’ Heel of the EV Revolution

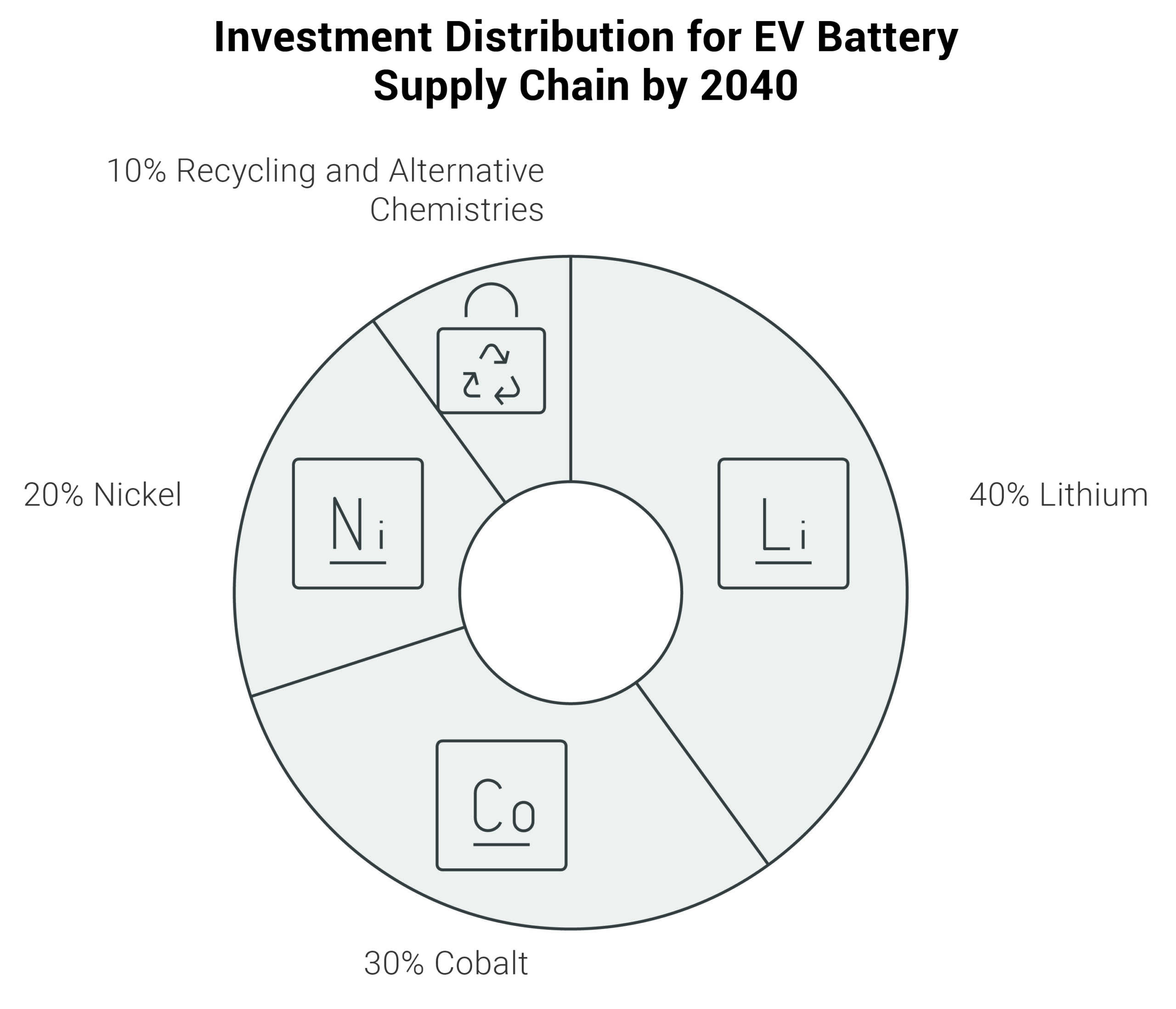

The EV market’s reliance on a fragile and highly concentrated supply chain presents a systemic risk. Morgan Stanley’s Rewiring the EV Battery Supply Chain estimates that meeting global EV demand by 2040 will require $7 trillion in investments, largely to address raw material bottlenecks.

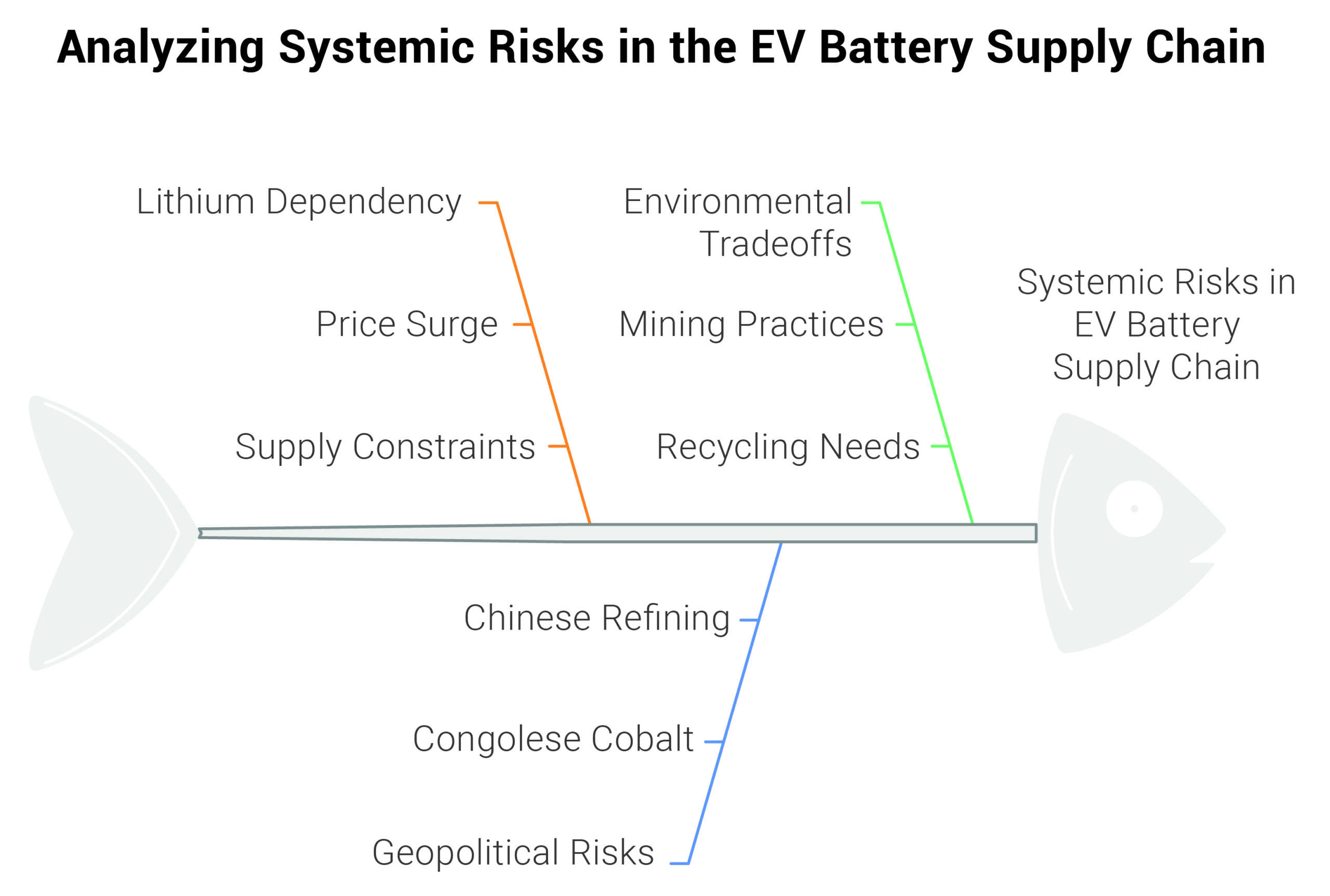

- Lithium Dependency: Prices have surged by 400% from 2020 to 2023, driven by constrained supply and soaring demand.

- Geopolitical Risks: With 70% of battery-grade cobalt sourced from the Democratic Republic of Congo and refined in China, the industry remains vulnerable to geopolitical disruptions.

- Environmental Trade-offs: Current mining practices raise sustainability concerns, necessitating investment in recycling and alternative chemistries.

Localized production initiatives, such as the Inflation Reduction Act’s incentives for U.S.-based battery manufacturing and Europe’s gigafactory expansions, are steps toward de-risking the supply chain. India’s exploration of sodium-ion and other emerging technologies could redefine the landscape, particularly for price-sensitive markets.

A Pivotal Turning Point

The electric vehicle revolution encapsulates a critical juncture in the global pursuit of sustainability. North America’s infrastructure gaps, Europe’s affordability challenges, and India’s push for scalable solutions reveal a market grappling with complexity and opportunity in equal measure. The stakes are high—not just for automakers and policymakers, but for economies, ecosystems, and consumers worldwide.

As the EV industry accelerates into a new era, its trajectory will hinge on collaboration, innovation, and decisive action. Will this be a story of isolated successes or a cohesive transformation that redefines mobility for generations to come? The world is not just watching—it’s invested. The choices made now will resonate far beyond vehicles, shaping the contours of a more resilient, sustainable future.

Contact Us: To learn more or schedule a consultation, please reach out to us at www.dickensonworld.com

Email:enquiry@dickensonworld.com.

About the Author

Shankhini Saha the Director of Investor Relations at Dickenson, holds an MPhil with distinction from the University of Cambridge, UK, and a BA magna cum laude from The New School, USA. Specializing in stakeholder engagement across diverse sectors, Shankhini is dedicated to transparent communication and providing strategic insights into clients’ financial performance and growth initiatives. With a proven track record of managing complex investor relations for a diverse portfolio of global clients, she excels in crafting impactful narratives that resonate with investors, analysts, and stakeholders. Shankhini’s leadership in high-profile quarterly results hosting and comprehensive IR campaigns showcases her commitment to creating lasting value for issuers in the global capital market.

Breaking the Stalemate

To download and save this article.

Authored by:

Shankhini Saha

Director, Dickenson World

Visit www.dickensonworld.com to learn more about our services and how we can help streamline your corporate reporting process.

Leave A Comment